《1 Introduction》

1 Introduction

The Belt and Road initiative has created an unprecedented opportunity for China’s seed industry technology to “go global”. As the crux of agriculture, the seed industry is an important carrier of agricultural science and technology. Raising its technology level is the base of agricultural sustainable development. Globally, the historical experience from developed countries shows that internationalization has become the dominant trend of the seed industry. China’s seed industry needs to promote its technology to “go global” for participating in international competition and cooperation, and planning global layout. At the same time, the “Silk Road Economic Belt” and the “21st-Century Maritime Silk Road” (referred to as the “Belt and Road” initiative), as the world’s most popular global public goods, has created a promising platform for international cooperation for its “going global” objective.

Therefore, based on the status quo, China’s seed industry should reduce its insufficiencies and grab the opportunity. Since the reform and opening up, it has persisted in reform and innovation, and has spent 40 years in the development process which costed developed countries more than a century, achieving a leap from traditional seed industry to modern seed industry. Its scale is among the top in the world, the level of opening up has continued to increase, and it has actively integrated into the global seed industry. During the period, the seed industry technology has gradually turned to the world while the government, enterprises and the private sector have successively carried out various forms of “going global” exploration. Some of its deficiencies have been revealed in addition to its achievements. Based on this, under the historic opportunity, this paper starts from the practical significance, examines the status quo and problems of “going global” in China seed industry technology, and proposes corresponding countermeasures to promote globalization.

《2 Practical significance of “going global” in China seed industry technology》

2 Practical significance of “going global” in China seed industry technology

《2.1 Agricultural technology “going global” is the core of agricultural globalization》

2.1 Agricultural technology “going global” is the core of agricultural globalization

As a country that abounds with agriculture and population, China has very limited agricultural resources, especially land. Faced with the increasing shortage of natural resources and narrow development space, China’s agriculture has to integrate with the international circle and exploit the abundant overseas resources to meet the domestic shortfall, which is a realistic option for achieving sustainability. On one hand, only by relying on science and technology can China’s agriculture gain a comparative advantage and a market share in international competition during its globalization. On the other hand, it is an important factor for further improving China’s agricultural science and technology to fully take part in international competition and cooperation. Therefore, agriculture going global is also, in essence, the globalization of agricultural science and technology

《2.2 Seed industry is a priority area for agricultural globalization》

2.2 Seed industry is a priority area for agricultural globalization

Seeds are the base and an irreplaceable means in the process of agricultural production, as well as an important carrier of agricultural scientific and technological achievements, occupying a core position in industrial development. As a systematic material production industry, the seed industry covers many links such as new variety breeding, production, processing and sales, and is a typical integration industry of the primary, secondary and tertiary industries. On one hand, after decades of development, China’s seed industry has made great progress in both the scale of output and the technological level, and has greatly increased agricultural production and income. Hence it has the ability to support and drive China’s agriculture to implement the “going global” strategy, considering its supply capacity and technical services. On the other hand, the establishment of a new pattern of comprehensive opening up in China requires the seed industry to be more open to the outside world. The negative list of seed industry in 2018 significantly relaxed the entry threshold for foreign investment, and constantly improved the level of the industry’s opening up, laying a good institutional environment for the seed industry to “go global” and remold its development pattern.

《2.3 “Going global” in seed industry technology is a key link in promoting agricultural cooperation under the Belt and Road initiative》

2.3 “Going global” in seed industry technology is a key link in promoting agricultural cooperation under the Belt and Road initiative

Seed industry technology is not only the focus of agricultural science and technology, but is also of significant importance in the deepening of agricultural cooperation with countries along the Belt and Road. Seed industry exchange and cooperation has been one of the main consociation contents of the Silk Road since ancient times. Through it, China had introduced crop varieties such as flax and pomegranate, popularized silk, tea and other technologies to the whole world, and promoted the inter-communication of agricultural civilization in Asia, Europe, and Africa. In the new era, most countries along the Belt and Road have strong desires to solve poverty and hunger, and to ensure food safety and nutrition, thus making deep cooperation in agriculture a common demand. In 2017, the Ministry of Agriculture issued the Vision and Action for Jointly Promoting Agricultural Cooperation in Construction of the Belt and Road, pointing out that agricultural science and technology exchange is a key area of cooperation; it is required to strengthen the exchange of germplasm resources, associated research and development, and to promote variety and technical cooperation. The forthcoming Agricultural Science and Technology Action Plan for Promoting the Co-construction of the Belt and Road also makes relevant arrangements around “going global” in seed industry technology.

《3 Status quo of “going global” in China seed industry technology》

3 Status quo of “going global” in China seed industry technology

《3.1 The scale of “going global” is expanding while the global market share is small》

3.1 The scale of “going global” is expanding while the global market share is small

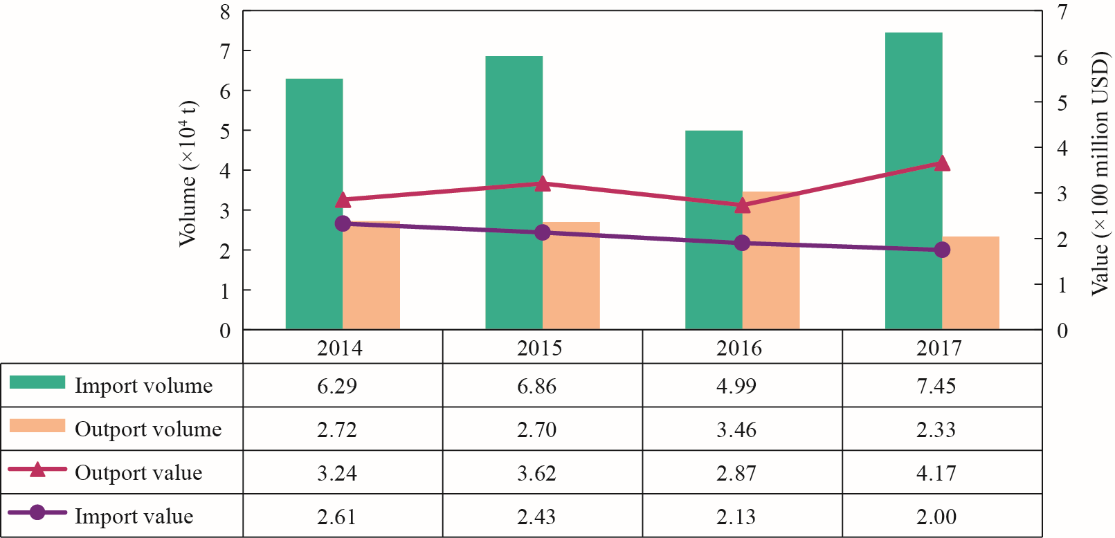

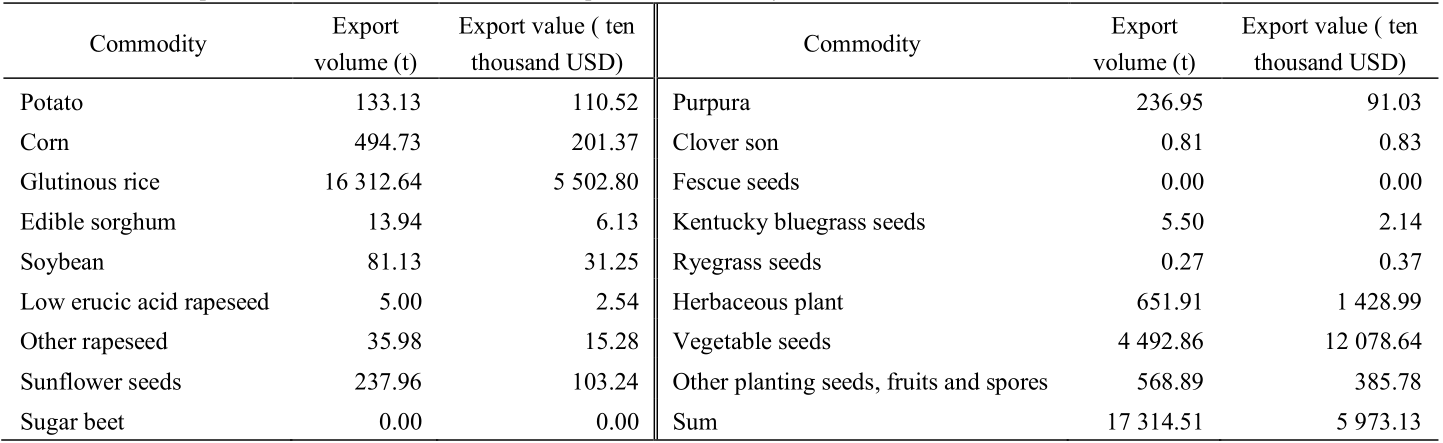

The scale of foreign trade in China’s seed industry has continued to expand while foreign investment has made breakthroughs. With the accession to the WTO and government support, the process of globalization of the Chinese seed market is accelerating and increasingly open. The scale of foreign trade has continued to expand as a whole, however, there is still a trade deficit in the long run. During the decade after its WTO entry, China’s seed trade grew steadily. Due to domestic production costs and property rights protection, the export volume has declined in recent years, but the overall trend remains positive with large export growth potential. According to China National Seed Trade Association (CNSTA), in 2017, the export volume was 23 300 t, valuing 200 million US dollars, while the import volume was 74 500 t, valuing 417 million yuan (Fig. 1). Vegetable seeds accounted for a large proportion of export volume, and the seeds of field crops were mainly rice (Table 1). The major exports to developed countries such as the United States, Japan, and South Korea were vegetable seeds, flower seedlings, and non-grain field crops, and its growth was relatively stable. The export to developing countries was dominated by grain crops seeds, especially rice, which has increased rapidly with much potential to explore [1]. On the other hand, while establishing overseas subsidiaries, China began to invest in offshore investment and mergers and acquisitions to participate in the global seed industry competition. In 2017, CITIC Agriculture acquired Dow AgroSciences’s Brazilian corn seed business, while Chemchina acquired Swiss Syngenta and Dutch Nidera, a grain and seed giant, making China’s seed industry rank in the world’s top echelon.

《Fig. 1》

Fig. 1. China’s seed industry international trade volume and value in 2014–2017.

Source : China National Seed Trade Association.

《Table 1》

Table 1. Export volume and value of China’s sub-species seed industry in 2017.

Source : China National Seed Trade Association.

However, China accounts for a small proportion of the global market share, facing high competitive pressure from its international counterparts. Although China is the second largest seed market in the world after the United States, accounting for about 20% of the world’s total value, its exports in 2016 were 197 million US dollars, which is only 1.73% of global exports according to the International Seed Federation (ISF) statistics (Table 2), ranking 15th in the world. There was a serious imbalance between industrial scale and export scale. The Netherlands, France, and the United States, the top three exporters, owned more than 14.00% in world market share. On one hand, it is inevitable for China to compete with European and American companies in its seed industry “going global”; with their multinational companies such as DuPont, Monsanto, and Limagrain, which have sound organizational and business structure, strong technical R&D strength, and supporting industrial chain, they could undoubtedly be China’s archrivals in globalization. On the other hand, with the worldwide spread of biotechnology, some developing countries which used to be China’s export targets have also cultivated or copied similar varieties through various channels, making the market share of Chinese enterprises smaller.

《Table 2》

Table 2. Import and export volume of seed industry in China and major countries in 2016.

Note\: The data comes from the International Seed Federation, excluding Hong Kong, Macao, and Taiwan.

《3.2 Insufficient R&D investment with development lag of market-oriented breeding model》

3.2 Insufficient R&D investment with development lag of market-oriented breeding model

Chinese seed companies are small and scattered, and have insufficient R&D investment. Statistics from the Ministry of Agriculture and Rural Affairs show that by the end of 2016, there were 4316 Chinese seed companies, among which only 10 were listed on the Main Board and the Growth Enterprises Market. The market share of the top 50 companies was only about 35%, and there are only about 200 companies with a registered capital of over 100 million yuan, while only about 100 companies carried out R&D activities. In terms of R&D investment scale, the aggregate annual R&D investment of the top 50 Chinese enterprises was 1.318 billion yuan (about 0.188 billion US dollars), while Monsanto’s R&D investment was 1.673 billion US dollars—an obvious scale disparity. R&D intensity was generally around 10% for foreign multinational seed companies, while for some it was as high as 15% to 20% [2]. Except for the top 50 seed enterprises in China, which had an average R&D input intensity of 7.4%, the other enterprises had generally low intensity, most of which were less than 1%, which was lower than the internationally recognized “dead line” of 1.5%.

China’s seed industry is still in the initial stage of marketization; its R&D is dominated by agricultural research institutes and supplemented by seed enterprises’ R&D departments, while marketization is inadequately oriented toward seed industry terminals. As the core link, the breeding is in the upstream of the industrial chain, in which the seed R&D is the key. As of 2014, there are more than 400 agricultural research institutes and universities engaged in seed R&D in China, possessing 16 000 R&D personnel and a long-term preservation of 430 000 seed resources [3]. With highly concentrated R&D professionals, germplasm resources, and breeding funds, agricultural scientific research institutes accounted for about 43.8% of seed-certified varieties, and domestic seed enterprises accounted for about 32.1%. Under the existing certification and R&D mechanism, low-level, repetitive research by agricultural research institutes is prevalent, and the developed varieties lack commercial promotion value, while domestic enterprises have limited R&D capacity, making the self-developed varieties in the domestic market only account for about 3% [4]. Agricultural research institutes have no incentive to carry out targeted R&D to compete in foreign markets, while seed industry enterprises are reluctant to do so.

《3.3 Production costs and sales expenses keep increasing with vicious competition among export enterprises》

3.3 Production costs and sales expenses keep increasing with vicious competition among export enterprises

Under the existing industry export model, the rise in the price of domestic production factors has pushed up the cost of seed production. China’s export model is still dominated by domestic seed production with overseas sales promotion; few enterprises directly breed, reproduce, and promote sales in the target country [5]. Correspondingly, the continuous and rapid rise of labor price and land rent in China has increased the production cost and narrowed the profit margin of seed companies in recent years. Taking hybrid rice as an example, the seed grain ratio of domestic seed production cost increased from 1:5 (three-line) – 1:6 (two-line) in 2008 to 1:7 (three-line) – 1:10 (two-line) in 2011. In the context of the accelerated quantitative easing policy in the United States, the domestic seed production costs settled in RMB continued to rise. The international transportation logistics costs and the international market development costs, which were settled in USD got relatively higher, pushing up the CIF price of Chinese seeds, thereby weakening the export competitiveness of the seed industry. In addition, coupled with the recent strengthening of foreign exchange control and foreign investment approval, the hidden costs of seed companies to exchange international currencies have increased, and the transaction costs for opening up overseas markets have further increased.

The market tends to be saturated, and Chinese export enterprises compete intensely with each other. In 2002, China began to implement a series of policies to strengthen agriculture and benefit farmers, such as the provision of improved seed subsidy, which drove the domestic demand for fine breeds. Along with the government’s role in strengthening support and supervision, rapid industry development, and the limited domestic market share, the excess capacity of China’s seed industry has turned to the international market. However, many small-scale export enterprises were not well-balanced, making it difficult to meet the quality of seeds in developed countries; thus, the excess capacity is diverted to developing countries. Additionally, the lack of strategic vision and operational capability for international market development has led to irregular export of seeds, widespread problems of border trade, and competitive price reduction regardless of cost. The existence of short-term behaviors with sub-prime and low-cost dumping is more prominent, so that bad money drives out good money, directly affecting the reputation and export profits of the Chinese seed industry in the global market.

《3.4 Domestic tight export policy with endless international trade barriers》

3.4 Domestic tight export policy with endless international trade barriers

For protecting germplasm resources, China has issued a series of restrictions on seed export. Take rice seeds, for example: China’s policy of “strict export and broad import”, which aimed at protecting the patent resources and technical advantages of hybrid rice, has made domestic legitimate rights and interests be eroded by foreign hybrid rice intellectual property. Many multinational seed companies have already carried out R&D in hybrid rice, and successively developed their varieties with the same advantages as Chinese varieties, and have obtained intellectual property protection from the host country before China. Strict years of management of export varieties makes it impossible for China to export its new varieties with greater advantages in the international market, thus losing market opportunities. Meanwhile, some old varieties that allowed to be exported lack market competitiveness due to their inconspicuous advantages. The strict management of seed-parents and two-line rice closed front door and opened the side door, which has not only blocked the scientific and technological cooperation between China and the target country, but has also gone against the application of legitimate intellectual property rights. While enjoying the preferential policies of “going global” in China, large domestic seed companies with state-owned shares are also bound by the provisions of the State-owned Assets Supervision and Administration Commission, and are confronted with severe “obstacles” of foreign investment approval when developing a presence in the international market and setting up factories in target countries.

Countries adopt different forms of restrictions on the import of seeds, raising the threshold for China’s seed industry to “go in”. Governments have set up strict seed trade barriers for their own considerations. One is direct policy restrictions; for instance, India has not allowed direct import of many hybrid rice seeds, allowing only seed production and sales in India, and foreign investment cannot control domestic seed production enterprises when they register. Indonesia and Bangladesh require varieties to be produced and sold in their own countries after they get certification for 2 years and 5 years respectively. The second is phytosanitary control, which involves global requirements to prevent foreign seed companies from entering their countries on the grounds of preventing quarantine diseases and maintaining agricultural safety. For example, Indonesia, Sri Lanka, the United States, and South American countries have imposed strict quarantine conditions on the entrance of Chinese hybrid rice seeds, which is daunting for Chinese exporters.

《3.5 Poor connection with target countries, and insufficient supply of supporting services and facilities》

3.5 Poor connection with target countries, and insufficient supply of supporting services and facilities

The difference between the target country and the domestic society and natural environment has become an important limiting factor for China’s seed industry to “go global”. In case of rice, for example, China’s hybrid rice breeding technology is at the leading level in the world, but as the dominant variety, it is not ideal to export to South and Southeast Asia. The rainy and dry seasons in South Asia and Southeast Asia are distinct. During their growing period, the climate is dry with sufficient light and few diseases, which is suitable for rice production. However, some countries, such as Indonesia, are rich in resources, sparsely populated, and have diverse food choices. There is no need for rice cultivation, which makes the market difficult to promote. Myanmar, a traditional rice producer with analogical natural resources, has low acceptance of hybrid rice varieties requiring more fertilizer and water management due to differences in rice management modes. Instead, it has a special preference for conventional rice varieties developed early in China. Similarly, Thailand prefers the conventional rice varieties, mainly due to quality needs, and hybrid rice production accounts for a very low proportion of total rice import. In the process of exporting to Pakistan, Pakistan’s seed dealers often adopt a step-by-step credit sales method, resulting in a long export receipt period and a high risk of bad debts. In some countries, the new plant variety protection system is not perfect, which makes the export products of China’s seed industry be copied in the short-term of the target country, causing heavy losses.

In the process of “going global” in China’s seed industry, there can be deficiencies in the provision of supporting technical services and infrastructure. Besides seeds as the core element, pesticides, fertilizers, and corresponding cultivation management, and labor machinery inputs are indispensable in agricultural production. The seed industry “going global” cannot only export seeds, especially to promote the export of new varieties to developing countries, as this can often lead to poor performance due to the lack of corresponding cultivation experience, production factors, supporting irrigation, and transportation facilities in the target countries. For example, the extension of Chinese hybrid rice to India, Pakistan, and Bangladesh has already driven China’s corresponding export of chemical fertilizers and pesticides, while agricultural machinery has yet to be developed, only rice machines in Bangladesh market are popular. Whether it is a small-scale agricultural machine in Southeast Asia or large-scale machinery required for the production of large manor in Pakistan, it is still mainly imported from Europe, America, and Japan. It is difficult for China’s agricultural machinery to compete with them in quality, and in local after-sales service. In Mozambique and Kenya in Africa, despite the local climate and strong willingness, it is difficult to promote Chinese hybrid rice due to restrictions of water conservancy facilities and road traffic.

《4 Countermeasures to promote the “going global” in Chinese seed industry technology》

4 Countermeasures to promote the “going global” in Chinese seed industry technology

《4.1 Improve the policy support system and enhance the preferential policies for seed export companies》

4.1 Improve the policy support system and enhance the preferential policies for seed export companies

The Chinese government should supplement and improve relevant support policies based on the overall development of the seed industry. It must continue to bring into play the role of the inter-ministerial coordination group of agricultural “going global” work and the working mechanism for cooperation in the development of overseas agricultural resources to solve the problem of multiple departments operating independently and to improve administrative efficiency. It must strengthen the means of diplomatic service, incorporate the “going global” of China’s seed industry into the framework of bilateral or multilateral economic and trade negotiations, and resolve issues such as intellectual property protection, taxation, visas, and export of labor and technical personnel through diplomatic means.

The corresponding preferential policies in the areas of taxation, credit, capital, and export are also required, such as, more accommodative financing policies and foreign exchange policies, and establishment of corresponding overseas investment risk funds to greatly increase the participation of seed industry enterprises in overseas exploitation, and promoting Chinese seed enterprises to participate in the international market. There must be the establishment and improvement of standardized laws and regulations, such as systems of credit guarantee, direct investment in overseas agriculture, insurance and legal aid, so as to effectively protect the legitimate rights and interests of China’s export enterprises. On the other hand, in addition to increasing seed export to developing countries, in the future, the industry must increase international trade with developed countries to further promote the introduction and absorption of advanced breeding technologies from them and implement breeding technologies, which implements the “bringing in” strategy and enhances the technology spillover effect.

《4.2 Improve the mechanism of seed R&D and validation, and strengthen intellectual property protection》

4.2 Improve the mechanism of seed R&D and validation, and strengthen intellectual property protection

The enhancement of scientific and technological innovation capability is an important base for China’s seed industry to improve its competitiveness and to develop stably at a high speed. Since the promulgation of the Opinions of the State Council on Accelerating the Development of Modern Crop Seed Industry issued in 2011, China has successively announced a series of documents such as the Opinions of the General Office of the State Council on Strengthening the Work of Forest Seeds and Seedlings, Opinions of the General Office of the State Council on Deepening the Reform of Seed Industry System and Improving Innovation Capability,and Notice of the State Council on Printing and Distributing the National Agricultural Modernization Plan (2016–2020), which have made strategic arrangements for the development of China’s seed industry, significantly enhancing its innovation capacity, and have put the seed trade on a stable and healthy track. It is required to start from the seed industry technology level and improve the R&D capabilities of seed companies so that the industry obtains further expansion and growth. China has a large number of research institutes and colleges in agriculture, which have obvious resource advantages. Therefore, it is necessary to reform and improve the existing mechanism of seed R&D and certification, induce the connection between industry, education, research, market, and breeding practice, and establish a seed promotion system oriented to market terminal. At the same time, in order to lay a talent foundation for expanding the overseas market, China’s seed industry should accelerate the cultivation of inter-disciplinary talents, establish a talent training base that can adapt to the development of the foreign market, and form a corresponding talent team as soon as possible.

In addition, China has ignored the protection of intellectual property rights in the seed industry for a long time, and domestic enterprises have a weak awareness of intellectual property protection, leading to the outflow of plentiful domestic resources, and suffering from restrictions of pre-registered rights beyond seas, which has caused unnecessary losses to the industry’s development. As the core of seed R&D, intellectual property rights that have been effectively protected can help realize the healthy long-term development of the seed industry. Consequently, it is necessary for China’s seed industry to strengthen the awareness of protection laws and understand related laws. Meanwhile, the government must also introduce relevant policies to encourage seed companies to apply for patents, paying attention to property rights protection. Beyond the seed law, all kinds of laws and regulations on safeguard of germplasm resources, variety right and patent right should also be established, which can benefit the intellectual property rights protection system, protect the legitimate rights and interests of seed research and innovation, and mobilize the enthusiasm of R&D investment. Furthermore, the industry must establish formal and flexible external circulation channels for seed resources, encourage seed companies to implement overseas intellectual property protection strategies, pre-lay out the application of new plant varieties in the target country, and use the International Convention for the Protection of New Varieties of Plants to safeguard their legitimate interests.

《4.3 Accelerate the merger and reorganization of seed enterprises and optimize the environment for industry development》

4.3 Accelerate the merger and reorganization of seed enterprises and optimize the environment for industry development

It is inevitable for the development of the seed industry in China to accelerate the merger and reorganization of enterprises and realize the development of seed companies to scale, group, and internationalize. It is important to encourage the small- and medium-sized seed enterprises to carry out joint venture and acquisition, loosen policy to attract private capital into the large state-owned seed enterprises, encourage mergers among upstream and downstream enterprises in the industry, eliminate small-scale backward enterprises, and ban the unscrupulous enterprises that produce and sell counterfeit or shoddy goods. Additionally, China must combine the advantages of seed industry enterprises with different scales, natures, and industrial chain links, and integrate them into leading enterprises, backbone enterprises, and enterprise groups which cover the research, development, production, and sales of the seed industry. It is also necessary to encourage superior enterprises to “go global” through direct export, overseas investment and acquisition, subsidiaries establishment, joint-stock cooperative operation, and other means, and jointly develop overseas markets with relevant pesticide and fertilizer enterprises to participate in international market competition, so as to improve the overall competitiveness of domestic seed enterprises.

A fair and equitable market and policy environment is the foundation of industrial development. Further development of China’s seed industry requires a good market environment. On one hand, it is necessary to optimize the technology trading market by simplifying the formalities of market entry and transaction for seeds technology developed by scientific research institutions, and modifying their performance evaluation system by improving scores weight of crossing research projects. The registered personnel shall be permitted to obtain legitimate, regular, and appropriate remuneration and income from such work, scientific research institutions shall be encouraged to actively undertake R&D projects entrusted by seed enterprises, and their staff shall be encouraged to take part-time management or technical posts in seed enterprises. On the other hand, further enhancement in market management is essential. This can be achieved by improving the corresponding laws and regulations, clarifying the duties of market supervision departments, enhancing their supervision level, protecting germplasm genetic resources and technology, speeding up the validation of new plant varieties, and increasing the impact on the production and sale of counterfeit and shoddy seeds.

《4.4 Support overseas R&D and develop contract farming》

4.4 Support overseas R&D and develop contract farming

Seed companies that have implemented overseas R&D and have adopted localized breeding have been successful in exploring international markets. Taking hybrid rice as an example, the development, preliminary test and demonstration of its breeding and supporting technology is long and regional, facing competitive threat from multinational corporations. It is necessary to carry out localized technology R&D in the target countries to open up the gap with other companies, maintain China’s competitive advantage in breeding and supporting technologies to achieve sustainable development. Therefore, in order to adapt to the natural, social, and technological needs of the target country and to reduce the industrial costs of production and operation, the Chinese government should relax the relevant export control of technology and germplasm resources, and use the existing agricultural demonstration center for foreign aid. The seed industry enterprises could be encouraged to establish overseas R&D bases and seed production bases on their own or in cooperation with local institutions and companies through the export of breeding techniques and germplasm resources for the purpose of selectively cultivating varieties suitable for local environment and consumer demand, which not only helps to reduce market risk and resistance in target countries, but also effectively avoids the production risks faced by domestic seed production bases due to frequent climate disasters. It is also an additional guarantee for stabilizing domestic seed supply and can collect, explore, and utilize foreign excellence and characteristic germplasm resources for our own use, continually increasing the technical advantages.

The seed industry exports could combine with agricultural product imports by establishing overseas contracted agriculture. The “going global” in China’s agriculture is making full use of domestic and international resources to ensure food security and agricultural sustainable development. China imports a large number of agricultural products every year, which has driven the development of export-oriented agriculture abroad. In practice, a few private enterprises have taken this opportunity to bring domestic contract farming abroad, signing production contracts with farmers in the target country, directly allocating production materials such as seeds and fertilizers, and deducting the input costs from final products. Through the marketability, contract, and expectation of the contract agriculture, the closed loop of the industrial chain can be constructed, which can not only effectively reduce the distribution cost and bad debt risk of the traditional export mode of seeds and fertilizers, but can also enhance the process control and supply stability of imported agricultural products, and comprehensively promote the agricultural commodity import and rural capital export.

《4.5 Strengthen cooperation and exchanges with other countries, build and improve information platforms》

4.5 Strengthen cooperation and exchanges with other countries, build and improve information platforms

The open history of China’s seed industry market is not vast, so the communication and cooperation system with the international seed market is still imperfect. In the background of global economic integration, China’s domestic market and overseas market are developing together. In the context of today’s global economic integration, it is especially important for Chinese companies to seek new and effective cooperation mechanisms, while China’s domestic market is developing along with overseas markets, making them face fierce market competition from other companies inside and outside the country. In terms of technological innovation, it is necessary to increase technical exchanges with foreign countries, especially with developed countries, while increasing domestic investment. In terms of production and operation, national capital is encouraged to understand the experience and advantages of introducing excellent foreign companies (especially transnational seed companies) in technology R&D, production management, market sales, and after-sales service through holding shares and controlling shares in target countries and transnational companies in the international financial market.

There is still a problem of poor information exchange in China’s seed industry “going global”, and it is necessary to build and improve the information networks and platform, which is to create an opportunity for enterprises to understand the foreign market, and to play a role in connecting enterprises. With the help of industry associations, through the construction of industry propaganda columns, it is more concentrated to reflect the information of foreign seed market, including the foreign natural environment of agriculture, the price and quantity of required capital goods, the laws and regulations of overseas seed industry and policy dynamics, local agricultural production patterns, and consumption habits. It is also possible to promote information through online columns, newspapers and magazines, and news release conferences. Although there are already some related information networks, the content is still relatively simple, while the introduction of the foreign market is relatively low. In addition, the government needs to take the lead in setting up a platform to enable domestic companies to strengthen contacts with foreign companies and seek more and better opportunities for cooperation and exchange.

京公网安备 11010502051620号

京公网安备 11010502051620号