《1 Introduction》

1 Introduction

Energy is the foundation and lifeblood of the national economy and social development in China, and energy security is directly related to national and social security. Currently, China relies heavily on exported crude oil resources, which imposes hidden hazards to energy security [1]. Meanwhile, carbon emissions from the use of fossil energy also threathen environmental protection. As China adjusts its energy strategy structure and promotes the construction of ecological civilization, the transformation and upgrading of traditional energy forms have become the trend. Low-carbon and clean energy consumption has become mainstream. The industrialization of new energy sources will help to bring about a revolution in energy production and consumption, optimize energy structure, ensure energy security, reduce greenhouse gas emissions, protect the environment, and improve China’s capability to manufacture industrial equipment [2].

Hydrogen energy is an emission-free and renewable energy source, and the use of hydrogen energy is an excellent solution to the energy and environmental pollution crisis. As the development of hydrogen energy accelerates globally, fuel cell vehicles will become an R&D priority at research institutions and enterprises worldwide. In 2019, the U.S. Department of Energy announced a development goal for class 8 trucks, saying that by 2030, the service life of fuel cell systems should reach 25 000 h, and the peak efficiency should exceed 68 %. Many automobile companies in Japan and South Korea use metal bipolar plate in fuel cell stacks and have launched fuel cell power system solutions for passenger vehicles. In terms of commercial vehicles, fuel cells based on graphite electrode stacks have become a promising solution for power systems. Many European automobile companies have jointly developed fuel cell systems for heavy-duty vehicles. The fuel cell system developed by Bosch in Germany is expected to launch at the end of 2020.

To keep abreast of international progress, China is also stepping up the development of and investment in hydrogen energy in the transportation field and is actively promoting the production and application of fuel cell vehicles [3]. After reviewing the current technical status of materials, key components, stacks, and systems for fuel cell vehicles, the Dalian Institute of Chemical Physics, Chinese Academy of Sciences [4] analyzed and published the laws of fuel cell performance degradation and an improvement strategy. During the time span from the 11th Five-Year Plan to the 13th Five-Year Plan, China continued to launch major projects related to new energy. Through the research and development model that links companies, universities, and research institutes, China made breakthroughs with a variety of key technologies for fuel cell vehicles, gaining insight into fuel cell materials and components, stack integration, system and vehicle matching, construction of hydrogen refueling infrastructure, and other core technologies [5]. A technical team from Tsinghua University [6] studied the common challenges faced by domestic and global teams in the development, promotion, and application of core fuel cell technologies for vehicles, expanded on the trends in the development of China’s fuel cell vehicle industry, and sought a development path for fuel cells that was suitable for China.

This study focuses on the significant strategic value of energy transformation. It identifies the development layout and trends in global hydrogen energy and fuel cell vehicles. It demonstrates a development route for fuel cell commercial vehicles in China and presents the key factors that hamper industrial development. Based on national guidelines and policies for industrial development, it proposes a direction for technical innovation and development along with recommendations, thereby serving as a theoretical reference for research for the fuel cell commercial vehicle industry.

《2 Strategic significance of developing fuel cells for the commercial vehicle industry》

2 Strategic significance of developing fuel cells for the commercial vehicle industry

The widespread application of fuel cell vehicles is important to supporting energy conservation, emissions reduction, and sustainable development. Considerable technical research has been done, and many application and promotion efforts have been made for fuel cell vehicles in the United States, the European Union (EU), Japan, South Korea, and other countries and regions. This reflects the rapid development of high-end manufacturing. Correspondingly, the development of fuel cell vehicles constitutes a positive driving force in the technological advancement of China’s automobile manufacturing industry and encourages traditional manufacturing to achieve higher quality.

In terms of automobile development, as of the end of 2019, the number of civilian vehicles in China was 2.615×108 , of which 4.05×107 were commercial vehicles, which represents 15.5 % of all vehicles [7]. A high number of commercial vehicles leads to high pollution and energy consumption. For example, about 50 % of petroleum is consumed by the transportation industry [8]. The shift from traditional fuel to pollution-free hydrogen fuel in commercial vehicles is a principal measure of energy conservation and emissions reduction.

In terms of energy utilization, although the sales volume of commercial vehicles is much lower than that of passenger vehicles, their fuel consumption is much higher [9]. Therefore, it is more productive to promote new energy technology for commercial vehicles to replace crude oil. At present, public transportation tends to use electricity for power. Hydrogen fuel cells with high energy density would be a more valuable power source for commercial vehicles that travel long distances or that operate long hours within a certain area.

In terms of national policies, the Government Work Report 2019 proposed to “promote the construction of hydrogen refueling facilities,” establishing a “fast track” for fuel cell vehicles. The plan for the hydrogen refueling infrastructure and the promotion of the hydrogen fuel supply guarantee system has also been added to the Plan for the Development of New Energy Automobile Industry (2021–2035). According to this industrial plan, hydrogen energy will be an important part of the strategic plan for new energy by 2030, and the hydrogen energy industry will support economic growth.

Compared with electric vehicles and hybrid vehicles, fuel cell vehicles have advantages in terms of refueling time and driving range. Fuel cells have been recognized as the optimal technical solution for large commercial vehicle that require a long driving range and high power performance. Commercial vehicles travel on a fixed route and are, therefore, less dependent on hydrogen refueling stations than passenger vehicles. Therefore, the value of developing fuel cells for commercial vehicles is higher than it is for passenger vehicles during the early development of the fuel cell industry.

《3 Development status of hydrogen energy and the fuel cell vehicle industry》

3 Development status of hydrogen energy and the fuel cell vehicle industry

《3.1 Globally》

3.1 Globally

In the context of increasingly prominent energy and environmental issues, such as energy security and carbon emission limits, many countries and regions have set up specialized management bodies, invested a lot of resources, and raised plans and policies to promote the rapid development of the hydrogen energy and fuel cell industries.

3.1.1 Technology development

The research and development of fuel cells began early in the United States, the EU, Japan, and South Korea, where the technical advantages of fuel cell technologies for passenger vehicles have been established. As early as 1970, the United States put forward the concept of a hydrogen economy and included hydrogen energy and fuel cells in its energy strategy. Financial support has exceeded 1.6 billion US dollars in the past 10 years. The fuel cell vehicles of Japanese companies boast cutting-edge performance, and they lead the world in the commercialization of fuel cells; hydrogen-powered trucks have also become a critical aspect of cooperative development among automotive companies. In 2006, Germany launched the National Innovation Program (NIP) for hydrogen energy and fuel cell technologies to promote the development of technology in the form of NOW GMBH (National Organization for Hydrogen and Fuel Cell Technology). Plans have been made to level the cost of fuel cell passenger vehicles with that of current electric vehicles by 2025. In 2003, South Korea identified hydrogen energy as one of the major technical fields of the 21st Century Cutting Edge Sciences Program. Relevant automobile companies have started to develop core fuel cell technologies with Swedish companies.

3.1.2 Policy support

The United States of America released several hydrogen energy plans represented by the National Hydrogen Energy Roadmap and enacted policies such as the Hydrogen and Fuel Cells Program and the Energy Policy Act to support the development, demonstration, and application of hydrogen technologies. October 8 was chosen as National Hydrogen and Fuel Cell Day. Japan incorporated the development of hydrogen energy in its national plan in 2013 and proposed the long-term goal of building a hydrogen-energy-based society. The Hydrogen Energy Utilization Schedule (2019) clarified specific targets for hydrogen energy application by 2030. The EU has successively issued policies such as the 2030 Climate and Energy Framework and the 2050 Low-Carbon Economy Strategy as its energy strategies, and it has established a fuel cell alliance to jointly promote the industry and the development of key technologies. In 2020, South Korea issued the Administrative Act for Promoting Hydrogen Economy and Hydrogen Security to help construct a safety-based hydrogen economy and clarify the government’s administrative and financial support for the hydrogen energy industry. This support includes company cultivation, assistance, talent training, product standardization, and other basic issues in the industry. This act makes up for the shortcomings of the High-Pressure Gas Act and the Gas Act and offers a legal basis for the safe management of lowpressure hydrogen equipment (hydrogen production by electrolysis of water) and hydrogen fuel application facilities.

3.1.3 Market operation

America manages a more advanced promotion and operation of fuel cell vehicles. The Fuel Cell and Hydrogen Energy Association (FCHEA) proposed in the National Hydrogen Energy Roadmap that the number of fuel cell vehicles in America should reach 5.3×106 by 2030 [10]. South Korea has promoted more than 5000 fuel cell vehicles and built 34 hydrogen refueling stations. The Hydrogen Economy Development Roadmap indicates that the number of fuel cell vehicles produced by 2040 would increase to 6.2×106 accumulatively [11]. In 2019, Japan owned 3500 fuel cell vehicles and more than 120 hydrogen refueling stations. According to the Hydrogen Energy Utilization Schedule, the number of fuel cell passenger vehicles would reach 8×105 , the number of fuel cell buses 1200, and the number of stations for hydrogen refueling 900 by 2030 [12]. The EU has been dynamic in the promotion of fuel cells, which is shown by the demonstration and promotion of 1080 fuel cell vehicles, more than 150 fuel cell commercial vehicles, and 177 hydrogen refueling stations in 20 nations. According to the Hydrogen Roadmap Europe, by 2030, 3.7×106 passenger vehicles, 5.0×105 lightweight commercial vehicles, 4.5×104 heavy-duty trucks and buses, and 570 trains will be in use [13].

3.1.4 Regional development

California in the United States is a major rallying point for fuel cell passenger vehicles worldwide, and it is also the most developed promotional base for fuel cell vehicles worldwide. South Korea has gradually considered regional geographical characteristics in the development of hydrogen energy and has designated Ansan, Ulsan, Wanju, and Jeonju as “candidate cities for hydrogen energy economy.” Pau, France has launched the world’s first fuel cell rapid transit (BRT), with vehicles 18 m in length, and having a driving range of more than 300 km and a hydrogen consumption of 10–12 kg per 100 kilometers. This performance rivals that of a tram, but the overall investment is only one quarter of the tram.

《3.2 Development in China》

3.2 Development in China

In recent years, China has issued an array of policies to support the development of the fuel cell industry in an all-rounded manner, covering development routes, industrial planning, and phased subsidy measures. All the development plans represented by the Energy-Saving and New Energy Vehicle Technology Roadmap [5] incorporate support for the hydrogen energy and fuel cell industry.

3.2.1 Overview of the industry

The sales volume of fuel cell vehicles witnessed a dramatic increase from 2016 to 2019 (Fig. 1). According to data from 2019 Economic Operation of the Automobile Industry, issued by the China Association of Automobile Manufacturers, the numbers of fuel cell vehicles produced and sold in 2019 were 2833 and 2737, respectively, up by 85.5 % and 79.2 % year on year. In the first half of 2020, production and sales volume decreased due to the COVID-19 epidemic. As of June 2020, the cumulative sales volume of fuel cell vehicles in China exceeded 6000. According to the data on vehicle sales, China’s fuel cell vehicle industry has apparently developed in a different way than other countries. While the United States, Japan, South Korea, and the EU mainly promote passenger vehicles, China mainly promotes commercial vehicles and has achieved mass production and operation.

《Fig. 1》

Fig. 1. Sales volumes of fuel cell vehicles in China over the years.

Note : The data come from Economic Operation of the Automobile Industry in 2016, Economic Operation of the Automobile Industry in 2017, Economic Operation of the Automobile Industry in 2018, and Economic Operation of the Automobile Industry in 2019 issued by the China Association of Automobile Manufacturers. Sales volume of fuel cell vehicles

The Energy-Saving and New Energy Vehicle Technology Roadmap predicts that, by 2025, the number of fuel cell vehicles will reach 1×105 as core fuel cell technology becomes more developed. In 2030, the number of fuel cell vehicles will reach 1×106 as technical breakthroughs continue to be made on the core components of fuel cells. According to the predictions made in the White Papers of China for Hydrogen Energy and Fuel Cell Industry [14], the number of fuel cell commercial vehicles will reach 3.6×105 in 2030, which accounts for 7 % of the total sales volume of commercial vehicles; in 2050, this number will increase to 1.6×106 , accounting for 37 % of the market share. In 2050, hydrogen energy consumption in the transportation sector will be 2.458×107 t/a, which accounts for 19 % of the total energy consumption in the sector. Of the total hydrogen consumption in the transportation sector, 70 % will be consumed by commercial vehicles for freight, making the commercial vehicles for freight the major driving force for the growth of hydrogen consumption in the transportation sector.

3.2.2 Regional development

China’s industrial support for fuel cell vehicles has always been strong. By the end of 2019, 19 provinces and cities and 40-odd prefecture-level cities had issued policies and plans to boost the development of the hydrogen energy and fuel cell industry, encouraging the demonstrative operation of fuel cell buses, logistics vehicles, and other commercial vehicles. The application of fuel cell vehicles has been established in five major clusters in Beijing– Tianjin–Hebei, East China, South China, Southwest China, and Central China. For example, as an important part of the fuel cell vehicle industry cluster in East China, Shandong Province is home to hydrogen industries such as production, storage, and transportation, refueling, fuel cell engines and key components, and fuel cell vehicles. Many leading companies in the industry have achieved breakthroughs in technology and application. As of June 2020, Shandong had demonstrated and promoted more than 200 fuel cell commercial vehicles, operated seven bus lines with a total mileage of more than 1.6 × 106 km, and built six hydrogen refueling stations.

Guided by national policies, many regions have begun to value the establishment and development of the hydrogen and fuel cell industry. Cities with a prominent geographical advantage, complete industrial chains, and high industrial concentrations, such as Foshan, Zhangjiakou, Zhengzhou, and Chengdu, have actively promoted fuel cell vehicles. In addition, according to the Tianjin Action Plan for the Hydrogen Energy Industry (2020-2022), Tianjin will strive to build at least 10 hydrogen refueling stations and three pilot and demonstration areas for the promotion and application of fuel cell vehicles in 2022. The Changshu Action Plan for Developing Hydrogen Fuel Cell Vehicle Industry (2019–2022) indicates that Changshu will promote 3000 fuel cell vehicles, build two to three public hydrogen refueling stations for commercial purposes, and cultivate one to two fuel cell companies in 2022. The Three-Year Action Plan of Weifang for the Development of Hydrogen Industry (2019–2021) requires that the industrial chain of the hydrogen industry should focus on core materials, key components, stack development, systems integration, testing and certification, vehicle matching, and other industrial clusters, and the building of centers for testing and supporting new energy innovation that are required for industrial development.

《4 Challenges faced by the fuel cell commercial vehicle industry and corresponding countermeasures》

4 Challenges faced by the fuel cell commercial vehicle industry and corresponding countermeasures

Because of the concurrent efforts of enterprises for technical innovation and the political support of the country, China already leads the world in demonstrating fuel cell vehicles. However, attention should be paid to the lack of critical technology bottlenecks; the development of fuel cells for commercial vehicles is still facing some basic constraints.

《4.1 Improvement to national standards and regulations for hydrogen energy》

4.1 Improvement to national standards and regulations for hydrogen energy

Although China’s hydrogen energy and fuel cell industry is developing rapidly, the technology and testing specifications and related regulations for the hydrogen fuel cell industry chain are still lacking, and the integrity of the system needs to be strengthened. Current regulations and standards still regard hydrogen as a hazardous chemical, and this outlook restricts the approval, construction, and operation of hydrogen refueling stations. In response to the above problems, we recommend refining the specifications for the development of key materials and core components for hydrogen energy and fuel cells, building a national innovation base of technical standards for hydrogen fuel cells, improving the priorities and targets of industrial and technical development, and promoting the regional industrial layout. After the attributes of hydrogen for vehicle use are defined, we recommend refining the technical standards of hydrogen production, storage, and refueling, thereby ensuring and accelerating the construction of hydrogen infrastructure.

《4.2 Independence of key materials and core technologies》

4.2 Independence of key materials and core technologies

Significant progress has been made in the research and development of fuel cell technology, but there is still a considerable gap in the independent research and development of core materials and key components. Catalysts, proton membranes, carbon paper, and air compressors are highly dependent on supply from other countries. The quality and safety standards for hydrogen quality, storage, and transportation, and for the construction of hydrogen refueling stations are insufficient. There is still a lack of high-precision detection equipment for hydrogen quality and leakage and institutions for authoritative inspection. These factors severely limit the expansion of the fuel cell industry. In view of the technical immaturity and uneconomical development of the hydrogen industry, coordinated plans should be made to fully exert the supporting and guiding function of policies related to the weak links in the industry. Support for enterprises in hydrogen energy research should be strengthened. The main function of enterprises in technical innovation should be defined, and the collaboration between enterprises, universities, and research institutes should be strengthened to achieve breakthroughs in their respective domains.

《4.3 Plan for hydrogen refueling infrastructure》

4.3 Plan for hydrogen refueling infrastructure

“Hydrogen refueling anxiety” has become one of the key factors that restrict the development of fuel cell vehicles. At the initial stage of promoting fuel cell vehicles, given that there were only a few vehicles in operation, it was difficult for the market-oriented public hydrogen refueling stations to make ends meet based on a scaled economy. Poor profitability quenches the enthusiasm for constructing relevant facilities. The number of global hydrogen refueling stations in operation grew slowly from 2015–2019 (Fig. 2). Insufficient infrastructure directly restrained the scale of the promotion and application of fuel cell vehicles. In view of this, policies could be issued to improve the approval procedure and regulations for the operational supervision of hydrogen refueling stations. Meanwhile, the proportion of homemade hydrogenation infrastructure materials, core components, and technologies (such as new hydrogen storage materials, liquid hydrogen storage, and transportation) must be increased, so that the cost of constructing hydrogen refueling stations can be reduced. Compared with passenger vehicles, commercial vehicles use fixed routes of operation. Constructing hydrogen refueling stations along common routes for commercial vehicles will dramatically reduce a reliance on infrastructure, so that fuel cell vehicles can be operated as usual with a low density of hydrogen refueling stations.

《Fig. 2》

Fig. 2. Number of hydrogen refueling stations worldwide from 2015 to 2019 [15].

《4.4 High cost of purchasing and using fuel cell vehicles》

4.4 High cost of purchasing and using fuel cell vehicles

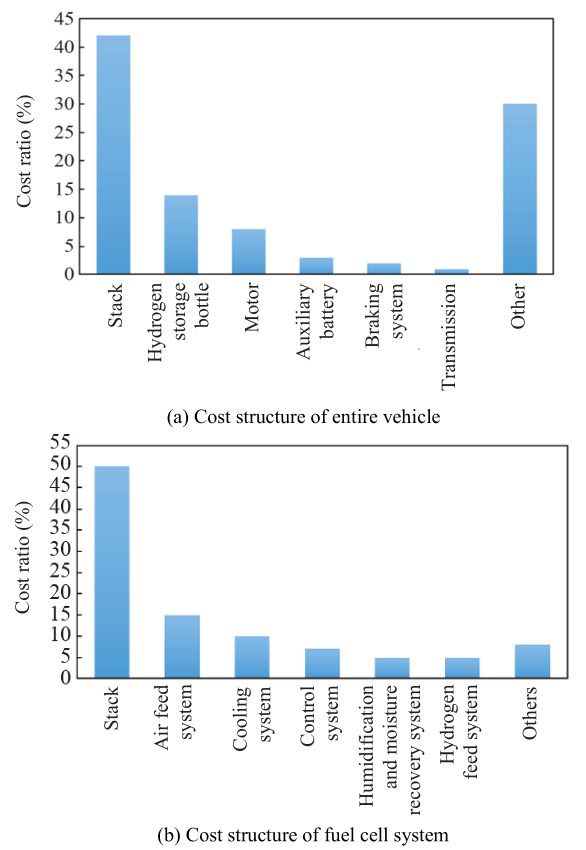

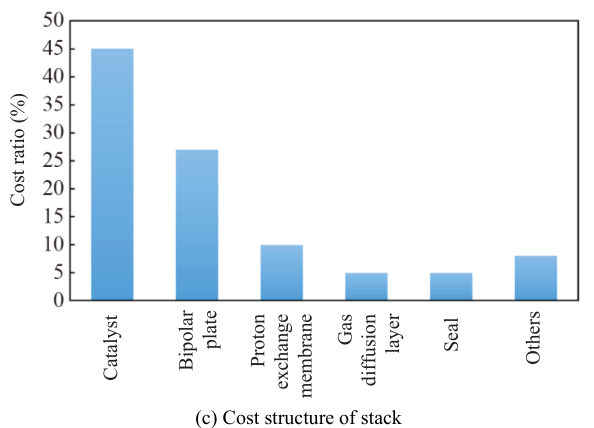

The high cost of fuel cells is still a major constraint in the promotion and application of fuel cell vehicles. The U.S. Department of Energy has analyzed the cost of fuel cell vehicles from the perspective of the cost for the whole vehicle, fuel cell system, and stack (Fig. 3). According to this analysis, the actual cost of China’s fuel cell systems is higher than that of the United States. Although many regions in China has conducted demonstrations of cell vehicles, the operating cost of vehicles shows no advantage compared with vehicles that use traditional fuel. The high cost of constructing hydrogen refueling stations and the difficulty of reaching a trade-off between expenditure and revenue are still obvious. The profit distribution of the industrial chain is not effectively balanced and does not accurately represent the value of each link.

《Fig. 3》

Fig. 3. Cost structure of fuel cell vehicles [16].

At present, China’s fuel cell commercial vehicles have entered the initial stage of industrialization. To better compete with global players in the fuel cell industry and technology market, more key materials, core components, and technologies for fuel cells and hydrogen refueling stations should be produced in China so that the cost of manufacturing fuel cell vehicles and constructing hydrogen refueling stations can be greatly reduced. The industry should first promote fuel cell vehicles commercially in hydrogen-abundant regions to effectively reduce the cost of hydrogen. The technical advancement and development of the entire hydrogen fuel cell industry could then be driven by means of technical enhancement and market expansion.

《5 Development prospects for fuel cells in commercial vehicles》

5 Development prospects for fuel cells in commercial vehicles

Owing to the special characteristics of refueling time, driving range, and durability, fuel cells in commercial vehicles will shape the complementary advantages for electric vehicles for a long time, boosting China’s growth from a large to a powerful automobile-making country. The development of the industrial chain of hydrogen and fuel cell vehicles will gradually improve over time. Hydrogen energy infrastructure is becoming increasingly accessible. The cost of hydrogen gas and fuel cell systems will continue to decrease. These are all important factors that support the market competitiveness of fuel cell commercial vehicles. Specifically, the development of China’s fuel cell commercial vehicle industry will show the following trends.

(1) Owing to the demands created by national policy support and the 2022 Olympic Winter Games, as well as other major events, the fuel cell vehicle industry will remain on the fast track. To develop fuel cell commercial vehicles, we must link the industrial chain of fuel cell vehicles, improve hydrogen energy infrastructure, establish industry-wide standards and regulations, and reduce the costs of parts and vehicles. By relying on technical advancements and the effects of scale, we must actively confront the fact that national subsidies diminish as the industry continues to grow, and consolidate our foundation to prepare for fiercer competition at the later stages while promoting further development of the industry.

(2) Fuel cell commercial vehicles will first be used in urban bus transportation and logistics industries. As the technology develops and costs decline, application will expand to ports and terminals, specific rail transit routes, intercity logistics, and intercity passenger transportation. In view of the energy structure differences in different regions, commercial vehicles powered by fuel cells and those powered by electric batteries will coexist and complement each other for quite some time.

(3) As fifth-generation mobile communication technology and intelligent driving technology grow, the opportunity to integrate fuel cell commercial vehicles with automobile intelligence will present itself. The “fuel cell + intelligent driving technology” will become a key priority in industrial innovation. Fuel cell technology will further reduce the cost of commercial vehicles, while the comfortable driving experience of highly intelligent vehicles will promote the rapid development of the commercial transportation industry, thereby providing more convenient and greener transportation services for economic and social activities.

京公网安备 11010502051620号

京公网安备 11010502051620号