In June 2021, the Ontario, Canada-based company Li-Cycle announced plans to, by the end of 2021, begin construction of North America’s largest lithium-ion battery (LIB)-recycling facility in Rochester, NY, USA. As automakers increasingly switch to electric vehicle (EV) production, the move addresses what the ‘‘resource recovery” company’s chief executive officer, Ajay Kochhar, hyperbolically has described as an incoming ‘‘battery tsunami” [1].

In the meantime, debates continue about how best to deal with the many end-of-life EV batteries the future inevitably holds—recycle, reuse, repurpose, or a combination thereof—and the implications for the environment.

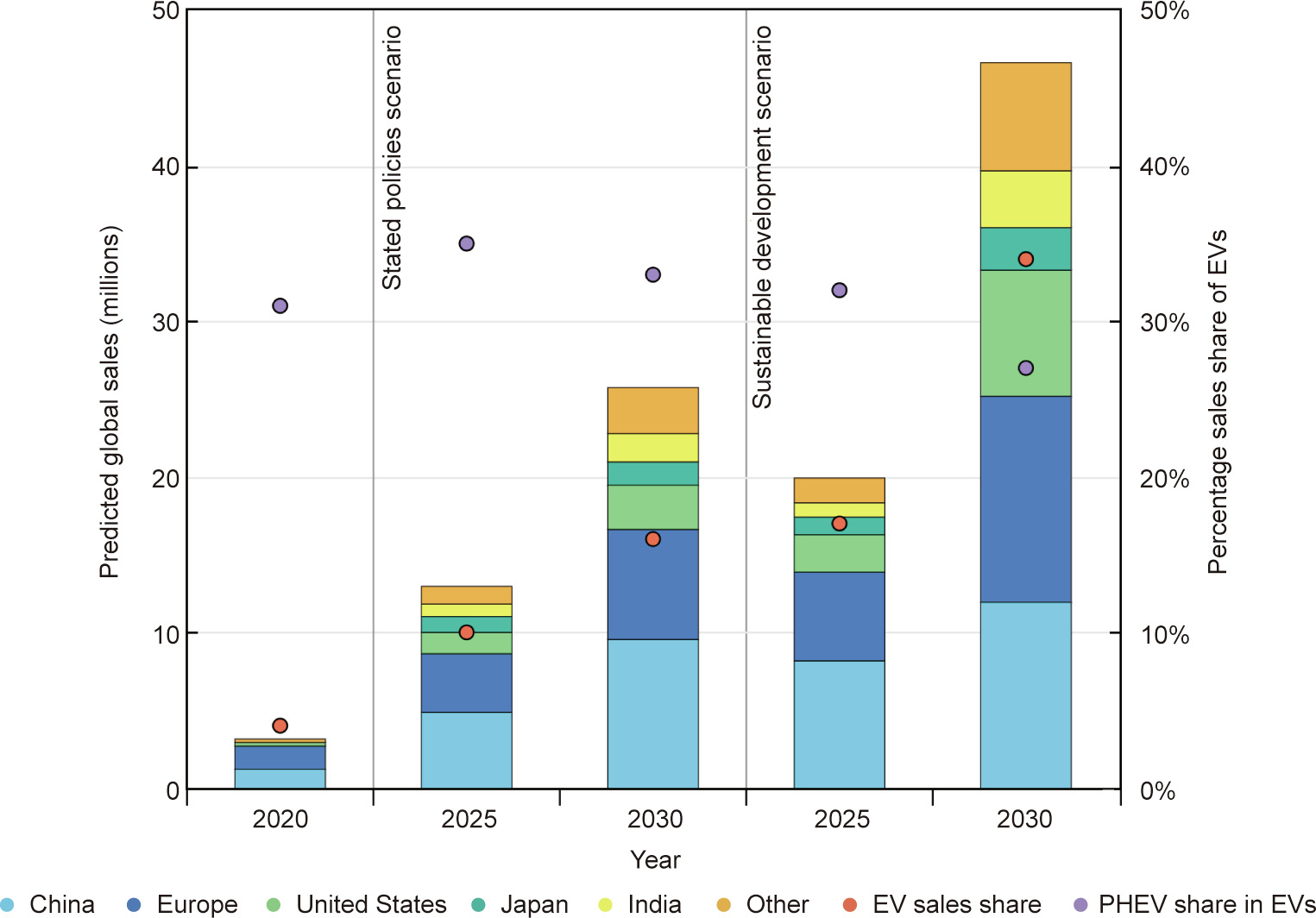

At the end of 2020, there were 10 million EVs on the road, according to the International Energy Agency. By 2030, that figure will rise to between 145 million and 230 million EVs on the road (Fig. 1), depending on how aggressively governments push national efforts to curb climate change through reducing greenhouse gas emissions [2–4].

《Fig. 1》

Fig. 1. Predicted global sales of EVs, in millions, based on current (2020) and stated national policies (center and left-hand bars) and under a sustainable development scenario (right-hand bars). The orange circles represent the percentage sales share of EVs out of total vehicle sales, and the purple circles represent the percentage of all EV sales that are for plug-in hybrid EVs (PHEV). Credit: International Energy Agency, with permission.

Dealing with the LIBs from these EVs when they reach the end of their lives is a looming challenge. For now, though, recycling of EV batteries is in its infancy, with most of the discard coming from production scrap, recalls and pre-production vehicles. ‘‘The basic problem is that there just isn’t all that much battery material available for recycling yet,” said Linda Gaines, chief scientist at ReCell, the US Department of Energy’s Vehicle Technologies Office’s advanced battery recycling research and development center. ‘‘Because the growth is so rapid, everybody talks about this huge pile of waste. But compared with the number of batteries going into service, the number of end-of-life batteries coming back is tiny.”

The environmental case for being ready to recycle large numbers of EV batteries when they reach the end of their useful life is not hard to understand, but there are both commercial and technical challenges in recycling or disassembling end-of-life LIBs. One is the sheer range of designs, sizes, chemistries, architectures, and production techniques. For example, the Tesla model S 85 Mk1 (2014) has a battery pack containing 16 battery modules, with 444 cylindrical cells per module, while the battery pack of the Nissan Leaf Mk1, made in the same year, has 48 modules, each with four large pouch cells. The cells in different vehicles are constructed using different bonding, may be housed under considerable pressure, and contain various levels of critical metals [6]. Bottom line, these batteries have not been designed to be easily picked apart, reconditioned, and reused.

Besides the architecture, the chemical formulations and proportions of LIB constituents are constantly evolving, though the cathode in the majority of EV LIBs consists of layered lithium transition metal oxides of nickel, manganese, and cobalt. These metals, particularly cobalt and nickel, are the prime targets of recycling, and a frequently used process to extract high value metals such as nickel is pyrometallurgical recovery. This involves, essentially, throwing the entire battery unit into a furnace and smelting it to reclaim the target metals, a process that carries high energy costs, creates toxic gases that need to be remediated with the burning off of the lithium, plastics, and battery electrolytes, and also reduces what can be reclaimed [5]. From an environmental perspective, it is an objectionable approach for tackling the coming deluge of EV batteries to be recycled.

Another widely used approach, hydrometallurgical reclamation, has a much smaller environmental impact and employs a variety of reagents to leach the important metals from the cathode material, including lithium. Before this reclamation can happen, though, the batteries must be thoroughly shredded, and typically sorted into three categories—plastics, aluminium/copper foils, and the anode/cathode materials (Fig. 2), a challenging task in and of itself. The anode/cathode material, called ‘‘black mass,” is what is subjected to the hydrometallurgical process to reclaim the valuable elements.

《Fig. 2》

Fig. 2. (a) LIB of various kinds—though no EV batteries in this picture—cascade down a conveyor belt for processing at Li-Cycle’s Rochester, NY, USA, ‘‘Spoke” facility. (b) Once shredded, the battery materials are sorted into plastics (top), aluminium/copper foils (middle), and the anode/cathode materials, known as ‘‘black mass” (bottom). (c) The black mass is collected for recycling of its nickel and cobalt content by hydrometallurgical reclamation. Credit: Li-Cycle, with permission.

This approach has a particular appeal because it is less environmentally harmful than the smelting approach and can be widely applied. ‘‘We can take any type of lithium-ion battery, it does not matter the chemistry, whether it is a battery from an EV, a laptop, or a vape pen, it is all the same when it gets shredded up and made into black mass,” said Chis Biederman, Li-Cycle’s chief technology officer.

Li-Cycle’s plans to build the largest LIB recycling infrastructure in North America use what it calls a ‘‘Spoke and Hub” model. Currently, the company has two spoke facilities in operation—one in Kingston, ON, Canada, and the other in Rochester—which take all types of LIBs, shred and separate them into the three categories, and, currently, sell them to other companies that complete the recycling process. Each spoke facility can process 5000 t of LIBs annually, and the company has announced plans to build two more, one in Arizona and the other in Alabama. Its Rochester ‘‘Hub” facility, due for completion in early 2023, will process black mass from the equivalent of 60 000 t of batteries annually, said Biederman. ‘‘Currently we sell the black mass for its metal value. But the long-term play for us, with our hub technology, is to take that as an intermediate product and convert it back into energy materials such as cobalt sulfate, nickel sulfate, and lithium carbonate.”

The rapid electrification of the auto industry is driving the development of battery-producing ‘‘gigafactories” all over the world—a term inspired in part by its obvious reference to numbers in the billions, and by Tesla’s original car battery plant, the Tesla Gigafactory in Sparks, NV, USA. In July 2021, Nissan announced plans to build the United Kingdom’s biggest battery factory, in Sunderland [6]. Swedish car maker Volvo Cars has joined forces with another Swedish firm Northvolt to create a gigafactory called Northvolt Ett in Skellefteå, Sweden [7], in addition to a major battery-recycling plant. In 2019, General Motors Company (GM), based in Detroit, MI, USA, teamed up with LG Chem Ltd., based in Seoul, the Republic of Korea, to build a gigafactory in Lordstown, OH, USA, under the name Ultium Cells LLC, and in 2021 announced plans to build a second 2.3 billion USD gigafactory in Spring Hill, TN, USA [4,8,9]. And the Ford Motor Company also recently announced an 11 billion USD plan to build three battery factories, in addition to an electric truck plant, in the USA [10].

Once fully operational, these factories, and others like them, will produce enormous amounts of batteries, but also battery scrap. The latter, which includes EV batteries that fail quality control checks, are outputs that offer an opportunity to boost battery recycling capacity, said Biederman. ‘‘The really aggressive scale up of manufacturing produces scrap material that we can process and then put back into the supply chain. Then, as end-of-life vehicle batteries start to come through the chain, we can also process those and recover the material.”

Most LIBs are currently produced in China, Japan, and the Republic of Korea, where some have taken a different approach to recycling. ‘‘In China, lithium-ion battery manufacturing is highly vertically integrated,” said Gavin Harper, a Faraday Institution Research Fellow at the University of Birmingham in the United Kingdom. Harper is a member of the ReLiB project, run by the Faraday Institution—the UK’s independent institute for electrochemical energy storage research and early-stage commercialization. ReLiB explores the conditions required for the sustainable management of end-of-life LIBs from EVs. ‘‘China is making so many factories, and it is also building capacity to recycle battery scrap,” Harper said. Indeed, the Chinese authorities have stepped in to push a recycling agenda. In 2018, the Chinese Ministry of Industry and Information Technology issued regulations for manufacturers of EV batteries, including requirements that these products be standardized so they can be disassembled more easily. The new measures also required the EV producers themselves to take responsibility for the entire product life cycle, including end-of-life recycling for the batteries in their cars [11]. Meanwhile, in 2020, the European Union (EU) proposed a new Battery Regulation aimed at ensuring sustainability for batteries placed on the EU market [12].

While pyrometallurgy and shredding/hydrometallurgy currently dominate LIB recycling, when it comes to EV batteries specifically, shredding is not the preferred answer for many experts [13]. ‘‘Shredding is elegant, in the sense that it is a relatively simple solution,” said Harper. ‘‘But at ReLiB we question the value of mainly producing black mass, because it then becomes much more difficult to carry out the subsequent recreation of a battery. If you could separate the battery more cleanly into cathode, anode, and foils, then your subsequent processes could be much more efficient because you do not have to go back to square one.” Such a separation—or delamination—process that rapidly breaks adhesive bonds between electrodes and foils using high powered ultrasound has recently been reported [14].

Another key consideration in battery recycling is that it is not only the elements in a cathode that make it valuable. ‘‘The cathode has the cobalt and the nickel and so on, but it is not just the elements stuck together in a random way,” said ReCell’s Gaines. Because they enable the cathodes to hold the lithium ions and work in a battery, these compounds ‘‘have a value much greater than simply the value of the elements,” said Gaines. But different battery makers use different chemistries, so a specific cathode material is not universally useful to battery makers. ‘‘That argument has been used against direct recycling from the beginning,” she said. ‘‘But it is also a reason that battery manufacturers should process their own scrap, rather than sending it to a recycler that is going to smelt or shred it.”

That is not the current direction of US EV makers, however. For example, Ultium Cells LLC recently struck a deal with Li-Cycle to recycle the scrap generated by its Lordstown plant [15].

Another reason that smelting or hydrometallurgy may not be good long-term solutions to the EV LIB recycling challenge is that these approaches are commercially viable only for as long as battery cathode material contains valuable elements, such as cobalt and, to a lesser extent, nickel. These elements are not only costly, but they also have international supply chains that national governments would rather not rely on. In June, for example, the US Federal Consortium for Advanced Batteries published a National Blueprint for Lithium Batteries, which among other things advises the elimination of cobalt and nickel from new LIB by 2030 [16]. And, in 2020, Tesla announce its intention to move towards cobalt-free batteries [17].

Alternative approaches to battery design and dismantling are also being developed that could help to preserve the valuable structure of batteries and enable their recycling/refurbishment without requiring extensive human labor [18]. ‘‘There are a number of features of EV batteries that could make them easier to recycle. One is some degree of standardization—if there were a smaller variety of cell or battery module designs, it would be possible to design an automated disassembly step, rather than shredding everything and making a big mess,” said Gaines. Harper agreed: ‘‘Robotic disassembly and automation is an approach that will potentially apply to any type of EV battery.”

Indeed, in August 2021, researchers at the US Department of Energy’s Oak Ridge National Laboratory in Tennessee demonstrated a robotic disassembly system for spent EV battery packs. The researchers claim the system can be reconfigured for any type of battery stack, and that the robot can be programmed to access the individual battery modules or to take battery packs apart down to the cell level for materials recovery [19]. These sorts of technologies are in their early stages, however.

And for many, reuse before recycling makes good sense. For example, a group at the Massachusetts Institute of Technology in Cambridge, MA, USA, advocates repurposing swapped-out EV battery packs as batteries in solar grid power storage facilities, where the performance of the battery is not as critical as in EVs [20]. Indeed, there are many big battery reuse projects currently underway, said Harper.

While EV battery technology continues to evolve, the long-term future of LIB recycling is hard to predict, and the 99% recycling rate achieved with respect to lead in standard car batteries a distant goal [21]. What is clear is that EV LIBs, in all their forms, are poised to become an enormous recycling challenge. But regardless of the shifting value contained in end-of-life EV batteries, the global drive towards a more sustainable, circular economy must embrace this challenge, said Harper. ‘‘Plastic bags, newspapers, and glass are not intrinsically valuable, yet we are all encouraged to recycle them and not resort to landfill. Regardless of what battery technologies come down the line, recycling them is the only real option.”

京公网安备 11010502051620号

京公网安备 11010502051620号