《1 Introduction》

1 Introduction

With the implementation of Chinese enterprises’ internationalization planning in 2009 and the promotion of the Belt and Road initiative in 2013, Chinese construction companies (CCCs) have actively participated in international competition and cooperation through foreign direct investments, international project contracting, and labor services. Overseas businesses have reached a stage of rapid development, with an average annual growth rate of approximately 10% in turnover and an increase of 20% in the international market share [1]. Despite these achievements, CCCs are vulnerable to noncompliance. In fiscal years FY2009–FY2020 (FY is the fiscal year that refers to the period from July 1 of the previous year to June 30 of the current year), 636 entities (excluding cross-debarment and any affiliates controlled by debarred firms/individuals) were imposed the sanction of debarment by the World Bank Group (WBG), involving 62 Chinese entities of which 90% were construction companies. “Debarment” means that these entities are ineligible to receive WBG-financed contracts permanently or within a specified period, including direct and indirect holding subsidiaries of the entities and their successors and transferors. During the process of being released from sanctions, external agencies involved in regulation and assessment may increase the risk of disclosure of entities’business information. Some countries probably hinder CCCs from “going global” through “long-arm jurisdiction.” Therefore, if a Chinese construction company is sanctioned because of its noncompliance, its operating costs will increase, its reputation in the market will be tarnished, and its international competitiveness will be weakened. In addition, the sanction will spread, ruining the reputation of the Chinese construction industry with significant negative externalities and hindering the high-quality development of the Chinese construction industry.

In China, compliance management was first adopted in the banking industry. After the “ZTE Incident” in 2018, compliance management started to attract the attention of the authorities. China issued a series of documents related to compliance management, including Compliance Management Systems — Guidelines, Guidelines for Compliance Management of Enterprises’ Overseas Operations, and Guidelines for the Compliance Management of Central Enterprises, extending the requirements for corporate compliance management to other industries. However, these documents are not tailored to address the risk profiles and circumstances of construction companies. Corporate compliance management has attracted the attention of many researchers. The inducers for companies to engage in illegal risk-taking behaviors have been analyzed [2]. The content and essence of the German compliance management system have been introduced [3]. Systematic research on the basic concepts, sources, nature, tasks, and sinicization of corporate compliance has been conducted from a legal perspective [4]. Based on lessons learned from advanced international experience and taking the central construction enterprise as an example, the compliance framework of central enterprises has been analyzed [5]. It should also be noted that in the existing research on compliance management, most of the research objects were ordinary enterprises rather than construction companies, and most research targets were domestic operations rather than overseas operations.

The compliance management of overseas businesses is a prerequisite for CCCs to enhance their international competitiveness and for the Chinese construction industry to achieve high-quality development. Based on this demand, the World Bank sanctions system and the customary laws and regulations related to compliance management in overseas business operations are summed up. The current status of sanctions against CCCs for noncompliance in overseas operations is summarized. Outstanding issues in the compliance management of overseas businesses are refined. Finally, recommendations for the compliance management development of overseas operations by CCCs are proposed from a macro-perspective.

《2 Analysis of rules of companies’ overseas operations》

2 Analysis of rules of companies’ overseas operations

《2.1 Sanctions system of WBG》

2.1 Sanctions system of WBG

In the early days, the WBG considered corporate misconduct within the scope of a country’s internal affairs to respect national sovereignty and did not impose sanctions. The WBG did not decide to add anticorruption in construction projects into its jurisdiction until1995. From then on, the WBG has gradually established substantive rules and sanctions against corruption, fraud, and other misconduct through the expanded interpretation of the fiduciary duty in Articles of Agreement of the International Bank for Reconstruction and Development. The substantive rules stipulate the rights and obligations of relevant subjects, including nine documents distributed at three levels. The sanctions regime consists of three main regulatory documents and three functional departments.

After the reforms in 2006, the sanction agencies of the WBG mainly included the Integrity Vice Presidency (INT) as an investigation and prosecution agency, the Suspension and Debarment Office (SDO) as a primary trial agency, and the Sanctions Board (SB) as a secondary trial agency. The two-tiered administrative process has been formed since then. Sanctionable practices include corruption, fraud, coercion, collusion, and obstruction. All possible misconduct involved in WBG-financed projects is covered by the sanctions jurisdiction of the WBG.

There are five types of sanctions in the WBG sanctions system. (1) The first type is the letter of reprimand. (2) The second is debarment, in which the sanctioned party is immediately excluded from accessing WBG-financed contracts for a specified period of time or permanently. (3) The third is conditional non-debarment (CND), in which a firm or individual is eligible to participate in WBG-financed projects. CND converts to debarment with a conditional release if the firm or individual does not satisfy the sanctions conditions. (4) The fourth is the debarment with conditional release. The respondent will be released from debarment after meeting certain defined conditions (implementation or improvement of an integrity compliance program) and after the defined debarment period lapses. (5) The fifth sanction type is restitution.

In 2009, to ensure that the funds entrusted to it were used for the intended purposes, the WBG added the early temporary suspension before the existing two-tier administrative process. Thus, the sanction procedure consists of three parts: 1st tier-SDO phase, 2nd tier-SB phase, and the early temporary suspension (Fig. 1). Among the three types of sanctions procedures, the 1st tier-SDO phase is mandatory, the 2nd tier- SB phase is launched by the respondent, the early temporary suspension is initiated by INT, and the final adjudication power is issued by the SDO.

《Fig. 1》

Fig. 1. Sanctions system flowchart of the WBG.

In 2010, the WBG, along with the Asian Development Bank, Inter-American Development Bank, African Development Bank, and European Bank for Reconstruction and Development, established a system for the mutual recognition of enforcement actions (each known as a “participating institution,” and collectively, the “participating institutions”). If the initial debarment period exceeds one year, each participating institution enforces debarment decisions made by the other participating institutions. Thus, a cross-debarment mechanism has been developed. In the same year, the WBG started to implement settlement agreements. The final decision can be made before the SB issues a decision or even during the investigation. The most common final decision is the debarment with conditional release based on the settlement agreement.

In summary, the sanctions system established by the WBG for corporate misconduct is timely amended and logically rigorous. The scope of sanctionable practices and targets has gradually expanded and improved. Additionally, the types of sanctions have become more targeted. The rule system and sanctions process of the WBG is relatively complicated and significantly different from China’s legal system. For CCCs that are “going global,” it is challenging to master and apply the corresponding rules flexibly

《2.2 Representative laws and regulations》

2.2 Representative laws and regulations

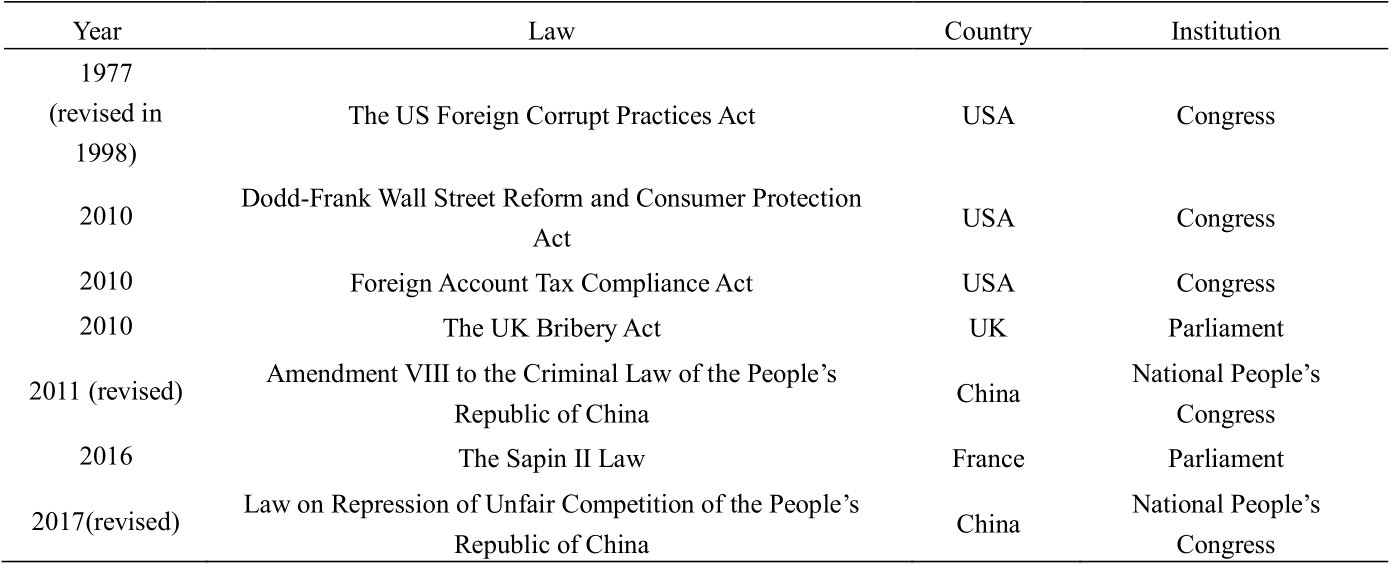

In response to the misconduct of multinational companies overseas, developed countries have legislated to strictly supervise their multinational companies, such as the US Foreign Corrupt Practices Act and the UK Bribery Act [6]. Active exploration of the legislation for this issue has also been conducted in China (Table 1). These laws have strict penalties for overseas misconduct. In addition, with the United States as a representative, many countries have promulgated laws and regulations to encourage compliance management (Table 2).

《Table 1》

Table 1. Representative laws issued to regulate overseas misconduct.

《Table 2》

Table 2. Representative regulations that motivate compliance management.

Note : Seven ministries of China refer to the National Development and Reform Commission, Ministry of Foreign Affairs of the People’s Republic of China, Ministry of Commerce of the People’s Republic of China, the People’s Bank of China, the StateOwned Assets Supervision and Administration Commission of the State Council, State Administration of Foreign Exchange, and All-China Federation of Industry and Commerce

According to the Federal Sentencing Guideline Manual, active and effective corporate compliance management is a vital plot to mitigate punishment in the United States. For “what is effective compliance management,” a checklist is made in the Evaluation of Corporate Compliance Programs. The United States popularized compliance management from criminal law enforcement agencies and gradually promoted it to administrative agencies. Finally, administrative supervision and criminal law incentive mechanisms coexist in the United States. Under the dual incentive mechanism, US companies actively implement compliance programs.

International organizations have also successively proposed declarations, set compliance standards, and established ex-ante incentive mechanisms (Table 2). For example, the WBG has developed an administrative compliance mechanism through which companies can seek to mitigate punishment by enforcing compliance management. For companies that have been sentenced to “debarment with conditional release,” they must establish (or improve) and implement an integrity compliance program and be supervised during the inspection period. In 2014, the International Organization for Standardization (ISO) launched ISO 19600:2014 Compliance Management Systems — Guidelines to guide companies in building a compliance program. Subsequently, ISO 37301:2021 Compliance Management Systems — Requirements with Guidance for Use was released to certify corporate compliance management. These standards provide a systematic reference for CCCs to improve their overseas compliance management capabilities and a direct basis for government agencies to conduct thorough administrative supervision.

《3 Analysis on the overseas operation of compliance management of CCCs》

3 Analysis on the overseas operation of compliance management of CCCs

《3.1 CCCs face a critical situation of noncompliance in their overseas operations》

3.1 CCCs face a critical situation of noncompliance in their overseas operations

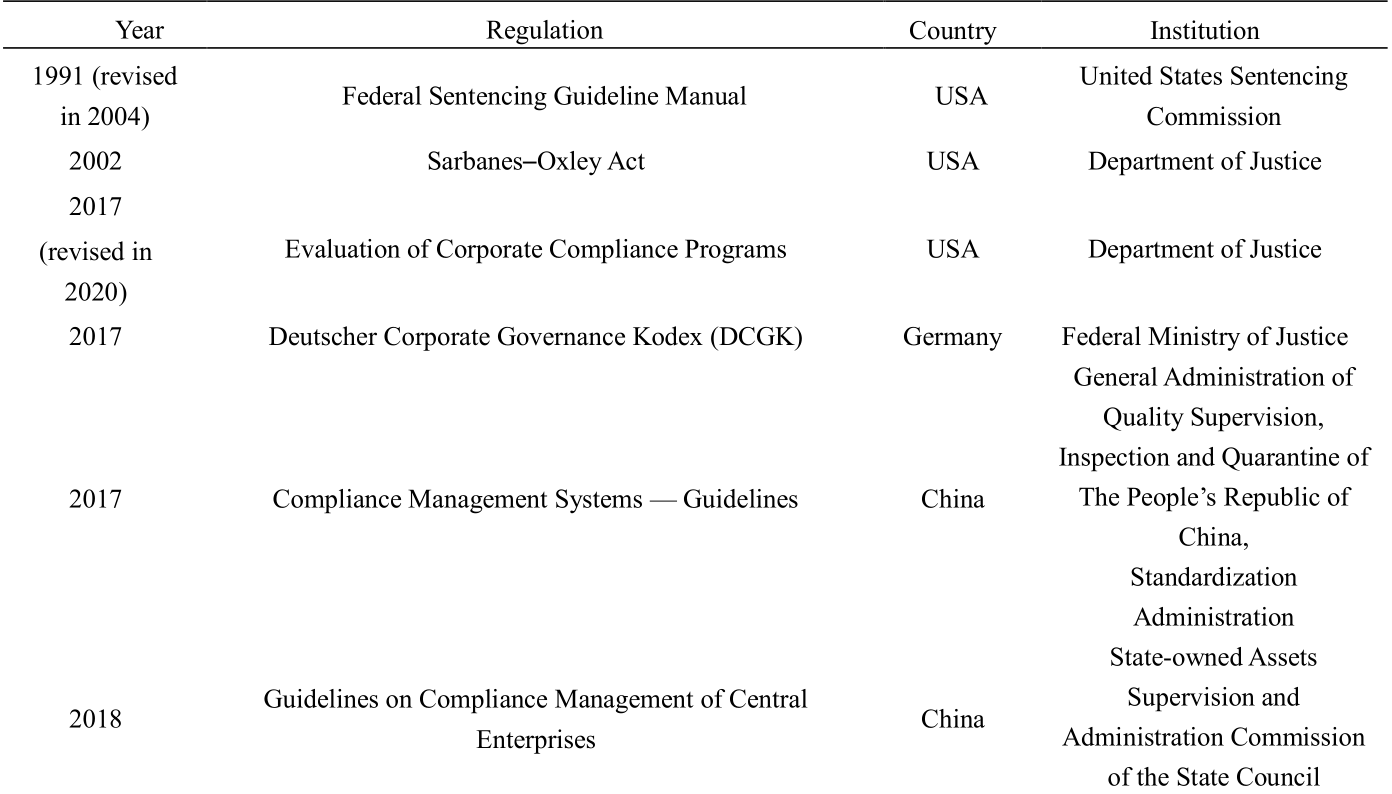

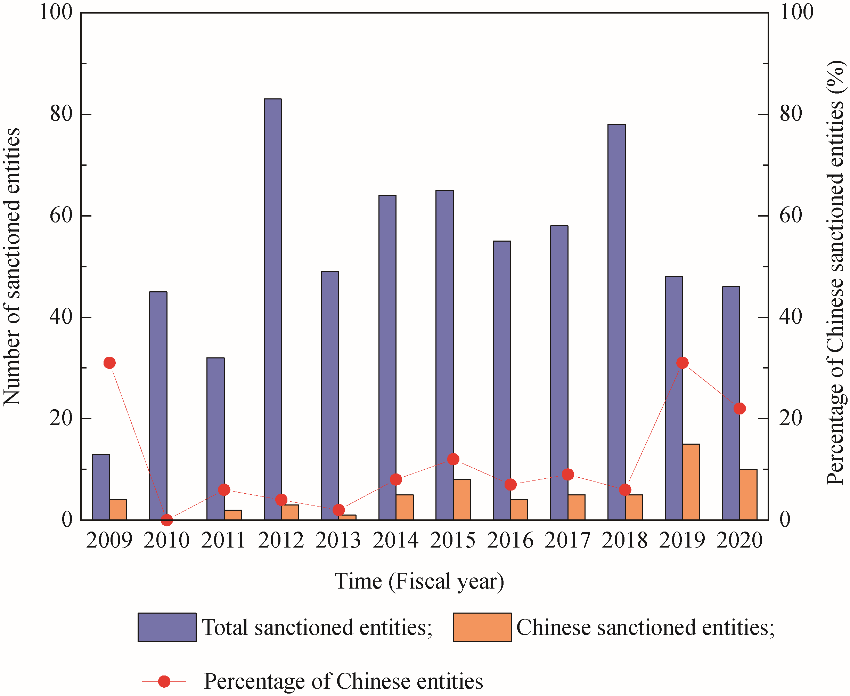

The WBG imposed sanctions on entities engaging in sanctionable practices since 1999. After reviewing the World Bank Group Sanctions System Annual Report from FY1999 to FY2020, it was found that the WBG sanctioned CCCs since 2009. In the following 11 years, the number of entities sanctioned for “noncompliance” continued to increase, notably, 10 in FY2020, accounting for 21.7% of the total sanctioned entities that year. From FY2009 to FY2020, 56 CCCs were sanctioned (Fig. 2), of which 39.3% and 51.5% were listed companies and state-owned enterprises, respectively. Most of the companies are well-known top-ranked companies in the construction industry. Because of the “corruption implicit case” effect [7], the actual number of CCCs committing “noncompliant” in overseas operations is higher than the values presented in Fig. 2. With the steady progress of the Belt and Road initiative, more CCCs will venture abroad. Effective supervision and control should be promptly conducted to significantly increase the proportion of companies that implement compliance management.

《Fig. 2》

Fig. 2. Entities sanctioned by the WBG (FY2009-FY2020).

《3.2 CCCs have a certain degree of opportunism in their overseas operations》

3.2 CCCs have a certain degree of opportunism in their overseas operations

Based on the data in World Bank Group Sanctions System Annual Report from FY1999 to FY2020, the types of misconduct alleged by the WBG are analyzed (Fig. 3). Fraudulent practices are the main reasons for debarment, accounting for 69.1%, followed by corrupt practices (15.2%), collusive practices (14.0%), obstructive practices (1.2%), and coercive practices (0.4%). Among the 56 CCCs that have been imposed debarment, 51 are alleged for fraudulent practices, four are alleged to be involved in collusive practices, and one is implicated in sanctions. Among the misconduct types, fraudulent practices mainly occur during the bidding phase of projects to qualify for contracts, for example, forging experience certificates, participants’ resumes, or performance guarantees. Compared to other sanctionable practices such as corruption and collusion, forging text documents before executing a contract is cheaper and easier; if the bid is won, the potential benefits significantly outweigh the costs, reflecting the opportunism of the entities in their overseas operations [8].

《Fig. 3》

Fig. 3. Type of misconduct alleged by the WBG in cases (FY2009–FY2020).

《3.3 Sanctions imposed on CCCs have a short duration and wide range of impact》

3.3 Sanctions imposed on CCCs have a short duration and wide range of impact

According to the Work Bank Group Sanctioning Guidelines, the default sanction for all misconduct is a threeyear debarment with conditional release. On this basis, aggravating or mitigating factors are considered when the final length of the sanctions is issued. Because most companies adopt a proactive and cooperative attitude, approximately 70% of entities are sanctioned for no more than three years (Fig. 4). The proportion of CCCs receiving sanctions of three years or less accounted for 84.3%, which is higher than the global average. For each incidence of misconduct, the sanction period varies according to the type of behavior. Compared to collusion and corruption, the duration of debarment for fraud is shorter. However, a respondent engaged in multiple incidences of misconduct faces a longer debarment. CCCs are mostly sanctioned for a single fraud behavior, so the overall debarment period is shorter than the average debarment duration.

《Fig. 4》

Fig. 4. Length of sanctions imposed by the WBG (FY2009–FY2020).

It should be noted that 89.3% of the sanctioned CCCs are subjected to a sanction period exceeding one year, which results in cross debarment based on the cross-debarment mechanism. In addition, the branches of the four companies have been implicated in sanctions; the corresponding branches are at least two and up to 730, with a wide range. Therefore, for large-scale group construction enterprises, many overseas affiliates with various operating levels are available, and it is a significant challenge for the domestic headquarters to control the compliance operations of overseas branches. When the WBG sanctions some branches, other affiliates of group enterprises are implicated in the sanctions. In this type of “bundled” sanctions, group construction enterprises are in an unfavorable situation.

In the sanctions cases disclosed by the WBG, the sanction period and sanction measures of the 2nd tier procedure are less severe than those of the 1st tier procedure. Moreover, reaching a settlement significantly reduces the severity of the sentence. Appealing to the 2nd tier procedure or reaching a settlement mitigates the consequences of sanctions positively, but this requires the mediation of proficient professionals in construction and international laws. As of April 2019, 66% of cases sanctioned by the WBG were terminated in the 1st tier procedure [9]. Up to 94.6% of the CCCs sanctioned by the WBG are in the 1st tier procedure, whereas only three are sanctioned in the 2nd tier procedure. Therefore, the resources and confidence of CCCs in conducting foreign-related defenses are insufficient. In March 2021, compliance officer was included for the first time in the Occupation Classification Ceremony of the People’s Republic of China, indicating that the compliance officer professionals are very scarce in China.

《3.4 The international supervision of the overseas business of CCCs is gradually strengthened》

3.4 The international supervision of the overseas business of CCCs is gradually strengthened

The WBG has improved its ability to collect evidence of misconduct by creating the company risk profile database, establishing information platforms, launching a global survey, and using commercial satellite remote sensing images. The WBG can promptly initiate investigations for entities engaging in sanctionable practices. Thus, the proportion of cases with sufficient evidence increases annually. After 2013, the proportion of cases with sufficient evidence remained above 60%, while it has been close to 80% in the past two years (Fig. 5). These values imply that once the WBG initiates an investigation, it exhibits a high degree of certainty to convict the company. Therefore, in the process of expanding overseas businesses, CCCs need to pay close attention to the changing compliance requirements.

《Fig. 5》

Fig. 5. Proportion of cases with sufficient evidence reviewed by INT of WBG (FY2009–FY2020).

《3.5 Environmental hostility in host countries for compliance management of CCCs》

3.5 Environmental hostility in host countries for compliance management of CCCs

Unlike conventional international trade, the production processes, management, and operations of construction companies are performed in the host country, and the corresponding behavior is considerably influenced by the host country’s environment. Based on the data collected for 171 countries where sanctioned projects are located in the World Bank Group Sanctions System Annual Report, the top ten representative project countries are depicted in Fig. 6. These project countries are all developing countries. The average values of the Corruption Perception Index [10] and World Justice Project Rule of Law Index [11] are 33 and 0.47, respectively, both of which are lower than the global average value (43, 0.56). Currently, most overseas businesses of CCCs are in developing countries, and most countries along the Belt and Road are also developing countries. The quality of the legal system in developing countries is low, and measures such as anti-corruption are weaker than in developed countries [12]. Keeping away from corruption is an urgent challenge for CCCs.

《Fig. 6》

Fig. 6. Host countries of projects sanctioned by the WBG (FY2009–FY2020).

《3.6 Home country has weak regulations on overseas operations of CCCs》

3.6 Home country has weak regulations on overseas operations of CCCs

According to the data of 636 cases presented in the World Bank Group Sanctions System Annual Report, the top ten regional origins of respondents sanctioned by the WBG are presented in Fig.7, all of which are developing countries. The behaviors of the parent company’s managers and expatriates are profoundly influenced by the environment of the home country. If the overall level of the rule of law in the home country is not high [13] and the incentives to eradicate misconduct is low [12], the probability of noncompliance behaviors occurring under the influence of inertia [14] by the overseas branch of the company will increase.

《Fig. 7》

Fig. 7. Regional origin of respondents sanctioned by the WBG (FY2009–FY2020).

Implementing a compliance program requires significant resources but hardly direct performance is achieved, so companies typically lack the motivation to implement compliance management. Therefore, external incentive mechanisms, such as administrative and criminal law incentive mechanisms, need to be established [15]. In terms of administrative incentive mechanisms, the document Implementation Measures for the Pilot Administrative Reconciliation was issued by the Chinese Securities Regulatory Commission in 2015, introducing the administrative reconciliation system in administrative supervision and law enforcement in the securities industry. Compliance Management of Securities Companies and Securities Investment Fund Management Companies was released in 2017 to enforce compliance management in the securities industry. However, a similar administrative incentive mechanism has not yet been implemented in the construction industry. Thus, construction companies cannot charge in exchange for more lenient administrative sentencing through an effective compliance program. What’s worse, the criminal law incentive mechanism in China is still in the theoretical stage.

China has not yet enacted a law specifically targeting misconduct in overseas operations, except relying on a few provisions in the Criminal Law of the People’s Republic of China and Anti-Unfair Competition Law of the People's Republic of China (Table 1). Furthermore, these provisions only address corruption and do not cover fraud, coercion, obstruction, and other noncompliant behaviors. Although China has made initial attempts to guide enterprises in implementing compliance management, the authority of the issuing organizations appears to be powerless. Currently, there are no written standards in China for evaluating the effectiveness of compliance programs. In summary, Chinese laws and regulations on the overseas operations of CCCs are incomplete.

《4 Recommendations》

4 Recommendations

《4.1 Encouraging multilateral cooperation and emphasizing international interaction》

4.1 Encouraging multilateral cooperation and emphasizing international interaction

It is recommended to strengthen cooperation with relevant countries, regions, and international organizations in the fields of anticorruption law enforcement, extradition, judicial assistance, transfer of sentenced persons, asset recovery, and information exchange, and actively carry out bilateral or multilateral cooperation. First, the construction companies should join the multilateral cooperation represented by OECD Guidelines for Multinational Enterprises, participate in the activities of the National Contact Points (NCPs) organized by the OECD, and carry out “responsible investment”. Second, in addition to bilateral cooperation with developed countries (such as China– US, China–Canada, and China–Australia anticorruption bilateral cooperation), efforts should be made to establish similar bilateral cooperation with developing countries. Third, joint investigations of criminal matters are recommended, including civil affairs and administrative investigation and litigation, such as preventing, investigating, prosecuting, punishing, recovering, and returning profits obtained through misconduct. Through these measures, China’s ability to combat overseas misconduct and international discourse power will continue to improve, and an open and transparent compliance atmosphere will be shaped.

Furthermore, attention should be drawn to the interaction with international nongovernmental organizations, such as inviting Transparency International in infrastructure construction projects to build the “Clean Silk Road ” jointly. The integrity and compliance of CCCs overseas should be vigorously promoted to create a responsible image in the international construction market.

《4.2 Accelerating establishment of legal systems and promoting the compliance program》

4.2 Accelerating establishment of legal systems and promoting the compliance program

The legal system involving foreign affairs should be strengthened, and the legislation of laws and regulations related to the overseas operation of CCCs should be carried out. It is necessary to establish ex-ante incentives and ex-post enforcement tactics to clarify the necessity of implementing the compliance program from both aspects. The former refers to establishing ex-ante incentive mechanisms in the dimensions of criminal law and administrative law. The latter refers to establishing a legal system to discipline noncompliant companies, including construction companies. Furthermore, guidelines should be tailored for the overseas operations of CCCs to solve the basic problem of “how to build the corporate compliance program.” Finally, standards that are consistent with international standards and reflect the characteristics of China’s construction industry should be developed to assess the effectiveness of compliance programs. The overall improvement of compliance management level in overseas operations should be promoted by combining legislative, judicial, administrative, and other multilevel and multifield measures.

《4.3 Integrating advanced technology and implementing digital governance》

4.3 Integrating advanced technology and implementing digital governance

It is recommended to develope an online and offline integrated supervision system, actively adopt new technology (e.g., blockchain, big data, and artificial intelligence), optimiz guidance and supervision methods, and improve the digital capability to govern the overseas operations of CCCs. First, given the common features of the construction industry, the compliance requirements in the “hard law” of the UN, regional and international organizations, and national laws should be sorted out comprehensively. Second, intelligent technology (e.g., knowledge graphs and natural language processing) should be used to compile compliance requirements by region and country to achieve the systematization and digitization of rules. Moreover, a regional- and country-specific platform of compliance requirements should be established to provide inquiries, compliance consulting, and knowledge engineering services, supporting CCCs in accurately identifying and safely fulfilling their compliance obligations. Third, the following measures need to be adopted: updating rules promptly, assessing overseas compliance risks by country, guiding CCCs to avoid businesses in areas with high compliance risks, and accurately identifying overseas investment directions.

It is also suggested to establish a regular reporting mechanism for the overseas compliance status of CCCs and build an information platform for corporate compliance supervision. Big data and machine learning techniques should be applied to supplement the collection of relevant data, detect misconduct, and assist in evaluating business compliance status. By integrating, sharing, and monitoring information, cross-field and cross-departmental linkage law enforcement and collaborative supervision mechanisms should be improved to facilitate the systematization, digitization, and intelligence of compliance supervision.

《4.4 Enhancing ability of compliance management and cultivating professionals》

4.4 Enhancing ability of compliance management and cultivating professionals

In adherence to the development path of the construction industry of “going out, going in, and sustainable development”, the overseas branches of construction companies should be guided to engage in rational competition and avoid vicious competition. CCCs should be encouraged to adopt advanced technology and satisfy advanced standards in their operations. It is encouraging for CCCs to learn from successful cases to improve their competitiveness by cultivating compliance management capabilities. It is proposed to create a culture of compliance and raise awareness of compliance risks in CCCs.

It is recommended to reasonably increase funding for research on compliance management of the construction industry, increase the proportion of moral and ethical education in vocational education courses, and cultivate engineering and technical talents with a wide range of knowledge. In terms of legal talents, the investment in international legal education resources should be increased to cultivate professionals proficient in foreign-related laws and regulations. For compliance management talents, a registration system for the Integrity Compliance Officer (ICO) should be established in line with international standards. Moreover, a compliance management talented team is needed to achieve the high-quality development goals of the construction industry.

京公网安备 11010502051620号

京公网安备 11010502051620号