In the last two years or so, there has been increasing interest in hydrogen as an energy source in Australia [1–3] and around the world. Notably, this is not the first time that hydrogen has caught our collective interest. Most recently, the 2000s saw a substantial investment in hydrogen research, development, and demonstration around the world. Prior to that, the oil crises of the 1970s also stimulated significant investment in hydrogen, and earlier still, the literature on hydrogen was not lacking. And yet, the hydrogen economy is still an idea only.

So what, if anything, might be different this time?

This is an important question that we all need to ask, and for which the author can only give two potential answers. First, our need to make dramatic reductions in greenhouse gas (GHG) emissions has become more pressing since these previous waves of interest. Second, renewable energy is considerably more affordable now than it was before, and it has consistently outperformed expectations in terms of cost reductions by even its strongest supporters.

While this dramatic and ongoing reduction in the cost of renewables is very promising, our need to achieve substantial GHG emission reductions is the crucial challenge. Moreover, meeting this challenge needs to be achieved with as little adverse social and economic impact as possible.

When considering what role hydrogen might play, we should first think carefully about the massive scale and complexity of our global energy system, and the typical prices of the major energy commodities. This provides insights into what opportunities hydrogen may have. Considering a temperate country with a small population like Australia, we see that domestic natural gas and transport fuel markets are comparable to and even larger than the electricity market on an energy basis [4]:

• Electricity: consumption ≈ 9 × 1017 J·a-1 , typical wholesale price = 60 AUD·(MW·h)-1 ;

• Natural gas: consumption 1.5 × 1018 J·a-1 , typical wholesale price 8 AUD·GJ-1 ≈29 AUD·(MW·h)-1 ;

• Gasoline, diesel, and kerosene: consumption 2.3 × 1018 J·a-1 , typical wholesale price 30 AUD·GJ-1 108 AUD·(MW·h)-1 .

Unsurprisingly, the natural gas market in colder countries is often larger than the electricity market. Nonetheless, such comparisons suggest that the displacement of transport fuels, with their relatively high price, is more prospective for hydrogen, with an abatement opportunity that is comparable in size to that of the electricity sector.

(1) Hydrogen production pathways

Today, hydrogen is mostly made by reforming natural gas, with coal gasification and electrolysis considered its most prospective alternatives. Notably, carbon capture and storage (CCS) must be included for both the natural gas and coal pathways to reduce emissions, which increases the cost of clean hydrogen production [2].

However, a lot of recent interest has been focused on the use of renewable energy to supply an electrolyzer. Alkaline and polymer electrolyte membrane (PEM) technologies are most commonly proposed, with several leading manufacturers of both (e.g. Refs. [5,6]) and reasonably good understanding of their relative strengths and weaknesses.

(2) The importance of electricity price and asset utilization

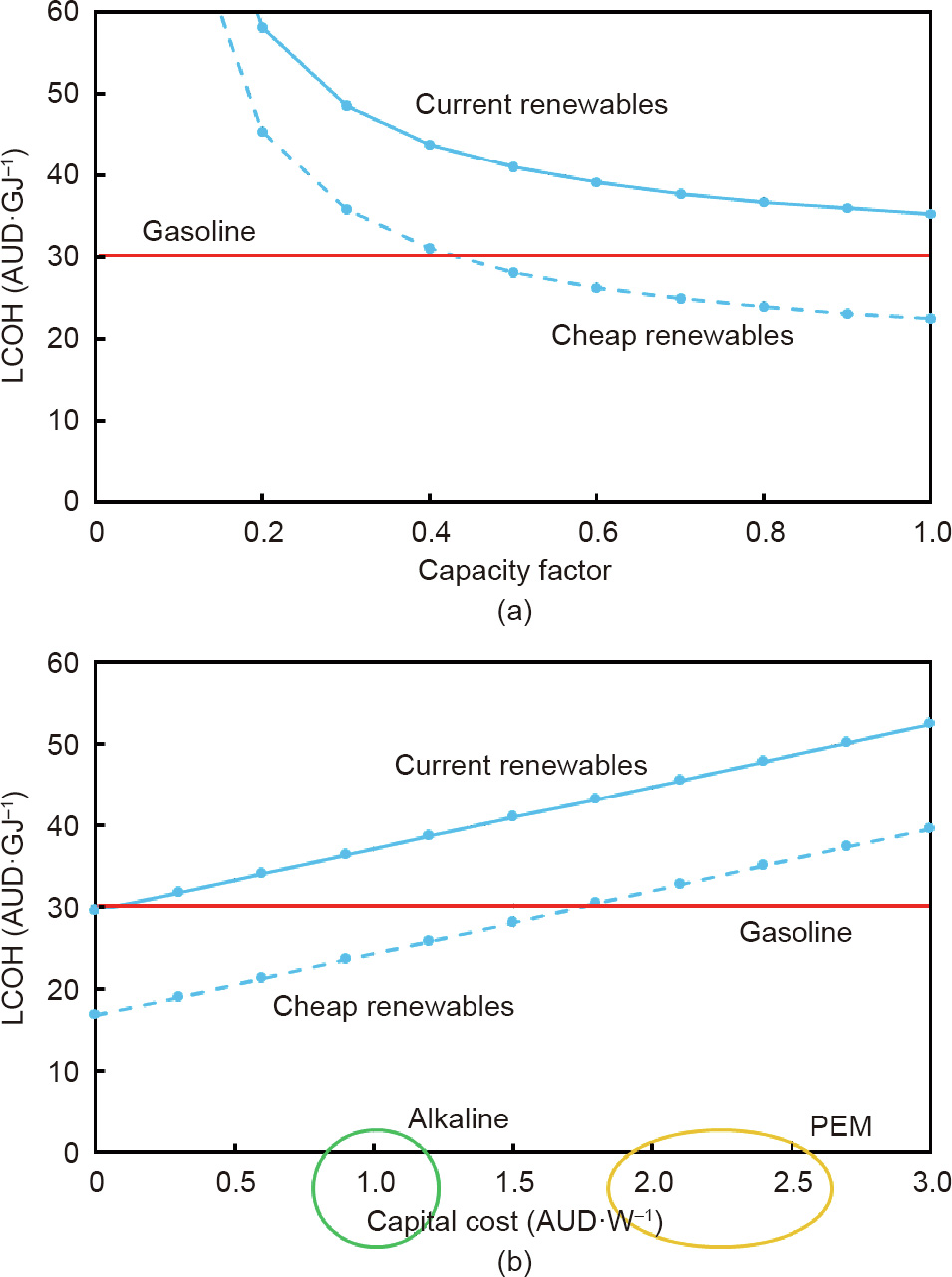

Irrespective of whether alkaline or PEM electrolysis is considered, Fig. 1 shows that the price of electricity and the electrolyzer capacity factors are the primary determinants of the cost of renewable hydrogen production, in that order. Using the definitions that are presented in Appendix A, renewable energy that is cheaper than current renewables, supplying an electrolyzer of high capacity factor, is required for renewable hydrogen to be competitive with liquid fuels if there is no subsidy.

The supply of intermittent renewable electricity to an electrolyzer is an additional challenge, since Fig. 1 shows that the electrolyzer needs to operate at a high capacity factor to achieve its most economic performance. This can be addressed in several ways, most obviously via a firm enough electricity supply such as that achieved by the combined use of renewables and certain combinations of hydro, nuclear, or fossil generation. Notably, the provision of firming by fossil generation also increases the embodied GHG of hydrogen production, and without some care, can destroy the GHG benefit of electrolytic hydrogen production.

《Fig. 1》

Fig. 1. Levelized cost of hydrogen (LCOH) versus (a) capacity factor for an alkaline electrolyzer and (b) capital cost with a 75% capacity factor and approximate alkaline and PEM capital costs.

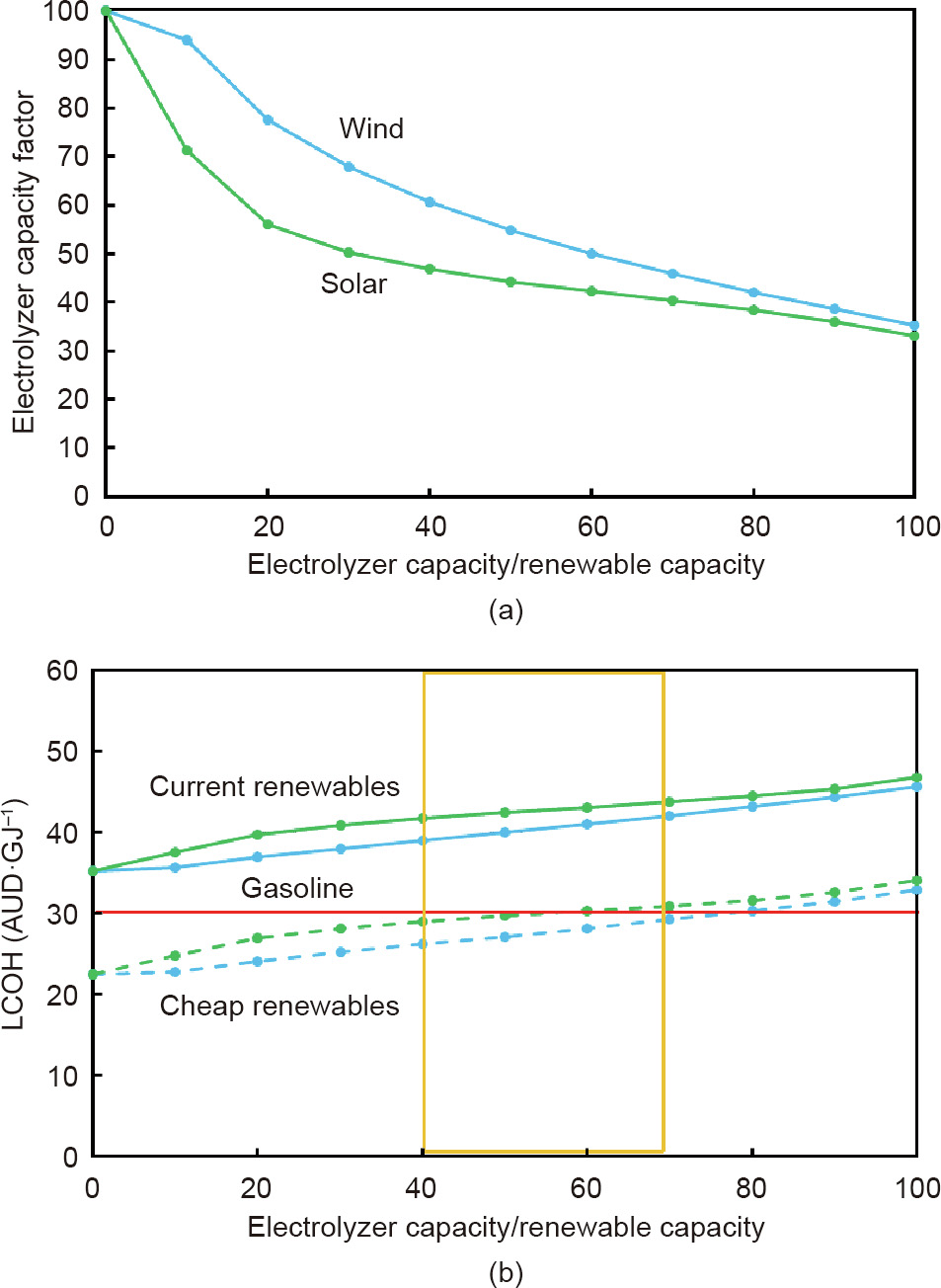

Another means of achieving high electrolyzer capacity factors whilst relying less on firming is to undersize the electrolyzer relative to the renewables that supply it. Fig. 2 shows that electrolyzers with capacities much smaller than those of the supplying renewables tend towards 100% capacity factor, while those with the same capacity as the renewables have the same capacity factor as the supplying renewables. While very high capacity factors may seem attractive, small electrolyzers produce little hydrogen. Given the similar magnitudes of our electricity and transport fuel systems, we may therefore choose to produce similar amounts of both, as achieved in the yellow box in Fig. 2(b).

《Fig. 2》

Fig. 2. (a) Capacity factor and (b) associated LCOH for an alkaline electrolyzer versus its capacity relative to that of the renewable generator supplying it. Generation data is from two operating wind and solar farms in Australia’s National Electricity Market.

(3) System integration and other considerations

There are many other considerations that have not yet been discussed, and which affect the economics of renewable hydrogen production. These include:

• Provision of ancillary and demand response services by electrolyzers in wholesale electricity markets, which tend to favor PEM over alkaline technology;

• How the capital costs and efficiencies of large-scale electrolyzers will evolve over the next ten years in particular;

• Impact of all the bundled charges for electricity, particularly network charges and contracting costs.

However, while such considerations are important, they should not considerably impact the underlying economics presented in this article. The price of renewable electricity is paramount to the prospects of renewable hydrogen via electrolysis.

(4) Closing thoughts

The production of hydrogen from renewable energy has plausible commercial prospects over the next approximately ten years, particularly in decarbonizing transport. Renewable hydrogen costs that are competitive with conventional liquid fuels appear achievable, even without subsidy, should renewable electricity prices continue to decrease. In such cases, hydrogen production on an energy basis can be comparable to the remaining renewable electricity, and this is an important consideration given the relative scales of these two markets.

However, it is nonetheless difficult to see how renewable hydrogen will compete with natural gas that is currently at least three times cheaper. Effective carbon prices of several hundred dollars per tonne are required to make the price of renewable hydrogen competitive with fossil natural gas [7], and there are many other, more cost-effective forms of abatement in our economies. This, in turn, suggests that hydrogen produced from natural gas or coal, with CCS, may have a significant competitive advantage for some time yet, as suggested by others [2,7].

Insisting on the sole use of renewable energy is therefore likely to reduce the chances of the hydrogen economy ever being realized. Entire supply chains need to be built for both domestic and export hydrogen markets. As we already know from the development of electricity, natural gas, and liquid fuel systems over the last approximately 100 years, this will be a huge social, infrastructural, and regulatory task extending over several decades.

Should such a world eventuate, the following are nonetheless tantalizing prospects:

• A gigawatt scale wind and/or solar farm coupled to a sub-gigawatt electrolyzer;

• The electrolyzer provides ancillary services for power system security and reliability;

• The electrolyzer also sells oxygen, for additional revenue as an industrial feedstock.

Buses, trucks, trains, and ships can then run on renewable hydrogen or fossil hydrogen with CCS, or their products. At the same time, hybrid or fully electric light duty vehicles can provide clean and private mobility, while hydrogen supplies industry and non-electrified heating and a clean electricity system that can support us all.

Acknowledgements

I am grateful to the owners of a solar and a wind farm of Australia’s National Electricity Market for supporting the data which are used for generating Fig. 2.

Appendix A. Supplementary data

Supplementary data to this article can be found online at https://doi.org/10.1016/j.eng.2020.09.008.

京公网安备 11010502051620号

京公网安备 11010502051620号