《1 Introduction》

1 Introduction

As a kind of solid lighting mode based on a new lighting material of light emitting diodes (LEDs), LED lighting is regarded as a new generation of green lighting technology, which is characterized by lower power consumption, higher luminous emissivity, and longer working life. Because LED lighting provides a new approach to solve the deficiency of global energy, many countries such as USA, EU, Japan, Australia, Korea, and China have drawn up schedules to eliminate incandescent bulbs and promote LED applications.

Manufacturing equipment plays a significant role in the development of the LED lighting industry. First, LED lighting is a technology- and capital-intensive industry, in which 70 % of the production line cost comes from the purchase of manufacturing equipment. Second, there is a very close interrelationship between the manufacturing equipment and processes in the LED lighting industry. On one hand, innovative designing or processing technologies for epitaxial wafers and chips usually leads to disruptive innovation of manufacturing equipment. On the other hand, the breakthrough of LED manufacturing processes depends greatly on available manufacturing equipment. Third, LED manufacturing equipment includes high-complexity, high-precision, and high-speed machines that integrate many comprehensive technologies including mechanical engineering, automotive control, machine vision, and optical engineering, which lead to high entry barriers to LED manufacturing equipment firms. Fourth, higher demand for LED lighting product quality from the consumers as well as higher demand for LED manufacturing quality and productivity from LED firms accelerate the depreciation rate of LED manufacturing equipment. In a word, because of the specifically important role of manufacturing equipment in the LED lighting industry, competition in the global LED lighting industry focuses on LED high-end manufacturing equipment, especially on those in the epitaxial wafer and chip manufacturing domains.

《2 Analysis of LED high-end manufacturing equipment in China》

2 Analysis of LED high-end manufacturing equipment in China

《2.1 Advantages of LED high-end manufacturing equipment in China》

2.1 Advantages of LED high-end manufacturing equipment in China

In general, the suppliers providing LED high-end manufacturing equipment in the global market are classified into three groups. First, the prime suppliers mainly come from developed countries such as USA, Japan, Germany, and the Netherlands. For instance, AIXTRON Ltd. (AIXTRON) in Germany and Vacuum Electronic Equipment Co. (Veeco) in USA share over 90 % of the global market for metal organic chemical vapor deposition (MOCVD) machines. Further, SUSS MicroTec (SUSS) in Germany and Japan Science Engineering Ltd. (DNK) also share over 80 % of the global market for aligner machines. Second, another group of suppliers come from Korea, Taiwan China, and Hong Kong China, which share the main global market for coater machines, developer machines, dicing saw machines, and breaker machines. The third group of suppliers mainly comes from mainland P.R.C., and usually provides LED back-end manufacturing equipment in the global market.

As a matter of fact, the manufacturing equipment firms in China entered the domain of LED lighting around the year 2005. Nowadays, they have made enormous achievements after more than ten years of technical innovation and market exploration.

First, China’s firms can provide the primary LED high-end manufacturing equipment emerging in the global market. Driven by China’s industrial policy, many firms learn from and track the development of LED high-end manufacturing equipment in developed countries and then can provide most of the LED highend manufacturing equipment in the wafer and chip manufacturing domains. For example, an MOCVD machine can be provided by three Chinese firms, including Advanced Micro-Fabrication Equipment Inc. (AMEC), Tang Optoelectronics Equipment Ltd., and Guangdong Real Faith Semiconductor Equipment Manufacturing Co. Aligner machines can be manufactured by Shanghai Micro Electronics Equipment (Group) Ltd. (SMEE). Moreover, NAURA Technology Group Ltd. (NAURA) can provide a set of LED high-end manufacturing equipment such as inductively coupled plasma (ICP) etching machines, evaporator machines, and plasma enhanced chemical vapor deposition (PECVD) machines. Shenyang KINGSEMI Ltd. can provide coater machines and developer machines. Additionally, six complete sets of LED production lines were applied by China’s LED production firms for process testing with domestic equipment in 2014.

Second, the gap between domestic equipment and overseas equipment has be narrowed. With the development of LED high-end manufacturing equipment in China, the quality and technological index of domestic equipment have been improved greatly. For instance, some types of domestic ICP etching machines, coater machines, developer machines, and laser dicing saw machines are applied extensively in LED product lines in China, which substitute for oversea equipment favorably.

Third, the global market share of Chinese-made LED manufacturing equipment has been upgraded to a certain extent. At present, domestic ICP etching machines, coater machines, developer machines, and laser dicing saw machines capture over 70 % of the Chinese market. Moreover, some domestic LED high-end manufacturing equipment has been applied successfully by LED firms in Taiwan China.

Fourth, LED manufacturing equipment firms in China effectively satisfy their customers with quick-response service and high-quality sales service. Because there are geographic and cultural advantages between domestic LED manufacturing equipment firms and production firms in China, LED manufacturing equipment firms can provide their customers with quickresponse service and satisfactory after-sales service. Moreover, they pay more attention to LED firms’ needs and communicate with their customers frequently, which improves LED production firms’ trust in the manufacturing equipment firms.

《2.2 Disadvantages of LED high-end manufacturing equipment in China》

2.2 Disadvantages of LED high-end manufacturing equipment in China

Because of its short history and the deficiency of technological accumulation, LED high-end manufacturing equipment in China differs greatly from competitors in developed countries. Specifically, there are two obvious disadvantages for domestic LED manufacturing equipment, that is, poor quality and low market share.

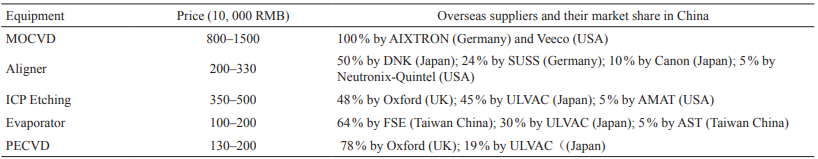

First, LED high-end manufacturing equipment in China occupies very little global market share. In general, LED high-end manufacturing equipment applied by China’s production firms come primarily from overseas firms, as shown in Fig. 1. Among that equipment, all MOCVD machines in China’s market are made by foreign firms. Furthermore, over 90% of other LED high-end manufacturing equipment also comes from outside China. Except for ICP etching machines, coater machines, developer machines, and laser dicing saw machines, other domestic LED high-end manufacturing equipment is seldom applied in China’s market [1].

《Table 1》

Table 1. Primary overseas suppliers of LED high-end manufacturing equipment in the Chinese market.

Data Source: Tao A. The Market for LED Die Equipment in China Participant Report[R]. May 2013 Note: AIXTRON (AIXTRON Co.); Veeco (Vacuum Electronic Equipment Co.); DNK (Japan Science Engineering Ltd.); SUSS (SUSS MicroTec); Canon (Canon S.P.A.); Neutronix-Quintel (Neutronix-Quintel Inc.); Oxford (Oxford Instruments); ULVAC (ULVAC Inc.); AMAT (Applied Materials Inc.); FSE (F.S.E Co.); AST (AST Co.)

Second, LED high-end manufacturing equipment in China is characterized by poor quality. Compared to overseas equipment, equipment made by Chinese firms have poorer quality, that is, lower equipment stability and reliability, poor process consistency, and shorter work life. Higher failure rates of domestic equipment in China would cause unstable production cycles and production quality, subsequently increasing production costs and risk confronted by LED production firms.

Third, LED high-end manufacturing equipment suppliers in China ignore R&D input. In general, the rate of R&D investment of firm income in LED high-end manufacturing equipment in China is from 2% to 5%. By contrast, their overseas competitors usually invest 5 %–10 % of total income into R&D activities.Specifically, R&D investment in LED high-end manufacturing equipment in China is not from firms themselves, but from governments.

Fourth, there is an imbalance in industrial chains for LED high-end manufacturing equipment in China. On one hand, although LED products in China have developed very quickly during the past few years, upstream chains in the LED lighting industry, including high-end manufacturing equipment, materials, and key components of manufacturing equipment, which indeed are competitive advantages of the LED lighting industry, lag behind the downstream chains. On the other hand, most LED high-end manufacturing equipment can be made in China; however, that equipment usually does not pass process testing (that is, pilot scale), which leads to missing industrialization for LED manufacturing equipment.

《3 Analysis of the environment confronted by LED high-end manufacturing equipment in China》

3 Analysis of the environment confronted by LED high-end manufacturing equipment in China

《3.1 Opportunities for LED high-end manufacturing equipment in China》

3.1 Opportunities for LED high-end manufacturing equipment in China

First, during the past few years, a set of national strategies consisting of a manufacturing power strategy and innovationdriven development strategy, have provided important opportunities for the development of LED high-end manufacturing equipment in China. On one hand, China is implementing an important set of national strategies, called the Made in China 2025 initiative. Among these strategies, the rate of equipment added-value in the manufacturing industry is regarded as an important index for manufacturing power [2], which shows China emphasizes the development of manufacturing equipment. On the other hand, the philosophy of intelligent manufacturing also brings new space for LED high-end manufacturing equipment. Intelligent manufacturing would optimize manufacturing processes and equipment through big-data mining of manufacturing procedures as well as diminish the dependence on the operational skill of the workers by improving equipment intelligence, which would strengthen the competitive advantage of the LED lighting industry.

Second, with energy-conservation and environmental protection included in the national strategy in China, the policy for the development of LED high-end manufacturing equipment in China has been optimized. Both the central government and local governments in China have been promoting the development of the LED lighting industry since 2003. These promotion approaches include project funding, the formulation of industry strategies, subsidy policies, and even tax preferences, which stimulate the development of the LED lighting industry. Meanwhile, those promotional approaches facilitate LED manufacturing equipment in China. On one hand, domestic firms can provide some LED high-end manufacturing equipment. On the other hand, LED middle-end and low-end manufacturing equipment dominate the local market in China.

Third, domestic market volume of LED high-end manufacturing equipment in China will increase greatly. For relieving the pressure of environmental pollution and energy shortages, China formulates many policies and laws to develop LED green lighting, which bring forth an over 20 % annual compound growth rate in the LED lighting market. Consequently, LED high-end manufacturing equipment confronts many opportunities.

Fourth, technical upgrades and business innovation in the LED lighting industry accelerate from time to time. On one hand, the emergence of new LED materials such as silicon substrate and ultraviolet sources need new LED processing technologies and equipment. New processing technologies such as flip chip and chip-scale package (CSP) also need replace existing LED high-end manufacturing equipment. On the other hand, equipment separation in LED manufacturing procedures would become the popular manufacturing pattern, which needs reconstruction of LED high-end manufacturing equipment.

《3.2 Threats to LED high-end manufacturing equipment in China》

3.2 Threats to LED high-end manufacturing equipment in China

First, policy arrangements of the LED lighting industry in China diminish the expectation of LED high-end manufacturing equipment. Because of GDP-oriented and market priorities of the LED lighting industry, some local governments in China propose competitive policies for the LED lighting industry. Local governments support LED production firms greatly and provide them with subsidies to purchase LED high-end manufacturing equipment. For instance, some local governments provide LED production firms with subsidies of RMB 10 million, which accounts for about 50 % of the equipment price for the purchase of an MOCVD machine. As a result, overseas LED high-end manufacturing equipment becomes the main force in LED production firms in China, which in turn restricts the development of domestic LED high-end manufacturing equipment in China.

Second, both international and domestic economic development limit the market scale of LED high-end manufacturing equipment. From a global market perspective, large economies in the world have been impaired from the global financial crisis and international market demand has been diminished since 2008. From a domestic market perspective, the Chinese economy would enter into a structure-adjusted phase in the long run. There is excess production capacity and a deficiency of domestic market demand simultaneously in China. In a word, the reduction of international and domestic purchasing power imposes a constraint on the market size of LED high-end manufacturing equipment.

Third, domestic LED high-end manufacturing equipment confronts the risk of being substituted by overseas equipment. In the context of globalization, the domestic market fuses with the international market so that LED production firms in China can pursue LED high-end manufacturing equipment worldwide. Meanwhile, China joined the World Trade Organization (WTO) in 2001 and promises to obey the rules of fair competition. It is difficult for China’s government to provide favorable policies, except for R&D input, to support the development of domestic LED high-end manufacturing equipment. As a result, many LED production firms in China must import much of their equipment. This phenomenon of import substitution has a negative effect on domestic LED high-end manufacturing equipment.

Last, the habit and trust from LED production firms on domestic LED high-end manufacturing equipment also hinders the application of domestic LED high-end manufacturing equipment. The risk confronted by LED high-end manufacturing equipment comes not only from environmental factors, but also from the downstream LED production firms. Some technicians in China’s LED production firms are accustomed to working with overseas equipment, others have low trust or have a bias against domestic LED high-end manufacturing equipment. Consequently, it is highly difficult to introduce domestic LED high-end manufacturing equipment into LED production lines in China.

《4 Strategies for independent development of LED high-end manufacturing equipment in China》

4 Strategies for independent development of LED high-end manufacturing equipment in China

《4.1 Strategic targets for independent development of LED high-end manufacturing equipment in China》

4.1 Strategic targets for independent development of LED high-end manufacturing equipment in China

To develop LED high-end manufacturing equipment, China needs to solve the key problem that LED production firms in China depend greatly on overseas equipment. There is no doubt that independently developing LED high-end manufacturing equipment may be the best approach for China. From the preceding analysis, a strategic target for LED highend manufacturing equipment in China may be proposed, that is, consistent with the plan for high-end manufacturing equipment of the Made in China 2025 initiative, to strengthen the existing advantage of LED high-end manufacturing equipment in China, to improve the pace of independent development and innovation, and especially to overcome the disadvantages affecting the sustainable development of LED high-end manufacturing equipment in China. In detail, China wishes to provide most LED high-end manufacturing equipment independently by 2020, and then to provide world-level LED high-end manufacturing equipment and to own the entire LED industry chain by 2030, and even to have the strongest competitive advantage in the world.

《4.2 Basic analysis of independent development of LED highend manufacturing equipment in China》

4.2 Basic analysis of independent development of LED highend manufacturing equipment in China

Essentially, independent development means seizing the opportunities or dealing with the threats by overcoming the disadvantages. On the basis of this logic line, basic independent development approaches for LED high-end manufacturing equipment in China must make up for the disadvantages of domestic equipment in China. Compared to overseas rivals, the primary disadvantages of LED high-end manufacturing equipment in China include low quality, high cost, and inconsistent performance with mature LED production lines. The reasons lie in two aspects.

On one hand, different chains of the LED lighting industry are disproportionate. Except for short-time technical accumulation, lower process testing, and poor R&D input, the factors affecting LED high-end manufacturing equipment in China primarily focus on the deficiency of collaboration between upstream, middle-stream, and downstream chains in the LED lighting industry, which leads to the absence of an LED lighting industry ecology. Generally speaking, overseas LED high-end manufacturing equipment is rooted in a symbiotic industry network, that is, LED manufacturing equipment firms, LED production firms, and their component suppliers build up very close cooperative relationships and eventually form a symbiotic mode among upstream firms, middle-stream firms, and downstream firms. For instance, 80% of MOCVD machines applied by LED production firms in Japan are provided by their domestic suppliers. Veeco Co., which can provide higher-quality equipment relative to its Japanese peer, still met with resistance from LED production firms in Japan and was rejected by the latter. Similarly, to diminish the dependence on overseas suppliers and to find long-term strategic suppliers, Samsung Electronics and Hynix Group in Korea emphasize purchasing LED equipment from their domestic suppliers. Moreover, Korean LED production firms usually cultivate local equipment suppliers by joint venture, cooperative development, and procurement orders [3]. Adversely, there are few cooperative relationships between LED production firms, manufacturing equipment firms, and component suppliers in China. On one hand, most LED production firms are unwilling to support process testing of domestic manufacturing equipment firms. On the other hand, many LED manufacturing equipment firms do not want to cultivate local component suppliers.

Second, the industry environment also restricts the development of LED high-end manufacturing equipment in China. Manufacturing equipment firms confront double pressure, including both domestic LED industry policies as well as technical and market constraints from overseas rivals. In fact, policy arrangement disorder at the national level and subsidy policies at the local level play an important role in hindering the development of LED high-end manufacturing equipment in China. Many cases demonstrate that such factors as governmental policies have an important and far-reaching influence on the formation of LED industry ecology. For example, the rapid development of the integrated circuit (IC) industry both in Korea and Taiwan China during 1960s contributed to strong support from governmental policies. By contrast, government policies in China obstruct the development of domestic LED high-end manufacturing equipment. On one hand, although the strategy of market priority greatly promotes the development of LED lighting industry in China, this strategy ignores the fact that there is very poor domestic manufacturing equipment in China. On the other hand, the subsidy policies from many local governments lead to unfair competition in China’s market. For instance, the subsidy for MOCVD machines limits the development of domestic LED high-end manufacturing equipment in China.

In sum, the key approach of independent development of LED high-end manufacturing equipment in China is building a virtuous LED industry ecology between different chains to support rapid development of domestic manufacturing equipment. First, a national-level innovation platform for manufacturing equipment based on cooperation among industries, universities, and research institutes is a precondition, which not only improves cooperative development of different industry chains, but also constitutes an organizational basis to accelerate the formation of LED lighting industry ecology. Second, the perfection of a marketization mechanism would further promote the formation of an LED lighting industry ecology. Third, a policy environment based on innovation-driven development strategies and a fair competitive market environment would provide protection for the sustainable development of the LED lighting industry.

《5 Primary approaches for independent development of LED high-end manufacturing equipment in China》

5 Primary approaches for independent development of LED high-end manufacturing equipment in China

《5.1 Construction of a national-level institution for LED manufacturing equipment innovation》

5.1 Construction of a national-level institution for LED manufacturing equipment innovation

Overseas LED production firms and manufacturing equipment firms develop synchronously and construct an interdependent industry ecology through long-term collaboration, which indeed is a core competitive advantage of the overseas LED lighting industry [4]. In China, because many LED production firms are incapable of independently undertaking the high cost of process testing and many LED manufacturing equipment firms are also unable to support the development of domestic component suppliers, it is highly necessary to build a national-level institution for LED manufacturing equipment innovation, which includes many interrelated members of the LED lighting industry such as LED production firms, manufacturing equipment firms, component suppliers, LED material suppliers, outside research institutions, and others. It is important that such a national-level innovation platform operate independently.

5.1.1 The roles of a national-level institution for LED manufacturing equipment innovation

The national-level institution for LED manufacturing equipment innovation would play an important role in promoting independent development of LED high-end manufacturing equipment in China. First, it is a collaborative innovation platform for LED manufacturing equipment, which unites all members of the LED lighting industry to cooperate on production testing, process testing, equipment testing, and component reliability testing so as to improve the quality of domestic LED manufacturing equipment in China. Second, it is also a strategic alliance of the LED lighting industry to promote upstream, middle-stream, and downstream chains to form strategic partner relationships. These members of the LED lighting industry build a strategic alliance to work together on collaborative manufacturing and compete as an aggregation in the global market. Third, it is an association of the LED lighting industry. The innovation platform integrates many key resources of the LED lighting industry such as information, finance, technologies, and human capital to provide diverse services to customers.

5.1.2 The establishment of a national-level institution for LED manufacturing equipment innovation

The establishment of a national-level institution for LED manufacturing equipment innovation follows these principles. First, demand orientation is the focus of the establishment of such a national-level institution. As the customers of LED highend manufacturing equipment, LED production firms dominate industry development. Second, the core members of a nationallevel institution not only are the demanders of this institution, but also are the investors in the institution. Third, a nationallevel institution for LED manufacturing equipment innovation adopts market-oriented operations based on the principle of shared benefits and risk. Fourth, a national-level institution is a non-profit organization. It is a third-party organization operating independently from the other members of LED lighting industry. It is important that a nation-level institution generate income to maintain its sustainable operations.

There are three types of members in a national-level institution for LED manufacturing equipment innovation. The first type of members are LED production firms. To avoid specific stakeholder monopolistic control of the operation of a nation-level institution, several leading LED production firms must constitute the primary stakeholders of this institution. The second type of members include other stakeholders, such as other LED production firms, manufacturing equipment firms, material suppliers, and component suppliers, and are also main investors of this institution. The third type of members come from the financial industry, such as venture capital firms and industrial investment funds, which join in the national-level institution as strategic investors to gain profit.

5.1.3 Financing a national-level institution for LED manufacturing equipment innovation

The national-level institution for LED manufacturing equipment innovation has different financing approaches in different phases. During the construction of a national-level institution, public-private joint investment is the primary investment mode, and is regarded as a kind of outer investment. On one hand, equity investment from private firms is the main finance source for this institution. On the other hand, starting funds from government sectors is a complementary source, and usually accounts for no more than 30 % of the total investment in the institution during this period. During the operation of the national-level institution, service charges from R&D projects and technical services is main financing mode, and is regarded as a selfdevelopment approach. It includes project funding from governments, non-government organizations, private firms, technical service fees, membership fees, profit from capital operations, and other sources.

In sum, a national-level institution for LED manufacturing equipment innovation has three unique characteristics. First, the primary objectives of this institution not only aim at building up the link between R&D and the industrialization in the LED lighting industry, but also focus on promoting the formation of LED lighting industry ecology. Second, all stakeholders of this institution are motivated to carry on cooperative innovation. Meanwhile, the introduction of an industrial investment fund improves the marketization level of the nation-level institution. Third, this institution is an integrated platform in which the demanders integrate with the suppliers, upstream firms, middle-stream firms, and downstream firms to cooperate closely, and the optimized distribution of industry resources integrates with cooperative innovation.

《5.2 Perfection of a market-oriented operational mechanism for the formation of an LED lighting industry ecology in China》

5.2 Perfection of a market-oriented operational mechanism for the formation of an LED lighting industry ecology in China

Because the cooperation among upstream, middle-stream, and downstream chains in the LED lighting industry must deal with such issues as risk sharing, gain sharing, and conflict resolution, a market-oriented operational mechanism may be an important approach to promote the formation of an LED lighting industry ecology in China. With the introduction of a market-oriented operational mechanism, LED firms would cultivate entities both in global competition and industry investment. On one hand, LED firms must undertake the responsibilities and risk in market competition and gain accordingly. On the other hand, LED firms must play the role of investors for the development of the LED lighting industry.

5.2.1 The cultivation of strategic core firms in the LED lighting industry

The cultivation of leading firms in the LED lighting industry has highly significant strategic implications for the development of LED high-end manufacturing equipment in China, because strong leading firms may promote the development of the LED lighting industry ecology. There are several approaches to cultivating leading LED firms as strategic core firms of this industry.

On one hand, it is necessary to improve the global competitive advantages of LED leading production firms through merger and acquisition (M&A) and joint ventures. There are plans to form 2–5 world-class, innovative LED strategic core firms that have global competitive advantages in the LED lighting industry in the next three years. Specifically, one or two LED strategic core firms may rank in the top ten and two or three leading firms in the top 20.

On the other hand, improving innovative capabilities of LED strategic core firms is also important. There are three possible approaches for this. The first approach is to build cooperation among industries, universities, and research institutes. On the basis of a national-level institute for LED manufacturing equipment innovation in China, LED strategic core firms collaborate with universities, research institutes, manufacturing equipment firms, and component suppliers to work on joint technical development. The second approach is open innovation. The gliding of the global economy during the past few years provides an opportunity for LED strategic core firms in China to merge with and acquire overseas LED firms, including direct merging with overseas peers or indirect merging with them via industry investment funds, building up R&D start-ups, and non-equity investment such as cooperative research and licensing. It is important that the targets of mergers and acquisitions are preferentially in European countries and some Asian countries such as Korea; the former have little conflict with China and the latter shares a common culture and value with China to promote their cooperation.

5.2.2 The development of leading-firms-centric cooperative relationship in the LED lighting industry

In fact, domestic market demand for LED high-end manufacturing equipment is a part of a global market need [5], so that it is highly important to develop a cooperative and symbiotic industrial relationship in which LED strategic core firms lie at the center.

First, a national-level institution for LED manufacturing equipment innovation plays the role of leader and linker in the formation of the LED lighting industry ecology. As mentioned previously, a national-level institution has three different roles, that is, a collaborative innovation platform, a strategic alliance, and an industrial association, which help coordinate production and optimize resource distribution among LED lighting industry members.

Second, LED strategic core firms support technical innovation for LED high-end manufacturing equipment. LED strategic core firms must communicate with manufacturing equipment suppliers to ensure the former’s need and collaborate to work on R&D activities, which makes high-end manufacturing equipment innovation not only satisfy market needs but also have technical possibilities. Third, LED strategic core firms cultivate domestic LED highend manufacturing equipment firms. There are some important approaches for this. First, LED strategic core firms promote the development of high-end manufacturing equipment firms by technology transfer, knowledge sharing, or joining in R&D design of manufacturing equipment. Second, LED strategic core firms help manufacturing equipment firms to fulfill process testing, sign operations contracts on “commitment R&D,” or purchase high-end manufacturing equipment from domestic suppliers.

Third, LED strategic core firms invest in high-end manufacturing equipment firms by equity investments such as equity holding or participation so as to build up an interested community. Fourth, LED strategic core firms collaborate with high-end manufacturing equipment firms to merge overseas equipment firms from Germany, the Netherlands, Sweden, Finland, and other western European countries.

Fourth, it is necessary to promote the development of domestic key component suppliers. On one hand, LED strategic core firms and manufacturing equipment firms join in the R&D activities of domestic key component suppliers and purchase components from domestic suppliers. On the other hand, a national-level institution for LED manufacturing equipment innovation can build up technical standards and quality standards for LED equipment components.

5.2.3 The development of an ecology culture with the assistance of an industry association of the LED lighting industry

Industry ecology is not a kind of dynamic cooperative relationship, but a cooperative culture in the long run. Industry associations including a national-level institution for LED manufacturing equipment innovation would play a significant role in advocating the ecology culture for the LED lighting industry. First, they may study ecology symbiosis culture in which many members of the LED lighting industry interdepend on each other. Second, they may advocate the spirit of cooperation and stability in the pursuit of excellence. Third, they may promote the culture of comprehensiveness and patience among LED industry members.

《5.3 Creation of policies for innovation-driven development and a fair competitive market》

5.3 Creation of policies for innovation-driven development and a fair competitive market

Governments in China are among the most important determinants having an important effect on independent development for LED high-end manufacturing equipment in China. Different-level governments must draw upon policies for innovation-driven development strategies and a fair competitive market, which would provide advantageous support for the formation of the LED industry ecology.

5.3.1 The perfection of enterprise-centric innovation policies for LED lighting industry

On the basis of the principles that the demanders are the investors and the investors are also the beneficiaries, LED firms conduct the majority of technical innovation. It is necessary to promote enterprise-centric innovation policies for the LED lighting industry.

First, governments in China pay more attention to technical innovation and introduce R&D input into the performance evaluation index for local governments.

Second, governments in China must change the support methods for innovation-driven development. Specifically, local governments should substitute technical innovation subsidies for equipment-purchase subsidies. They also provide project funds to solve key problems in the cooperative development of LED high-end manufacturing equipment. Additionally, they must provide funds for the mode of cooperative innovation and a platform for cooperative innovation.

Second, governments in China must increase the motivation of firms to innovate. For instance, a pre-tax plus deductions policy for firm R&D activities should cover all stakeholders or members of LED high-end manufacturing equipment including enterprises, universities, research institutions, and new R&D institutions. Moreover, the fee for cooperative innovation among innovative entities may be included in this policy. Additionally,governments provide preferential tax policy for LED strategic core firms and manufacturing equipment firms that merge with overseas firms or build up overseas R&D institutions.

5.3.2 The creation of a fair competitive market for the LED lighting industry

On one hand, governments in China need to withdraw polices that hinder fair competition in LED lighting industry as soon as possible. First, it is necessary to implement a policy effectiveness review and withdrawal system in the LED lighting industry in order to withdraw the policies that have a detrimental effect on fair competition. Second, it is also necessary to implement a limited-time subsidy policy for imported key components for LED manufacturing equipment firms.

On the other hand, governments in China also must draw up beneficial policies to promote the development of domestic LED strategic core firms. First, governments provide LED strategic core firms with policies on reduction of tax and discount loads, which may strengthen them and improve their global competitive advantages. Second, governments provide beneficial policies for overseas M&A and joint ventures of LED strategic core firms and manufacturing equipment firms. Third, governments also support LED strategic core firms and manufacturing equipment firms to take part in global competition and extend their overseas market in the context of “One Belt and One Road.”

5.3.3 The reinforcement of policies motivating cooperative relationships in the LED lighting industry

On one hand, governments may reform operational mechanisms for national industry investment funds, transition from supporting technical innovation of a single firm to support that of industry members in LED lighting industry.

On the other hand, governments can also formulate policies to promote cooperation among the upstream, middle-stream, and downstream chains in the LED lighting industry. First, governments make policies for such cooperative activities as product quality testing, process testing, component quality testing, and design testing. Second, governments provide LED production firm purchasing domestic equipment or LED manufacturing equipment firms purchasing domestic key component with preferential policy, which consists of subsidies, discount loans, or interest-free loans, shortening the depreciation period of equipment, preferential taxes, and other measures. Third, governments also increase the tax preference for the purchase the first domestic LED high-end manufacturing equipment.

《6 Conclusions》

6 Conclusions

By three important strategic approaches consisting of the construction of a national-level institution for LED manufacturing equipment innovation, the perfection of the marketoriented operational mechanism, and the creation of policies for innovation-driven development and fair competitive markets, LED high-end manufacturing equipment in China aims at forming a cooperative, interdependent, and symbiotic industry ecology. The formation of an LED lighting industry ecology not only addresses the problems of the LED lighting industry depending strongly on imported manufacturing equipment, but also promotes the cooperative development of the LED lighting industry, eventually improving the technical capabilities and global competitive advantage of domestic LED high-end manufacturing equipment. It is certain that, with the opportunities brought forward by the strategic on innovation-driven development and the Made in China 2025 initiative, LED high-end manufacturing equipment in China can achieve the objective of independent development in the end.

京公网安备 11010502051620号

京公网安备 11010502051620号