《1. Introduction》

1. Introduction

The consensus among climate scientists is clear that human-made greenhouse gases (GHGs) are leading to dangerous climate change. Hence, ways of using energy more effectively and generating electricity without, or with limited, production of GHG must be found [1].

In the United Kingdom (UK), the power sector is currently the single largest source of GHG emissions, accounting for 27% of the total [2]. By 2050, emissions from the power sector need to be reduced to close to zero. In Great Britain (GB), the anticipated future decarbonized electrical power system is likely to rely on generation from a combination of renewables, nuclear generators, and fossil-fueled plants with carbon capture and storage (CCS) [2]. This combination of generation is difficult to manage as it consists of variable renewable generation, and large central generators that run at a constant output for both technical and commercial reasons. Meanwhile, the demand for electricity, with the potential electrification of heating and transport, will become more variable. As a result, the power system will need to become smarter at balancing demand and supply. Smart grid is widely recognized as the future of modern electrical power systems. It involves modernizing existing networks, changing the way they operate, facilitating changes in the behavior of energy consumers, providing new services, and supporting the transition to a sustainable low-carbon economy [3].

The UK has made significant progress to date in deploying smart grids and has made a considerable investment in smart grid research and demonstration projects. These projects have been delivered through a range of initiatives, including the Office of Gas and Electricity Markets (Ofgem) price control model, which places great emphasis on supporting network innovation; and the creation of the £500 million Low Carbon Networks Fund (LCNF) and its successor, the Electricity Network Innovation Competition (ENIC). These competitions provide funding for network companies to undertake innovation projects and try out new smart grid technologies and solutions. More limited funding for innovation is available to network companies through the Network Innovation Allowance (NIA) [4] and the previous Innovation Funding Incentive (IFI). GB has also begun the nationwide installations of smart meters, which will help to improve network management and facilitate demand reduction and shifting.

Various actors are involved in the development of the smart grid in GB, including the government (Department of Energy and Climate Change, DECC), a national regulatory authority (Ofgem), network companies, equipment manufacturers, and academia. This paper presents the current status of the development of the smart grid, the roles these actors have played in the past few years, the focus areas and achievements to date, and future work that needs to be undertaken to deliver a low-carbon smart grid. The learning from this work will provide valuable guidelines for future smart grid development in GB and other countries.

《2. Smart grid definitions》

2. Smart grid definitions

The future power system is expected to make extensive use of modern information and communication technologies (ICT) to support a flexible, secure, and cost-effective decarbonized electrical power system. A smart grid is capable of controlling active networks intelligently to facilitate the integration of renewable energy into the power system [5].

Various definitions of the smart grid have been used by different countries across the globe and no single universal concept has been agreed on. This paper presents two definitions that are often used in GB.

The concept of the smart grid, developed in 2006 by the European Technology Platform, is:

A Smart Grid is an electricity network that can intelligently integrate the actions of all users connected to it—generators, consumers and those that do both—in order to efficiently deliver sustainable, economic and secure electricity supplies.

A smart grid employs innovative products and services together with intelligent monitoring, control, communication and self-healing technologies in order to:

•Better facilitate the connection and operation of generators of all sizes and technologies;

•Allow electricity consumers to play a part in optimizing the operation of the system;

•Provide consumers with greater information and options for choice of supply;

•Significantly reduce the environmental impact of the whole electricity supply system;

•Maintain or even improve the existing high levels of system reliability, quality and security of supply;

•Maintain and improve the existing services efficiently; and

•Foster market integration towards a European integrated market. [1,5,6]

The definition provided by the Energy Networks Association (ENA) is:

The Smart Grid is everything from generation through to home automation with a smart meter being an important element, with every piece of network equipment, communications technology and processes in between contributing to an efficient and smart grid.

A completely Smart Grid of the future will enable appliances in the home to communicate with the smart meter and enable the networks to ensure efficient use of infrastructure, demand response and energy management. These are all critical to making the most of intermittent renewables and keeping the lights on in an affordable low-carbon energy future. [7]

《3. Drivers for smart grid》

3. Drivers for smart grid

In GB, the drivers for the smart grid include policy and technical aspects.

《3.1. Policy aspects》

3.1. Policy aspects

The Climate Change Act 2008 [8] established a legally binding target to reduce the UK’s GHG emissions to at least 80% lower than the 1990 baseline by 2050. Also, a target was set that emissions should be a third lower than the 1990 level by 2020.

In 2009, the European Commission (EC) passed legislation to ensure that the European Union (EU) meets its ambitious climate and energy targets for 2020. These targets are known as the “20-20-20” Renewable Energy Directive, in which three key objectives are set [9]:

• A 20% reduction in EU GHG emissions from 1990 levels;

• Raising the share of EU energy consumption produced from renewable resources to 20%; and

• A 20% improvement in the EU’s energy efficiency.

Within these overall targets, individual member states have been given different specific targets suited to their climates and circumstances; the target for the UK is to produce 15% of primary energy from renewable energy sources by 2020. Since the adoption of this directive, most member states in the EU have experienced significant growth in renewable energy consumption.

The UK has enjoyed a wealth of energy resources. However, the UK has mainly relied on the natural resources of fossil fuels. Only 1.3% in 2005 and 3.1% in 2009 of primary energy use was from renewable energy [10]. Compared to many other member states of the EU, the UK starts from a very low level of renewable energy consumption and the challenge to meet the 2020 targets is considerable.

The UK Government’s Action Plan concludes that delivering 15% renewable energy by 2020 is feasible through domestic action and could be achieved with the following proportion of energy consumption in each sector coming from renewable sources [10]:

• Around 30% of electricity demand, including 2% from small-scale sources;

• 10% of transport demand; and

• 12% of heat demand.

It can be seen that this proposed increase of renewable energy consumption in electricity, transport, and heating sectors is in line with the carbon budgets and will help keep the UK on track to hit the 2050 target of an 80% cut in GHG emissions [11]. In order to meet these targets, major changes in the way GB generates and uses energy, mainly within the electricity, transportation, and heating sectors, are required [2].

In electricity, three parts of the portfolio are renewables, nuclear power, and coal- and gas-fired power stations fitted with CCS. In transportation, ultra-low emission vehicles including fully electric, plug-in hybrid, and fuel cell powered cars are being developed. In heating, the technologies will include air- or ground-source heat pumps, and using heat from power stations.

As can be seen, electricity lies at the heart of these changes. Currently, GB has around 78 GW of generation capacity, leaving around 34% surplus capacity (known as gross capacity margin) over electricity demand at peak times (considered to be 58 GW) [12]. With the potential electrification of heating, transport, and industrial processes, average electricity demand may rise by between 30% and 60% [2]. As much as double today’s electricity capacity may be needed to deal with peak demand. Renewable energy will account for approximately half of the estimated capacity needed. The development of CCS technology is expected to bring the costs and risks down to make this technology at scale in a commercial environment. Fossil fuel power plants without CCS will only be used as back-up electricity capacity at times of very high demand [2].

The government has invested heavily in the technologies of renewables, nuclear power, and CCS. However, rather than choosing a technology, the government is technology neutral. The low-carbon technology that can deliver at the lowest cost will gain the largest market share. Section 4 presents some of the corresponding incentives, and Sections 5 and 6 report in detail on the main activities in the electricity industry—LCNF projects and smart metering.

《3.2. Technical aspects》

3.2. Technical aspects

3.2.1. Aging assets of the power grid

In many parts of the world (e.g., the US and most European countries), the power system expanded rapidly in the 1950s and 1960s [1]. The transmission and distribution equipment that was installed then is now beyond its design life and in need of replacement. The capital costs of like-for-like replacement will be very high. The need to refurbish the transmission and distribution circuits is an obvious opportunity to innovate with new designs and operating practices. Some of the existing equipment and/or lines are operating near their capacity, limiting the connection of renewable generation. For example, in order to maintain the quality of service, approximately 10% of the switchgear and 6% of the 132/33 kV transformers in GB’s distribution networks need to be replaced between 2010 and 2015 [13]. This replacement calls for more intelligent methods of dynamically increasing the power transfer capacity of circuits and rerouting the power flows through less loaded circuits.

3.2.2. Operational constraints

Distributed generation can cause over-voltages at times of light load, and the increase in demand resulting from the electrification of heating loads (e.g., electric heat pumps) and electric vehicles can give rise to local low voltages. Hence, adequate voltage management requires a coordinated operation of the local generation, on-load tap changers, and other equipment (e.g., voltage regulators and capacitor banks). Due to the local reverse power flow brought by the distributed generation, aligned with the increased demand, the thermal limits of the existing transmission and distribution equipment and lines can be exceeded. The use of dynamic ratings can sometimes increase circuit capacity, while demand management or more controllability of the distributed generation can overcome thermal constraints. Some distributed generation plants use directly connected rotating machines, such as older wind turbines and small hydro turbines that use induction generators, while combined heat and power (CHP) and large hydro turbines use synchronous generators. The connection of these generators and new spinning loads can cause the maximum fault current to exceed the fault-level rating of the distribution system. New fault current limiting technologies or services are then required in order to maintain safe operation of the power system.

Therefore, the grid will need a smarter operation in order to reflect the quantity, geography, and intermittency of power generation and to cope with the new forms of load. Otherwise, traditional and expensive network reinforcement must be carried out.

3.2.3. Reliability of supply

In the coming decade, there will be significant changes to the electricity market in GB. With the closure of a number of coal- and oil-fired plants that are considered to be too polluting, and with some nuclear plants coming to the end of their working lives, renewable generation capacity is increasing as more projects come online. As a result, the proportion of intermittent energy sources in the energy mix is getting higher, lowering the overall predictability of the electricity supply. In the meantime, the electricity capacity margin is decreasing, which increases the risks to the security of supply. To meet the requirement of the government’s reliability standard (which is set at no more than three hours loss-of-load expectation [14]), National Grid, the transmission network operator in GB, has procured additional balancing services, such as supplemental balancing reserve and demand side balancing, as extra tools to balance the system [15]. This situation also calls researchers to look at energy storage (e.g., advanced battery technology) to store electricity economically and in bulk, or at demand response to reduce the peak demand.

《4. GB smart grid incentives and current installed capacity of renewables》

4. GB smart grid incentives and current installed capacity of renewables

In GB, several incentive schemes have been used to promote the use of renewable energy. These are described in Sections 4.1 to 4.4, below. Section 4.5 describes low-carbon technology projects with the same aim.

《4.1. Climate Change Levy》

4.1. Climate Change Levy

The Climate Change Levy (CCL), introduced in 2001, is a tax on the supply of fuel for lighting, heating, and power used by business consumers including those in industry, commerce, agriculture, public administration, and other services. As of April 2015, the current rates in the UK are a tax of 0.554 p·(kW·h)−1 on electricity, 0.193 p·(kW·h)−1 on gas, and 1.240 p·(kW·h)−1 on liquid petroleum gas [16]. Energy supplies from renewable energy sources or high-quality CHP are exempt. This levy acts as a stimulus to the take-up of renewable sources and to energy-efficiency improvement.

CCL does not apply to fuel for use by domestic consumers. The exclusion of domestic consumers avoids increasing the number of households that experience fuel poverty.

《4.2. Renewable Obligation》

4.2. Renewable Obligation

The Renewable Obligation (RO), which came into effect in 2002 in GB and 2005 in Northern Ireland, is the main support scheme for renewable electricity projects in the UK. It places an obligation on UK electricity suppliers to source a certain proportion of their electricity from renewable sources. Each year, this proportion is increased toward a specified target.

Renewable Obligation Certificates (ROCs) are green certificates issued to operators of accredited renewable generating stations for the renewable electricity they generate. ROCs are used by suppliers to demonstrate that they have met their obligations. When suppliers do not have sufficient ROCs to meet their obligations, the suppliers must pay an equivalent amount into a “buy-out” fund, the proceeds of which are paid back on a pro-rata basis to suppliers who have presented ROCs.

《4.3. Feed-in Tariff》

4.3. Feed-in Tariff

The Feed-in Tariff (FIT) scheme, which came into effect on April 1, 2010 in GB, is a government program designed to promote widespread uptake of a range of small-scale renewable and lowcarbon electricity generation technologies. These technologies include solar photovoltaic (PV), wind, hydro, and anaerobic digestion up to a maximum installed capacity of 5 MW, and fossil fuel-derived CHP micro-generation up to 2 kW [17]. The scheme requires licensed electricity suppliers (FIT licensees) to pay a generation tariff to these small-scale generators for the electricity generated, whether or not it is exported to the electricity grid (e.g., 13.39 p·(kW·h)−1 for solar PV with an installed capacity of 4 kWp or less, starting from April 1, 2015 [18]), and a separate export tariff (e.g., 4.85 p·(kW·h)−1 as of April 1, 2015 [18]) where such electricity is also exported to the grid [17].

The tariff rate is calculated by Ofgem based on legislation set by the DECC. The rate is changed depending on the Retail Price Index and degression (i.e., a reduction to reflect the decreasing cost of renewable energy equipment), and changes can occur as often as every three months. The generation and export tariffs for individual installations can last as long as the installation is eligible (e.g., 20 years), determined by the eligible date, technology type, capacity, and energy-efficiency requirement. Since the introduction of the FIT scheme, a continuous reduction of the tariff rate for new installations has been seen. For example, the starting tariff (as of April 1, 2010) for solar PV with a total installed capacity of 4 kWp or less was 48.84 p·(kW·h)−1. This figure fell to 22.59 p·(kW·h)−1 in March 2012 and is currently 13.39 p·(kW·h)−1 (as of April 1, 2015) [18]. The main reasons for the cut were the falling installation costs and the number of applications for the FIT scheme exceeding DECC forecasts and funding allocations.

《4.4. Renewable Heat Incentive》

4.4. Renewable Heat Incentive

The Renewable Heat Incentive (RHI), launched in 2011, is a government environmental program that provides financial incentives to increase the uptake of renewable heat. The RHI provides a subsidy, payable for 20 years, to eligible renewable heat generators and producers based in GB. The RHI gives additional income per unit of energy produced by non-domestic (from 2011) and domestic (from March 2013) producers of heat from renewable sources, such as solar thermal, biomass boilers, and air- and ground-source heat pumps. By encouraging changes in the heating sector, which was previously dominated by fossil fuel technologies, the RHI aims to significantly increase the proportion of heat generated from renewable sources [19].

《4.5. Demonstration and deployment projects of low-carbon technologies》

4.5. Demonstration and deployment projects of low-carbon technologies

In order to prepare for the rapid de-carbonization requirement for the 2020s and 2030s, along with above incentives, the government has been supporting many demonstration and deployment projects of low-carbon technologies, where reforms to the electricity market and networks are considered to be the most important step. The government is:

• Helping industry to reduce the costs of offshore wind power (with a target of £100 per MW· h by 2020) by setting up an Offshore Wind Cost Reduction Task Force [20];

• Supporting the development of CCS technology (with a £1 billion investment) to bring down costs and risks;

• Committing up to £50 million to support innovation in marine and offshore technologies;

• Enabling mature low-carbon technologies such as nuclear power to compete by addressing the barriers preventing it;

• Supporting the building of charging infrastructure for electric vehicles, with a £30 million investment for the Plugged-in Places framework [21]; and

• Working with Ofgem and the industry for LCNF projects (with a £500 million investment) from 2010−2015 and with more limited funding for ENIC projects from 2015 onwards.

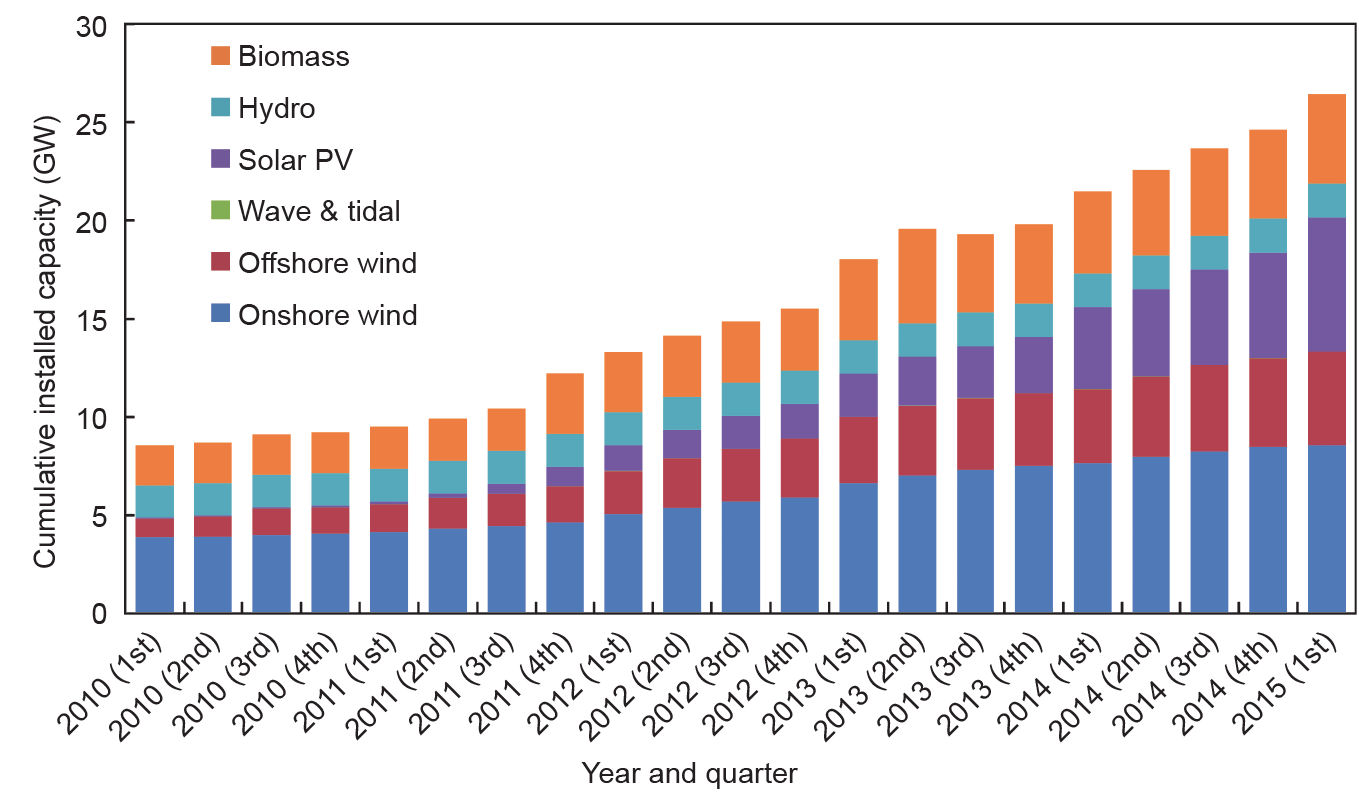

Due to these policy and technical drivers, the UK’s electricity capacity from renewables has increased dramatically in the past five years, from less than 9 GW in the beginning of 2010 to more than 25 GW in 2015 [22], as shown in Figure 1. Onshore wind power has increased from 3.8 GW in the beginning of 2010 to 8.5 GW at the start of 2015. During the same period, offshore wind power has increased from less than 1 GW to 4.7 GW and solar PV power has increased from only 41 MW to 6.8 GW. Biomass electricity has increased from 2 GW in 2010 to 4.9 GW in the second quarter of 2013, and maintains that level toward 2015. It is found that the installed capacity of these technologies has more than doubled in the past five years, with solar PV showing the fastest increase among them.

《Fig. 1》

Fig.1 Cumulative renewable electricity installed capacity, by technology, from 2010 to 2015 [22].

However, the government is now consulting reducing the incentives for renewables. For example, the FIT scheme has exceeded all renewable energy deployment expectations in terms of both the number of installations and the total installed capacity. Therefore, the government has proposed a further cut of the generation tariff for new applicants starting in January 2016, while keeping the export tariff as a route to market for renewable electricity [23]. In this proposal, the tariff for generation from solar PV with an installed capacity of 10 kWp or less will be further decreased to 1.63 p·(kW·h)−1.

《5. Execution and progress of LCNF and ENIC projects》

5. Execution and progress of LCNF and ENIC projects

《5.1. The focus of GB’s smart grid: Distribution networks》

5.1. The focus of GB’s smart grid: Distribution networks

In GB, the smart grid has been primarily focused on the distribution networks, where it is believed early action is needed. Firstly, the distribution network is the biggest component of electricity losses. It is essential that the distribution network operators (DNOs) are able to manage their carbon footprint. Moreover, the uptake of electric heat pumps and electric vehicles, investment in small wind generation, household and community micro-generation, and other initiatives to decarbonize energy use could have a profound impact on the nature and pattern of demand on the distribution networks. DNOs may need to actively manage the intermittent and two-way flows of electricity, which requires significant changes in electricity generation and demand technologies [24]. Therefore, initially, the distribution network will have the greatest opportunity for smart interventions; thus, mass investment is required to ensure that it can cope with the increasing demands and many new emerging requirements [25].

《5.2. Introduction to the LCNF and ENIC projects》

5.2. Introduction to the LCNF and ENIC projects

In GB, there are 14 licensed DNOs that operate the networks but do not supply energy; energy is provided by separate energy suppliers. The DNOs are regional monopolies, that is, each is responsible for a regional distribution service area. The 14 DNOs are owned by six different commercial groups. Rather than choice and competition, customers rely on Ofgem, the government regulator for electricity and natural gas markets in GB, to obtain the required services at a reasonable price. Ofgem sets the total revenues that the DNOs can collect from customers and places incentives on DNOs to innovate and find new ways to improve their efficiency and quality of service. This is achieved through a price control called Electricity Distribution Price Control Review (DPCR), which Ofgem sets every five years. The DPCR5 period was April 2010 to March 2015.

To encourage DNOs to begin the low-carbon economy transformation and to adopt new technologies and business practices, the government launched a £500 million fund—LCNF—for the DPCR5 period. The LCNF supports projects for DNOs to try out new technologies, ways of operating, and commercial arrangements. The aim of the projects is to help all DNOs to understand how they can provide security of supply and value for money as GB moves to a low-carbon economy.

There are two tiers of funding under the LCNF. The first tier allows DNOs to recover a proportion of their expenditure (£16 million per year) incurred on small-scale projects. Under the second tier, Ofgem runs an annual competition for an allocation of up to £64 million to help fund a small number of flagship projects [26]. DNOs explore and demonstrate how networks can facilitate the taking up of low-carbon and energysaving initiatives, such as electric vehicles, heat pumps, micro and local generation, and demand side management. DNOs also investigate the opportunities that the smart meter rollout provides to network companies. Learning from the projects will be relevant to all DNOs as well as to other interested parties; consequently, all GB customers will have the potential to benefit from these projects. It is intended that technologies that are being deployed on a small scale and proved in the trials will move toward mass deployment.

For the new price control period starting in April 2015, ENIC and NIA were created. These are successors to the LCNF projects, but have a broader structure. In addition to the LCNF first tier, the NIA also builds upon elements of the IFI, which was in place under previous price controls. The ENIC, which is broader than the second tier, allows for DNOs and transmission owners (TOs) to compete for funding (up to £81 million per annum) with the best innovation projects. These projects help all network operators to understand what they need to do to provide environmental benefits, cost reductions, and security of supply as GB moves to a low-carbon economy [27].

《5.3. Technical focus of the tier two projects》

5.3. Technical focus of the tier two projects

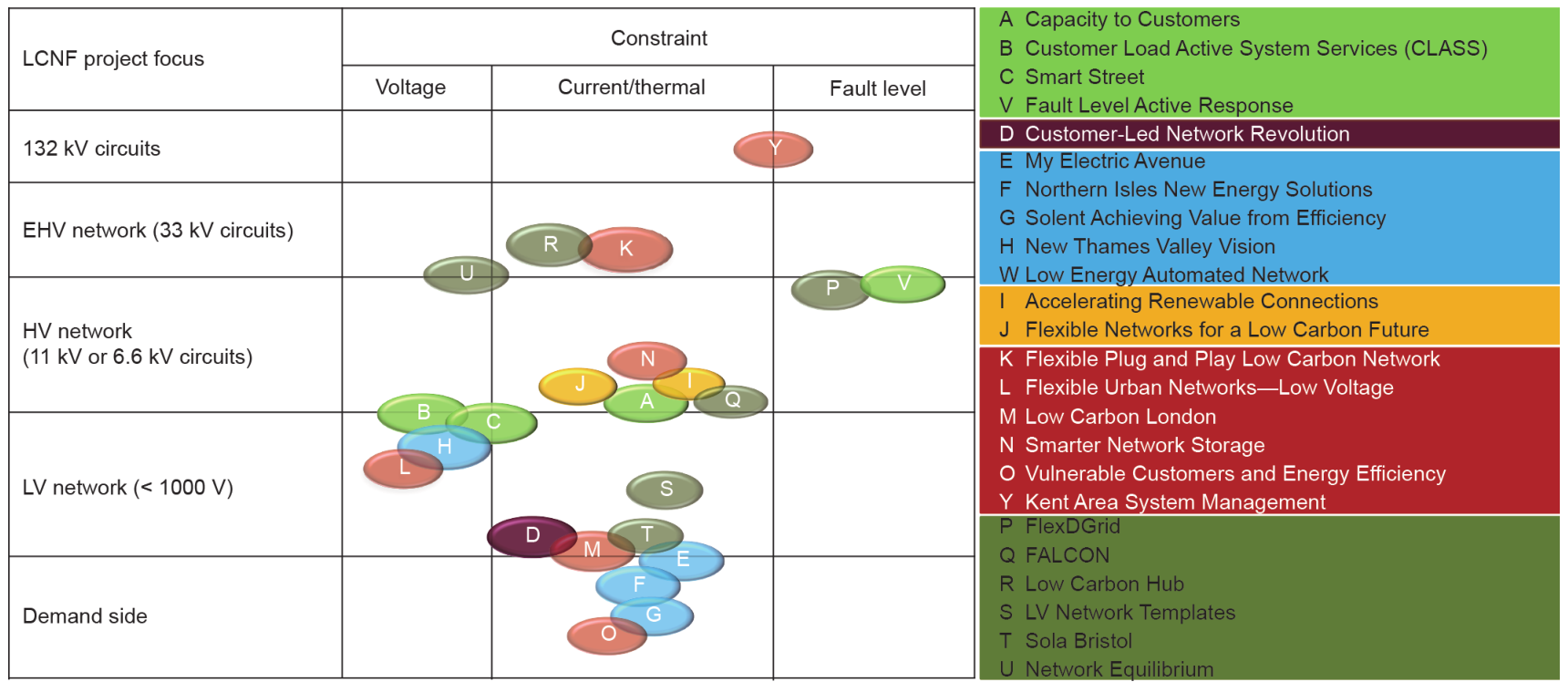

Every year, around four to six proposed tier two projects are awarded by Ofgem, with a range from several million pounds (£) up to more than £20 million, depending on the application and project nature. The titles of all the awarded projects during the last five years are shown in the right column of Table 1, with projects from the same DNO group shown in the same color. The corresponding voltage level and main technical issues addressed are presented on the left of the table. This table clearly shows the technical areas and corresponding voltage levels that the DNOs are concerned with, as well as the focus of the current stage of development of the smart grid.

《Tab.1》

Tab.1 Tier two projects with the corresponding voltage level and technical issues addressed.

It is found that, ① the trials involved all voltage levels, including the customer level, with the integration of the distributed energy resources (DERs) across different voltage levels; ② voltage and thermal overloading are the two main constraints for the integration of DERs; and ③ in many of the projects, the DNOs are exploring technologies that can solve more than one technical issue.

Figure 2 shows the percentage of projects per technology among all the tier two projects. As can be seen, communication technology plays the most important role in the future smart grid development and the majority of these trial projects are using ICT. More and more sensors and remote terminal units (RTUs) are installed in the distribution network in order to improve visibility and to provide control and automation for the network. For example, in the projects “LV Network Template” and “Smart Street,” many sensors are installed in low-voltage (LV) feeders (400 V) and medium-voltage (MV) feeders (6.6 kV and 11 kV). More than 50% of all projects are working on the active management of the power flow of their networks, with concerns regarding voltage and/or thermal constraints. Fault-level management is another area that has attracted attention. Network reconfiguration, realized by automatic switches or power electronics devices, is considered to be one of the most effective solutions to load balancing and/or improving voltage stability. Customer engagement to increase the level of demand response has also been addressed by the DNOs. On the other hand, due to the integration of distributed generation, loss mitigation has not been given as much as attention as previously in traditional power networks.

《Fig. 2》

Fig.2 List of technical focuses of all the tier two projects.

From these LCNF projects, the following trends of the development of GB’s smart grid can be found:

• The design of the smart grid is supported by new technological equipment and new paradigms of services, particularly the application of communication technologies and the harnessing of the demand side for the control and optimization of the power systems.

• Full visibility and control over the assets are being provided by installing a significant amount of new network equipment. The smart grid is required to be self-healing and resilient.

• The use of power electronics in power systems has also been investigated.

• Energy storage is being explored to determine how and where storage brings value to the operation of an electricity grid and to determine technology-neutral specification targets for the development of grid-scale energy storage.

《5.4. Direction of future ENIC projects》

5.4. Direction of future ENIC projects

The ENIC 2015 competition has finished its process of project selection. Five projects with a total of £44.9 million have been awarded [29]. From these ENIC projects, some trends of the industry’s concerns can be discerned and these can be considered as a signpost of future directions of the development of GB’s smart grid.

• A move toward extending the life of transmission assets is apparent. Research and demonstration will be undertaken to overcome operational barriers associated with implementing innovative methods and technologies for life extension of the transmission networks.

• Novel design of transmission towers is being explored, in order to reduce the costs of new overhead lines and to make them more acceptable to the public. There is particular emphasis on increasing renewable generation connection to the 132 kV and 275 kV networks in demanding terrain.

• There will be a demonstration of the use of medium voltage direct current (MVDC) technology (around 30 MW at 30 kV) to bring more controllable connections between sections of power network. This would help increase the amount of renewable generation connected to the network.

• There is emphasis on and wider application of advanced communication technologies in transmission networks. Digital communications will use fiber optic cables instead of copper hard wiring, in order to increase controllability, reduce environmental impact, improve station safety, and allow fast deployment. There will be a demonstration of part of a 275 kV substation that is fully compliant with EN 68150 using equipment from two vendors to test compatibility.

• Continued emphasis on optimizing distribution system will also be investigated to allow network companies to release increased capacity from existing assets without degrading their health and reliability.

《6. Smart metering》

6. Smart metering

《6.1. National rollout of smart meters》

6.1. National rollout of smart meters

The government has committed to the rollout of smart meters for both electricity and gas in all homes and most small businesses by the end of 2020. A sum of £8.6 billion will be spent in replacing some 47 million gas and electricity meters, which are expected to deliver total benefits of £14.6 billion over the next 20 years [30]. The total supplier benefits amount to £6.33 billion (43.3% of the total), including avoided meter reading (£2.69 billion), and reduced inquiries and customer overheads (£1.13 billion). The total consumer benefits are £6.43 billion (accounting for 44%), including energy savings (£4.23 billion) and load shifting/time-of-use tariffs (£1.06 billion), which are partially realized upstream in the electricity markets and are assumed to be passed down to consumers [30].

《6.2. Benefits of smart metering for electricity networks》

6.2. Benefits of smart metering for electricity networks

Even though the intention of smart metering is not primarily to benefit electricity networks, it offers benefits for the development of the smart grid.

Benefits for network planning. The analysis of load and voltage profiles obtained from smart meters will allow improved asset utilization in distribution networks. At present, network operators use generic profiles of domestic loads when assessing requirements for new connections and network reinforcement. These load profiles are likely to change in future due to the increasing connection of heat pumps and electric vehicles along with more prevalent demand response schemes. Using recorded smart meter data will provide a more accurate basis for the prediction of likely future voltage and demand operating ranges. This will enable network designers to specify equipment more accurately, reduce overspending on new equipment, and defer investment in asset replacement [31].

Benefits for network operation. The use of smart meters can help to locate outages and reduce supply restoration times. Traditional outage management relies on customer calls. It has been shown that polling a limited number of smart meters during an outage can help to locate faults [31]. Furthermore, using smart meters, network operators will have the ability to confirm the reinstatement of disconnected supplies. This approach can reduce reliance on customer calls and can therefore improve supply restoration times.

Benefits for demand management. Smart metering systems are seen as a precursor to the widespread implementation of demand response. Smart meters in GB will support demand response through the communication of pricing levels to users, along with provision for incentive-based schemes such as direct control.

《7. GB’s smart grid route map》

7. GB’s smart grid route map

《7.1. Contexts for the future smart grid》

7.1. Contexts for the future smart grid

From the electricity networks’ perspective, GB is already seeing the impacts of the transition to a low-carbon economy. The generation mix is changing, with an increasing level of renewable and other low-carbon generation. At distribution network level, increasing requests for the connection of solar PV systems, onshore wind farms, and other distributed generation are creating technical challenges, which have knock-on impacts ’on the transmission systems [25]. In addition, the increase of demand due to the increasing electrification of heat and transport has the potential to exceed the lines/cables and equipment with traditional design.

From a technology perspective, more and more ICT (e.g., sensors, RTU, etc.) and new technology equipment have already been installed in the network. The tested technology, along with the installation of smart meters, will be valuable for future smart grid development.

Therefore, the ability to respond effectively and efficiently to these impacts and engage the active participation of consumers will critically depend on the continued development of the smart grid.

《7.2. Potential roles and relationships》

7.2. Potential roles and relationships

The development of the smart grid will present new roles and relationships for all those who interact with the electricity system—suppliers, generators, network operators, and consumers, as shown in Figure 3.

《Fig. 3》

Fig.3 Potential roles and relationships in the future electricity industry (reproduced from Ref. [25]). DG: distributed generation.

Suppliers will be responsible for installing smart meters across GB and will be able to introduce new time-of-use tariffs that reward consumers for shifting demand away from peak times. Distributed generators will play a more active role in meeting local demand. Consumers, through demand management with the help of smart meters, will play a more active role in helping to balance supply and demand.

The DNOs (or another actor) will need to face a transition from the role of a traditional DNO that manages a largely passive network to the role of a distribution system operator (DSO) that supports local balancing and system optimization [25]. Firstly, better asset management will be realized. Currently, the resilience of the power distribution systems is assured by redundancy of infrastructure. There is a degree of over-capacity built in, allowing sections of networks to be shut down to accommodate routine maintenance, new connections, reinforcement, and equipment failures without the loss of power to homes and businesses. This form of risk management is likely to become integrated with improved network operational visibility, the use of real-time asset capabilities, and the active control of demand, generation, and storage. Secondly, a better management of supply and demand at the local level is required. With more asset investment, such as installing sensors, enabling the automated action of power switches, and installing communication cables and devices, a wider operation of the whole distribution system can be performed in order to support the local balancing and system optimization. Finally, new customer relationships need to be opened up by the network operators. The distribution networks must interact with the consumers and scale up new solutions to the taking up of low-carbon technologies.

《8. Conclusions》

8. Conclusions

The smart grid in GB is facing a challenging future, but it is also a future of tremendous opportunity. By reporting the policy and technical drivers, as well as the incentives and projection of GB’s smart grid, this paper presents the current status of the development of the smart grid, the roles the various actors play, the areas of focus and achievements to date, and the future work that needs to be done in order to deliver a low-carbon smart grid.

It is found that the focus to date has mainly been on distribution networks, including real-time flows of information and interaction between suppliers and consumers due to improved ICT, active power flow management, and demand management. The nationwide rollout of smart metering provides significant opportunities for smart grid development in terms of the network planning and operations, as well as for customer engagement through demand response. A transition from DNO to DSO is a possible future development for the operation of a smart grid in GB.

《Acknowledgements》

Acknowledgements

This work was supported in part by the UK-China NSFC/EPSRC OPEN project (EP/K006274/1 and 51261130473) and the Horizon 2020 project P2P-SmartTest.

《Compliance with ethics guidelines》

Compliance with ethics guidelines

Nick Jenkins was a member of the Ofgem LCNF Panel and is presently a member of the Ofgem ENIC panel.

Nick Jenkins, Chao Long, and Jianzhong Wu declare that they have no conflict of interest or financial conflicts to disclose.

京公网安备 11010502051620号

京公网安备 11010502051620号