While hydrogen has long been recognized as a promising alternative to fossil fuels, its widespread use as a carrier of energy has mostly not met expectations [1]. Now, increasingly practical low-carbon production, coupled with legislated incentives like those included in the US Inflation Reduction Act (IRA), are driving serious reconsideration of hydrogen as a cost-effective, emission-free energy solution. An August 2022 article title in the Institute of Electrical and Electronics Engineers’ Spectrum magazine asks ‘‘2022—The Year the Hydrogen Economy Launched?” [2]. Similarly, in Recharge, a leading business intelligence source for the renewable energy industries, a January 2023 article title announced 2023 as the ‘‘global lift-off year” for ‘‘green hydrogen” [3].

A combination of international carbon pledges, natural gas price increases, and falling costs of renewable energy technology has given many countries and companies reason to give hydrogen a second look [2]. Experts see the low-to-no-carbon, on-demand power hydrogen can produce as a key component of efforts to help decarbonize, in particular, the industry and transportation sectors of the global economy [4].

‘‘The biggest recent example of the acceleration is the passing of legislation—the Infrastructure Investment and Jobs Act and the IRA—that look to advance hydrogen technologies through the building of 6–10 hydrogen hubs across the United States and providing incentives to produce low-carbon hydrogen,” said Kevin Harrison, program manager and leader of power-to-gas/powerto-X capability development at the Energy Systems Integration Facility of the National Renewable Energy Laboratory (NREL) in Golden, CO, USA. Whereas the US Department of Energy’s Hydrogen Fuel Cell Technologies Office historically has received funding around 100–150 million USD per year, the new legislation allocates 8 billion USD towards hydrogen-related energy technology like the hydrogen hubs, Harrison said. Governments and industry around the world are similarly funding hydrogen technology, he said, to help drive down its cost and accelerate its deployment. Indeed, many countries in addition to the United States [2,5] have made recent commitments to hydrogen as an up-and-coming energy carrier, with new hydrogen-energy projects being developed in Australia and Asia [6–9] (Fig. 1), Europe [10,11], the Middle East [12,13], and South America [14].

《Fig. 1》

Fig. 1. International green hydrogen projects plan to build dual renewable energy plants to power electrolysis. For example, the Asian Renewable Energy Hub in Western Australia, shown here in an artist’s illustration, will have a photovoltaic farm to harvest solar energy during the day and nearby wind turbines to collect energy during windy nights. Combining renewable power sources maintains the energy needed for green hydrogen production, without relying on fossil fuels. Credit: Pixnio (CC0).

Based on the carbon footprint of its production method, a shorthand has emerged to describe three main categories of hydrogen: grey, blue, and green [15]. Grey hydrogen, today’s most prevalent type by far, is produced using steam methane reforming, a hightemperature process that burns fossil fuels to separate methane into hydrogen and CO2 [15,16]. Burning natural gas, the process generates significant CO2 emissions, creating 8–12 kg of CO2 for each kilogram of hydrogen produced [2,17]. If powered by coal, the generated CO2 jumps to 18–20 kg per kilogram of hydrogen [2]. Blue hydrogen is produced via the same process, but about 85%–95% of the carbon is captured and stored [18], resulting in an estimated 1–4 kg of CO2 per kilogram of hydrogen [17].

In contrast, electrolysis powered by renewable energy sources, including solar, wind, geothermal, and hydroelectric is used to split water into hydrogen and oxygen gases to produce green hydrogen, also called low-carbon hydrogen. Currently, it is estimated that less than 2% of hydrogen produced worldwide can be considered green [19]. Traditionally, grey hydrogen is significantly cheaper to produce than green hydrogen—about 1–2 USD versus 3–8 USD per kilogram [20]. By offsetting its increased cost, government incentives are intended to make green hydrogen a more attractive proposition, with the 3 USD per kilogram subsidy in the US IRA potentially bringing the production cost of green hydrogen down to 0 USD per kilogram [21]. The International Energy Agency (IEA) predicts that hydrogen production will increase five-fold by 2050, with most of the new production being green or blue [22].

While subsidies may reduce its cost of production, technical advances and infrastructure investments are also needed to make green hydrogen a widely available reality [2,12,23] and several large fossil fuel companies have begun to invest in low-to-no-carbon energy sources, including green hydrogen [23,24]. For example, British Petroleum (London, UK) is a lead investor in Australia’s Asian Renewable Energy Hub project [22,25], and, in July 2022, Shell (London, UK) announced its commitment to building Europe’s largest green hydrogen plant in the Netherlands [26].

Government and industry investments are also being made in improving green hydrogen production technology. Because green hydrogen production relies on the renewable energy-powered electrolyzer (Figs. 2 and 3), bringing down its cost is of particular interest [27]. In 2021, ITM Power, a leading electrolyzer manufacturer based in Sheffield, UK, priced its 10 MW system at about 8.5 million USD (850 000 USD·MW–1 ); it said it expected to produce 100 MW systems in the mid-2020s for about 53 million USD (530 000 USD·MW–1 ) [28]. ‘‘Today the cost to buy an electrolyzer is high,” said Harrison. ‘‘Roughly speaking, the capital cost needs to be cut in half to approach parity with hydrogen produced via steam methane reforming, and then further reduced for even wider-scale adoption.”

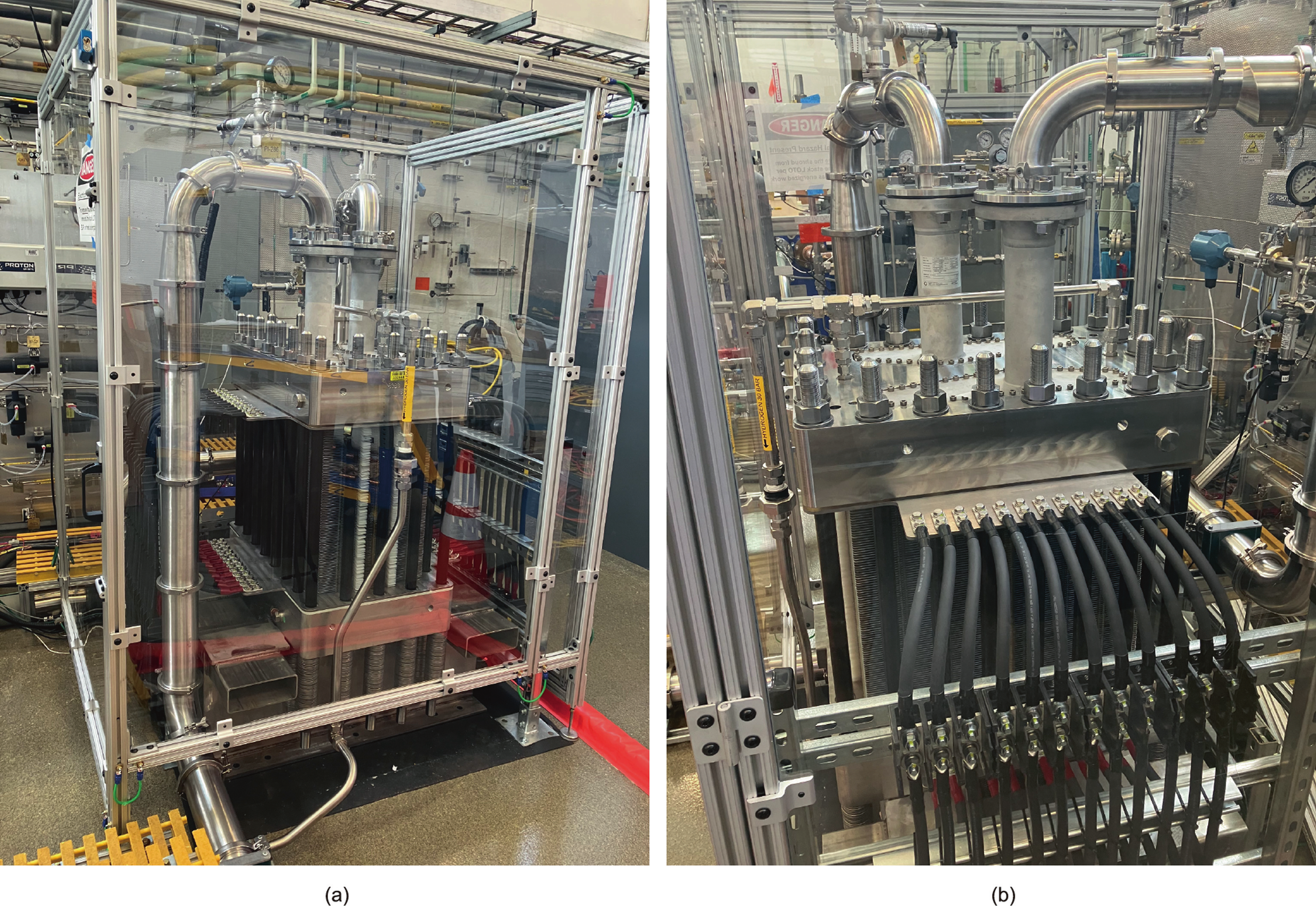

《Fig. 2》

Fig. 2. Powered by renewable energy, this 1 MW, low temperature, proton exchange membrane electrolyzer stack operating at NREL’s Energy Systems Integration Facility splits water into hydrogen and oxygen gases. The Golden, CO, USA-based NREL is working on advancing affordable hydrogen technologies for the production, transport, storage, and utilization of green hydrogen for multiple energy sectors. Credit: Kevin Harrison, with permission.

《Fig. 3》

Fig. 3. Built in 2021 by ITM Power PLC at its factory in Sheffield, UK, this electrolyzer uses renewable energy to separate tap water into green hydrogen and oxygen gases. Credit: Wikimedia (CC BY-SA 4.0).

While they may not directly impact the initial up-front cost of buying an electrolyzer, ways to increase the efficiency of electrolyzers and their output at scale that could improve their longer-term economics are under investigation [27,29,30]. In one recent study reported in December 2022, Australian researchers directed sound waves at an operating electrolyzer [31]. They found that high-frequency waves (10 MHz) helped disrupt the bonds in water, splitting water into hydrogen 14 times faster while using 27% less energy than standard electrolysis [31].

Other work has focused on the need to use clean water—a scarce resource in many parts of the world—for electrolysis, to avoid issues with corrosion and the release of toxic gases. In December 2022, a team of Chinese researchers reported on their work developing a method to use seawater in electrolysis with a membrane designed to keep the seawater impurities away from the electrodes in the electrolysis system [32]. In another study reported in September 2022, an Australian team described a method to use a sponge soaked in a water-absorbing electrolyte liquid to pull water from semi-arid air, which can then be split into hydrogen and oxygen gases via electrolysis [33].

Harrison’s experience confirms that the pace of innovation in the area has recently accelerated. ‘‘Over the past 15 years I have normally worked with two to three groups on their electrolyzer technology with performance and validation support here at NREL,” he said. ‘‘Over the past eight months I have been inundated with trying to support ten groups from across the globe that need our help to validate and reduce the cost of their technology.”

The hydrogen landscape is indeed changing, said Marie Le Mouel, an affiliate fellow at Bruegel, a well-respected Brussels, Belgium-based economic policy institute. ‘‘In terms of innovation, economics, and the deployment of new technologies, we would probably make a parallel to what happened in the solar industry,” she said.

The availability and affordability of renewable energy is also helping green hydrogen become more competitive. Over the past decade, utility-scale photovoltaic systems costs have decreased 82% [34]. Advances in wind turbines have also increased their energy production—in one example, GE Renewable Energy claims a 45% increase in energy production for its giant turbines compared to previous offshore wind turbines [35].

But while producing green hydrogen is one thing, transporting it is another. Some have suggested repurposing existing natural gas infrastructure to transport hydrogen [36] but that may not be as straightforward as some envision, with issues that could include materials compatibility and the ability to withstand higher pressure conditions. Instead, concentrating hydrogen into hubs— like those now planned in many regions, including those in the United States supported by the IRA—and targeting hydrogen for use in certain industry sectors appears to be the most viable proposition from both practical and economic perspectives.

‘‘Hydrogen seems to make sense for larger scale applications. There are big and fixed costs associated with transporting it; because you need to pressurize it or freeze it so low, it might make most sense to use it in big quantities at an industrial scale,” said Le Mouel. ‘‘There seems to be consensus for a few ‘no-brainer’ industrial applications, like for making steel or to make ammonia for fertilizer.” In transportation, battery-powered electric cars have almost totally eclipsed ones powered by hydrogen fuel cells [1]. Some, however, still see great potential for hydrogen fuel cells to power heavier vehicles, like trucks, buses, and trains, that can be refueled from central sites [1,23,36–40].

While the subsidies will help low-carbon hydrogen become competitive in the short term, increasing scale with high-volume manufacturing, and scientific and engineering advances will continue to improve the economic viability of hydrogen for carbonfree energy in the coming decades, Harrison said. ‘‘Working with the Department of Energy and our industry partners we are all focused on making hydrogen production via water electrolysis on parity with other forms of hydrogen production in the next ten years, with the goal of becoming the lowest cost,” he said. ‘‘And then the world changes.”

京公网安备 11010502051620号

京公网安备 11010502051620号