《1 Introduction》

1 Introduction

At present, China is one of the fastest growing regions in the global automotive market. It has also become the world’s largest automotive consumer and producer. The scale of energy consumption, such as that of vehicle refined oil, has been increasing each year and has shown a rapid growth trend, especially in recent years. Vehicle energy has become an important issue in China’s automobile development strategy and energy development strategy [1]. In the automobile production process, the manufacturing of key components, car bodies, batteries, motors, and so on, consumes a large amount of mineral resources. The significance of production capacity, technical levels, and mineral resource reserves, represented by carbon steel, magnesium, aluminum, lithium, rare earth, and platinum, have become increasingly prominent in the development of the automotive industry. In order to cope with the energy and resource challenges faced by the rapidly developing automotive industry, it is necessary to conduct comprehensive research on the status quo of China’s vehicle energy and resource utilization, future challenges, and development paths.

《2 The status quo and development trend of vehicle ownership in China》

2 The status quo and development trend of vehicle ownership in China

With the country’s rapid economic development, the living standards of the Chinese people have greatly improved. As a result, the car penetration rate has also increased. In 2016, China’s automobile production and sales reached record highs of 28.12 million and 28.03 million units, respectively. China hasnow ranked first in these two areas for eight consecutive years. Vehicle ownership in China reached 194 million [2], that is, 142 vehicles per 1 000 people. Based on per capita gross domestic product (per capita GDP) as a measure of the economic development level, China’s economic growth has meant an increase in the car penetration rate is inevitable, as evidenced by the world’s other major countries. Compared to developed countries, China’s per capita GDP and car penetration rate are both at a relatively low level. Family vehicles (i.e., private passenger vehicles) are not yet popular on a significant scale. For example, vehicle ownership per 1 000 people is at a similar level to that of the United States in 1921 and that of Japan in 1975. Therefore, there is still room for significant growth in vehicle ownership as the country’s per capita GDP continues to increase.

Civil vehicles can be subdivided into passenger vehicles, large passenger vehicles, and freight vehicles. In general, the future level of vehicle ownership in a country or region is closely related to its social economy, population, and level of urbanization. As shown by historical data and the experiences of other countries, the relationship between passenger vehicle ownership and per capita GDP approximates an “S-shaped” curve. Thus, the Gompertz curve can be used to predict the level of passenger vehicle ownership. The ownership of large passenger vehicles and freight vehicles is related mainly to economic aggregates. Thus, future increases in China in these categories can be analyzed using the elastic coefficient method [3].

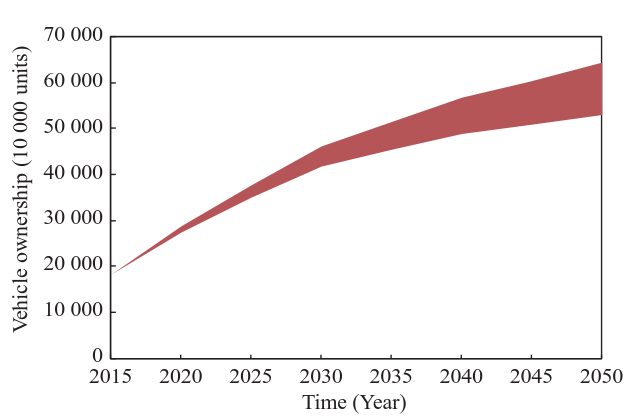

Based on the above-mentioned methods, a model for predicting China’s vehicle ownership was developed by the China Automotive Energy Research Center of Tsinghua University. The model shows that civil vehicle ownership in China will continue to grow. Passenger vehicle ownership could reach between 380 million and 420 million by 2030, and between 500 million and 600 million by 2050. Furthermore, the model predicts that the ownership of large passenger vehicles and freight vehicles will peak at 4.4 million and 37.5 million, respectively, by 2040, before then decreasing to 4.3 million and 36.8 million, respectively, by 2050. Based on these results, China’s vehicle ownership will reach between 420 million and 460 million by 2030, and between 540 million and 640 million by 2050 (Fig. 1). In addition, vehicle ownership per 1 000 people will be approximately 300 in 2030, climbing to 400 by 2050.

《Fig. 1. 》

Fig. 1. China’s vehicle ownership forecast (2015–2050). Notes: The strip chart indicates the predicted range of vehicle ownership. Owing to the uncertainty about future driving factors, such as the economy, population, and urbanization rate, there is a growing range of variation in the forecast of future vehicle ownership.

《3 China’s vehicle energy consumption status quo and demand analysis》

3 China’s vehicle energy consumption status quo and demand analysis

The dramatic increase in vehicle ownership has resulted in a rapid increase in vehicle fuel consumption, which has gradually become the mainstay of petroleum energy consumption. Apart from a small number of alternative fuels, China’s current vehicle fuels are still gasoline and diesel, which are refined from petroleum. In 2016, the total apparent consumption of petroleum in China was approximately 5.56×108 t, with a total annual gasoline consumption of 1.19×108 t and a total annual diesel consumption of 1.63×108 t [4]. Petroleum consumption in the transportation sector accounted for approximately 50 % of all consumption, of which 80 % was consumed by cars. In contrast to this growth, China’s capacity for petroleum production has remained at around 2×108 t in recent years. Thus, the increase in vehicle fuel consumption following the growth in vehicle ownership has led to a continuous increase in the dependence on petroleum imports, which reached 64.4% in 2016 [4]. China’s vehicle ownership is set to increase even further, which means the difference between the supply and demand for vehicle fuel will continue to grow. Therefore, it is necessary to find and form a diversified supply of vehicle energy through multiple channels, reduce the dependence of automobiles on gasoline and diesel, and ensure petroleum security.

《3.1 Demand forecast for vehicle refined oil, without considering the large-scale development of new energy vehicles and alternative fuels》

3.1 Demand forecast for vehicle refined oil, without considering the large-scale development of new energy vehicles and alternative fuels

In this section, the large-scale development of new energy vehicles and the substitution effect of alternative fuels are not considered. Therefore, future automotive technology is assumed to remain dominated by the traditional internal combustion engine. This section also assumes that the electrification rate will not improve significantly. Then, even if the economic level of vehicle fuels continues to improve, the use of passenger vehicles decreases, public transportation continues to be optimized, and freight management improves, China’s demand for vehicle refined oil will continue to grow in the short term. The future increase of passenger vehicle ownership is the main driving force for the increase of gasoline consumption. In 2020, the consumption of gasoline will reach between 1.88×108 and 1.98×108 toe (tons of oil equivalent). This number is expected to peak between 2.35×108 and 2.60×108 toe around 2030. Under the combined effect of an optimized transportation structure, reduced intensity, and improved energy efficiency, gasoline consumption could decrease to between 1.86×108 and 2.27×108 toe by 2050. At present, diesel is mainly consumed in road-operated buses and freight vehicles, and its demand is closely related to economic transformation and industrial restructuring. According to the current development situation, the increase in diesel consumption caused by the increase in freight turnover can be mitigated by improvements in energy efficiency. The growth rate of diesel consumption will slow. By 2020, diesel consumption will be between 1.62×108 and 1.70×108 toe, and is expected to peak between 1.60×108 and 1.77×108 toe around 2030. By 2050, this could decrease to between 1.32×108 and 1.62 × 108 toe. Based on these predictions, China’s demand for vehicle refined oil will reach between 3.50×108 and 3.68×108 toe by 2020, 3.95×108 and 4.37×108 toe by 2030, and 3.18×108 and 3.89×108 toe by 2050.

《3.2 The substitution effect of new energy vehicle development and alternative fuels on vehicle refined oil》

3.2 The substitution effect of new energy vehicle development and alternative fuels on vehicle refined oil

New energy vehicles are driven by motors and have high energy conversion efficiency. As such, they can effectively reduce the consumption of petroleum resources, providing an effective way to achieve fuel substitution and energy conservation. China’s strong promotion of such vehicles via government policy has meant that new energy vehicles have shown gratifying development. In 2016, the annual sales volume exceeded 500 000 units, ranking China first in the world [5]. According to the Energy Conservation and New Energy Vehicle Industry Development Plan (2012–2020), China will strive to achieve a cumulative production and sales volume of 5 million new energy vehicles by 2020 [6]. With the advancement of new energy vehicle technology, reduction in costs, and improvements in infrastructure, the market share of new energy vehicles will grow rapidly. Electric vehicles will gradually replace passenger vehicles and large passenger vehicles, and fuel cell vehicles will become a viable alternative to passenger vehicles and large passenger and freight vehicles. If new energy vehicles are developed rapidly, the model predicts that approximately 9.33×106 toe, 5.71×107 toe, and 1.87×108 toe of refined oil could be substituted by 2020, 2030, and 2050, respectively. Table 1 shows the proportions of new energy vehicles in use over time.

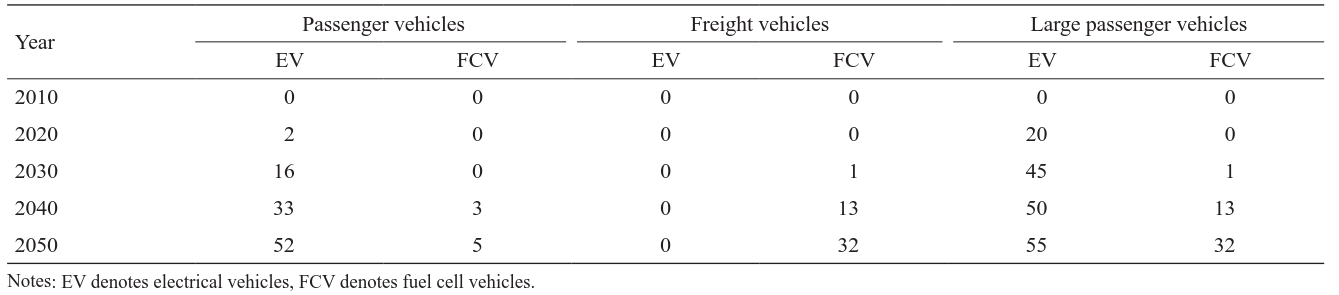

Table 1. The proportions of new energy vehicles over time (%).

《Table 1.》

The development of natural gas vehicles is significant in terms of improving the energy structure of the current transportation sector, diversifying the structure of vehicle fuels, and a low-carbon transformation. The “Energy and New Energy Vehicle Technology Roadmap” proposes the moderate promotion and steady development of commercial vehicles using natural gasbased alternative fuels [7]. In 2015, China’s natural gas vehicle ownership was approximately 5 million, ranking it first in the world. As a result, natural gas substituted approximately 1.5×107 t of gasoline consumption and 8×106 t of diesel consumption [4]. As the country begins to focus on natural gas vehicles, their substitution for refined oil products will become increasingly prominent. In this scenario, China’s consumption of refined oil products is predicted to decrease by approximately 4.4×107 toe by 2020. Then, after 2030, owing to the development of new energy vehicles and other liquid fuels, the growth rate of natural gas vehicles is expected to slow, substituting approximately 4.3×107 toe of refined oil consumption by 2050.

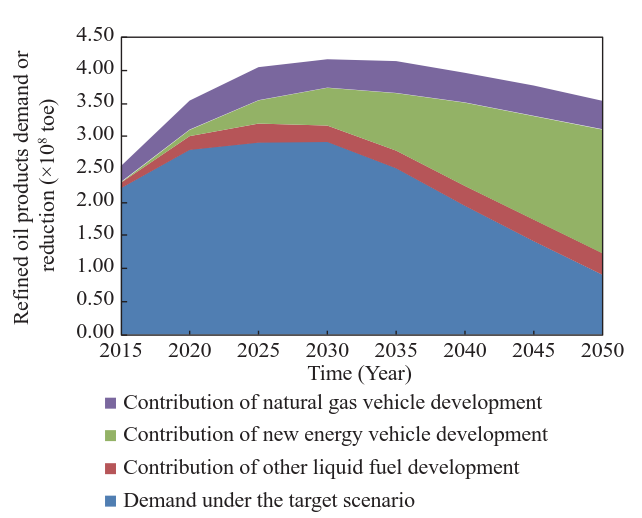

Other liquid fuels, such as fuel ethanol, biodiesel and other biofuels, fuel methanol, and coal oil and other coal-based fuels have obvious petroleum substitution effects, and can reduce the dependence of vehicle fuels on petroleum. In 2015, liquid alternative fuels substituted approximately 8.45×106 t of refined oil products [4]. The application scope of alternative fuels continues to expand. According to China’s energy structure and relevant national energy development plan and incentives, and considering the development trends of various alternative fuels, in the near- and mid-term, biofuels and coal oil will be promoted further. The usage of liquid fuel will maintain an increasing trend. However, in the long term, the development of technology, raw materials, and new energy vehicles will mean this growth trend in consumption will slow. By 2050, it is expected to substitute approximately 3.3×107 t of refined oil products. The contribution of the rapid development of alternative fuel and new energy vehicles to reducing the demand for vehicle refined oil is shown in Fig. 2.

《Fig. 2. 》

Fig. 2. The contribution of the rapid development of alternative fuels and new energy vehicles to the reduction of demand for vehicle refined oil. Notes: Demand under the target scenario refers to the consumption of refined oil products after considering the development of new energy vehicle and the substitution effect of alternative fuels.

《4 China’s vehicle mineral resource utilization and development trend》

4 China’s vehicle mineral resource utilization and development trend

《4.1 Adequate supply of steel for vehicles, optimistic outlook for high-strength steel》

4.1 Adequate supply of steel for vehicles, optimistic outlook for high-strength steel

In the coming period, steel will continue to be the main raw material used to manufacture automobile bodies and parts in China. In the automotive industry, the usage of steel will still account for 60 % to 70 % of materials used for similar applications. The supply of automotive steel is sufficient in terms of current production capacity. With the advent of lightweighting in the automotive industry, high-strength steel materials will become the main materials used here as well. At present, the overall application ratio of high-strength steel in China’s automobile manufacturing remains at approximately 50 %. Although the application ratio is not much different to that in other countries, there is still a gap between the strength level of steel used in China and that in other countries. In particular, very little ultra-high-strength steel is used in China [7]. With the increase in domestic demand for high-strength steel, manufacturers are increasing their R&D efforts and striving to improve the technical level and product performance. As a result, the application ratio and strength level of high-strength steel for vehicles is expected to increase.

《4.2 The amount of vehicle magnesium resources is relatively low, and product performance needs further improvement》

4.2 The amount of vehicle magnesium resources is relatively low, and product performance needs further improvement

Magnesium alloy casting is a key material for automotive lightweighting. The average magnesium alloy usage per vehicle is approximately 10 kg in developed countries. In China, the average usage is less than 1.5 kg [7]. According to the technical roadmap, the magnesium alloy usage per vehicle in China will reach 15 kg in 2020, 25 kg in 2025, and 45 kg in 2030. Combined with the scale of automobile production and sales, the total amount of magnesium alloy in the automotive industry is expected to reach 4.5×105 t, 8.8×105 t, and 1.71×106 t in the aforementioned years, respectively. There is still a large gap between magnesium alloy products from China and those from other countries in terms of dimensional accuracy, intrinsic quality, and performance stability. Thus, product performance needs to improve.

《4.3 Aluminum resources are highly dependent on imports and face multiple challenges》

4.3 Aluminum resources are highly dependent on imports and face multiple challenges

The application of aluminum alloys is an important way to achieve automotive lightweighting. Aluminum is one of the staple mineral resources in China, which has a shortage. At the end of 2015, the proven reserves were 4.71×109 t, ranking only seventh in the world, and its dependency on imports has exceeded 40% [8]. The large import ratio has resulted in China’s aluminum product-related industries being vulnerable to the policies of exporting countries. China is a major producer and consumer of aluminum. In recent years, the output of aluminum has shown a steady upward trend. However, compared with developed countries, the 105 kg of average aluminum consumption per vehicle in China is still much smaller than the 140 to 150 kg in developed countries. However, aluminum consumption per vehicle is expected to exceed 350 kg by 2030 [7]. In addition, the current domestic aluminum industry has a high energy consumption, large emissions, and serious pollution problems. The technical performance of aluminum alloy parts needs to improve, and the application of automotive aluminum alloys faces many challenges.

《4.4 Lack of supply of lithium resources, and obvious shortterm constraints》

4.4 Lack of supply of lithium resources, and obvious shortterm constraints

The positive electrode of lithium ion batteries is made of lithium oxide. Lithium ion batteries have a high energy density and a long life cycle, and are core parts of electric vehicle batteries. In 2015, China’s proven reserves of lithium resources were about 5.1×106 t, ranking it fifth in the world. However, salt lake reserves exceed 80 % and mining and processing are difficult. The annual mining volume has accounted for only 5 % of the world total for many years. As a result, key lithium materials and products still rely on imports [5]. With the rise of the new energy vehicle industry, the downstream demand for lithium resources will increase substantially. However, upstream lithium mine development is constrained by factors such as resources and technology. In the short term, it is impossible to increase supply through rapid expansion. Therefore, the lithium industry needs urgent breakthroughs.

《4.5 Rich rare earth reserves and sufficient supply capacity》

4.5 Rich rare earth reserves and sufficient supply capacity

Rare earth is a key raw material for motors and batteries used in hybrid and electric vehicles. Its role in the manufacturing process of new energy vehicles is irreplaceable. China owns the world’s largest reserve of rare earth resources. In 2015, the total reserves were approximately 5.5×107 t (based on rare earth oxide REO), accounting for 44 % of the world’s total reserves. Moreover, the minerals and rare earth elements are complete and of a high grade. The distribution of mines is also reasonable [5]. In terms of current production capacity, China’s supply can fully satisfy the future development goals of new energy vehicles. According to the 13th Five-Year Plan of the rare earth industry, the new pattern of the industry with rational development, orderly production, efficient utilization, technological innovation, and coordinated development will provide strong support for the development of the new energy vehicle industry [9].

《4.6 Platinum resources are scarce, long-term constraints are prominent》

4.6 Platinum resources are scarce, long-term constraints are prominent

Platinum metals are mainly used in fuel cells and catalytic exhaust gas purifiers, and are one of the most expensive materials in automotive products. China is the world’s largest platinum consumer, the platinum consumption reached 73.1 tons in 2013, and its demand is growing each year. However, China’s annual platinum production is only 2 to 3 tons, which is far less than the domestic demand. In addition to the recycling of renewable resources, imports have become critical to satisfying this demand [10]. The lack of platinum resources and the high costs directly restrict large-scale commercial applications of fuel cells. As the scale of China’s automobiles continues to expand, the use of platinum will continue to grow, and the dependence on platinum imports will further increase.

《5 Policy suggestions》

5 Policy suggestions

《5.1 Clarify the technical roadmap, distinguish the near-term and long-term strategic development priorities, and promote different automotive technology routes in stages and with diversification》

5.1 Clarify the technical roadmap, distinguish the near-term and long-term strategic development priorities, and promote different automotive technology routes in stages and with diversification

It is suggested that China adhere to the development of electric vehicles and consider technology related to high-efficiency engines, hybrid vehicles, alternative fuel vehicles, hydrogen energy, and fuel cells. At the same time, China should guide the cross-integration and innovation of technology, strengthen the linkage and integrated development of new energy vehicles with renewable energy, smart grids, smart transportation, and smart Internet. Additional systematic policies should also be designed.

《5.2 Strengthen the infrastructure construction for new energy vehicles, implement good top-level planning, and improve the policy support system》

5.2 Strengthen the infrastructure construction for new energy vehicles, implement good top-level planning, and improve the policy support system

The development of new energy vehicles should be integrated with new urbanization, smart grid construction, transportation hub planning, regional economic planning, and communication networks. The construction of a charging infrastructure should be accelerated. Oil and gas supply companies such as China Petroleum and Chemical Corporation (Sinopec) and PetroChina Company, Limited, and social capital should be encouraged to invest in the charging infrastructure construction and services. Financial subsidies for charging infrastructure construction should be increased.

《5.3 Focus on industrial upgrading in the field of lightweight material manufacturing, increase independent innovation, and improve product performance》

5.3 Focus on industrial upgrading in the field of lightweight material manufacturing, increase independent innovation, and improve product performance

It is suggested that China accelerate the establishment of an independent R&D system, facilitate industry–university cooperation, and accelerate the development of new types of products suitable for the needs of the lightweight automotive industry. Efforts should be made to reduce the intensity of pollutant emissions in the manufacturing process of high-strength steels, aluminum alloys, and magnesium alloys. Furthermore, the safety of product applications needs to improve, and the cost per unit product should be reduced.

《5.4 Promote rational development and effective utilization, optimize the structure, and maximize the economic and environmental benefits of China’s mineral resources》

5.4 Promote rational development and effective utilization, optimize the structure, and maximize the economic and environmental benefits of China’s mineral resources

“Broadening sources” and “reducing expenditure” should be combined to scientifically plan the development and utilization of domestic resources, actively develop and utilize foreign mineral resources, and implement international cooperation. The Belt and Road Initiative should be considered a development opportunity to promote mining cooperation, increase collaborative exploration and mining investment, and fully utilize the complementary advantages and cooperation potential of all parties along the road, thus promoting the development and utilization of mineral resources and achieving mutual benefits. A strategic mineral storage system should be established to ensure the longterm and stable development of the automotive industry. It is also suggested that China increase its scientific and technological research, reduce technology costs, develop alternative materials for vehicles, and reduce the use of rare minerals per unit vehicle.

京公网安备 11010502051620号

京公网安备 11010502051620号