《1. Introduction》

1. Introduction

The proliferation of distributed energy resources (DERs) is resulting in a paradigm change in power system operation. Homeowners are increasingly investing in residential solar photovoltaics (PVs) and battery storage for economic reasons [1]. However, uncertainties in both the solar PV generation and the residents’ energy demand challenge the safe operation of the distribution system. To alleviate potential congestion and voltage violation problems, exploitation of the flexibility embedded in the DERs is a promising economic solution that is drawing worldwide attention.

The transactive energy (TE) represents a group of technologies that facilitate the coordination of intelligent devices and balance the interests of different stakeholders using monetary value as the sole media [2]. Early TE technologies were primarily based on applying price signals directly to the consumers of grid services in order to mitigate either congestion or imbalance, assuming the price responsiveness of the consumers. Although the design was straightforward, the response from the consumers was not guaranteed and could result in a ‘‘kick-back” effect [3]. Later, consumer behavior was modeled further. In Ref. [4], an optimal scheduling model for most common residential appliances was proposed, considering different energy vectors. The market participation mechanism for consumers such as commercial buildings was developed into different bidding strategies [5]. The model of a proactive prosumer reacting to an external price signal was elaborated further in Ref. [6]. However, these studies only address one operation setting (e.g., intraday or near real-time), and the market operation of the aggregators and interactions with the distribution system operators (DSOs) are not clearly developed.

The market operation model of aggregators based on the TE approach was further developed in Refs. [7–10], in which the operation is divided into day-ahead and real-time stages. The whole problem is formulated as a two-stage optimization problem following the ‘‘schedule and control” principle of conventional operation. The model can be implemented in a distributed manner, in which monetary value is the only information exchanged among the parties, which protects their privacy and autonomy. Ref. [10] elaborates on the bidding process of prosumers in a local market environment. The work in Refs. [7,8] differs from the rest, as it attempts to develop a full TE market operation framework for prosumers, in which an independent market operator is introduced to eliminate the possible bias the system operator may display toward consumers; moreover, network constraints are taken into account.

Although many TE schemes has been presented, the prosumers’ devices are primarily assumed to be controlled directly by an upper-level agent such as the aggregator. In Ref. [11], the TE is applied between a parking lot aggregator, with PV and eletric vehicle (EV) chargers, and a local trading agent. The transactive process is performed using the double-side auction method. In Ref. [12], the TE takes place between the DSO and the microgrid operator, where the microgrid operator controls the microgrid-owned assets. In Ref. [13], the aggregator controls the power dispatch among EVs directly, using the proposed hierarchical bipartite graph (HBG) matching method for optimizing the power exchange between vehicles.

The interaction of prosumers and their agent has also been explored. To activate the demand response from prosumers, the work in Ref. [14] attempts to activate the transactions between prosumers with energy storage systems and a microgrid. The work in Ref. [15] promotes trading energy between the bidders and askers. However, it rules out that the prosumers do not have the ability to arrange their bidding functions and settlement. In Ref. [16], the demand response of each residential consumer is activated with the proposed nested TE; however, the mechanism only covers flexibility procurement and excludes normal operation and network constraints.

Once network constraints are considered in the formulation, the cost paid by the consumers increases in order to motivate lower network utilization. Security and grid constraints are considered in Ref. [17]; however, it is assumed that the DERs are directly controlled by the aggregators, so the preferences of the prosumers are not fully respected. Research based on dynamic tariffs [18,19] addresses the network cost based on the distributed locational marginal price concept; however, due to the radial operation of distribution systems, the interests of the consumers at certain locations (e.g., at the end of the feeder) are always harmed due to the higher power loss and voltage drop that are induced for power delivery in comparison with the other nodes in the network. Although this type of design takes into account network impacts such as loss and/or congestion, it introduces a natural bias toward certain consumers, thereby limiting the applicability. A fair market operational model must not introduce bias toward consumers in terms of their geographical locations; otherwise, special policies would be introduced to differentiate the users, which would lead to an increased cost for the implementation of such a system. Furthermore, the tariff caused by network constraints may be much higher than the normal retail price, as illustrated in Ref. [18]. A multi-leader multi-follower (MLMF) Stackelberg game approach is utilized in Ref. [20] to model the energy trading process among microgrids (MGs) while the assets in the MG are directly controlled by the MG operator. A network-constrained distributed bilateral energy pricing scheme is proposed in Ref. [21]. Trading between the prosumers is quantified in a distributed way using the mutual reputation index.

So far, previous research on TE that addresses the economic operation of aggregators or prosumers mainly addresses aggregators or prosumers’ operational model interacting with the external market signal, or the interactions between the two parties respectively [22]; thus, a complete interaction framework covering the interests of the prosumers, aggregators, and network operators that can ensure unbiased operation, responsiveness, the privacy of the prosumers, and avoidance of grid security violations is missing. This paper proposes a framework to address the abovementioned issues. To be specific, the contributions of this work can be broken down into the following aspects:

(1) Most of the existing research on TE is based on an open-loop mechanism, whereas our work has closed-loop features and is combined with an architecture in which the interests of aggregators, network operators, and prosumers are considered. The previous work in this area does not have the same mechanism or formulation [21,22].

(2) An innovative price adder (PA) is proposed and applied to all prosumers to activate the response, which makes it possible to avoid the bias that was introduced in previous work using a dynamic tariff due to the network position of the prosumers. Previously, the PA concept was mentioned in the context of the transmission grid [23,24] or implicitly used in the concept of distributed locational marginal price (DLMP), as proposed in Refs. [18,19,25]. The authors in Ref. [26] propose a new method that contains the PA concept; however, the network constraints are missing.

(3) The role of the aggregator is further clarified and enhanced compared with the model in Refs. [6,7]. In the current work, the aggregator is not only an agent of the prosumers for energy trading and a market participant, but also a mediator between the DSO and the prosumers, formulating and spreading the PA to the prosumers. This setup also alleviates the potentially heavy computational burden for aggregators in other community-based markets [27].

The organization of this paper is as follows. In Section 2, the proposed TE architecture is specified. The optimization model is then described in Section 3. The simulation results and discussion are given in Section 4, followed by conclusions.

《2. Transactive energy framework》

2. Transactive energy framework

This section first discusses the tariff policy, followed by the TE framework.

《2.1. Current tariff model in Denmark》

2.1. Current tariff model in Denmark

The tariff can be defined according to the customer’s production or consumption and the connected voltage level [28]. At present, many countries have no production tariff for residential customers, who only pay tariffs for each kilowatt-hour of consumption, in addition to a subscription fee [28]. In addition, a time-of-use tariff is adopted by some DSOs in order to reduce the peak load [29]. In Denmark, the peak and off-peak load tariffs of the DSO for the times between 17:00 and 20:00 during the period from October 1st to March 31st are 0.09 and 0.03 EUR∙(kW∙h)-1 , respectively, while the tariff of the TSO is 0.01 EUR∙(kW∙h)-1 . This information is not included in the optimization model of the aggregators, as the tariff is paid by the prosumers regardless of the energy price [30], which implies the necessity for an energy management function at the prosumer level.

《2.2. The proposed transactive energy framework》

2.2. The proposed transactive energy framework

Much of the previous work assumes a price-quantity characteristic curve of consumers. However, it is challenging to approximate such a curve in reality. Furthermore, if such a curve is formulated externally, the privacy of the consumers could be at risk. Instead, with the increasing use of controllable household solar PV and storage (PVST) units and online appliances, prosumers tend to schedule their energy usage to maximize their self-sufficiency and hedge against volatile supply conditions. Home energy management systems (HEMSs) can help prosumers to coordinate and optimize their schedules with respect to their forecasted production and consumption preferences. In this way, the residents’ energy consumption information is not shared, allowing them to retain their privacy [31], while their energy consumption information remains commercializable [32].

Prosumers equipped with HEMSs may participate in the electricity market directly, provided that they are allowed to access the market and have the means to interact [33]. Otherwise, they can subscribe to an electricity aggregator/retailor as their supplier, and the aggregator pools the distributed resources to join the market operation. In the latter context, the HEMS communicates with the aggregator to submit the prosumers’ schedule and obtain price information based on their type of supply contract. Such two-way communication among prosumers and aggregators enables a TE network. From the network operator side, to ensure efficient grid operation and fulfill network security, a TE framework can be set between the aggregator and the network operator through a distribution-independent system operator (DISO) [6]. In this way, a TE framework can be established to ensure the coordinated operation of prosumers, aggregators, and network operators at the same time.

In this framework, it is assumed that there is a variable price contract between the aggregator and the prosumers, where the prosumers create their schedule based on the predicted electricity price from the associated aggregator and the forecasted consumption and PV production. The HEMS will then minimize the electricity bills (or maximize profits in the case of excess generation). The schedule from the prosumers in each time interval will be collected by their subscribed aggregator, who will then trade in the market according to their bidding strategy. The schedules of all the aggregators will be sent to the DSO to verify the network security. If no congestion or voltage limit is violated, the DSO will accept the schedule. Otherwise, a negotiation process will be triggered between the DSO and the involved aggregators through the solution process of a social welfare problem mediated by the DISO. This transactive procedure will generate a price quantity representing the added cost due to security. In the literature, this price quantity has not been effectively used to activate individual prosumers after the transactive process. In this work, instead, this price quantity is used to formulate a PA that is communicated back to the prosumers through the aggregators, which represents the network cost of electricity due to their schedule. The HEMS will add this PA to the original forecasted electricity price, reschedule the consumption, and submit to the aggregator again. If the new schedule still results in violations of the network constraints, the process will repeat until the security criteria are met. In fact, this PA is equivalent to a network tariff that is without bias toward individual prosumers. The overall conceptual architecture is shown in Fig. 1.

《Fig. 1》

Fig. 1. (a) The proposed TE architecture; (b) HEMS for PVST prosumers.

《2.3. Rolling window operation for prosumers》

2.3. Rolling window operation for prosumers

The operation of prosumers is expected to follow a forward rolling time window, where the forecasted production and consumption are known within the time window. The time window length is designed to be 3 h, with 1 h resolution. The proposed rolling window optimization (RWO) model is illustrated in Fig. 2.

《Fig. 2》

Fig. 2. Rolling procedure for HEMS-controlled PVST prosumers.

The rolling window has a certain length (3 h, in this case), where the prosumers submit their schedules before the actual operating hours. In each rolling window, a TE process will take place to ensure that there is no constraint violation in the time window. The rolling (a forward moving time window of 3 h) takes place for every time interval; therefore, only the schedule in the first hour of the rolling window will effectively be implemented, while the schedule for later time intervals will be subject to revision in the next rolling step.

The overall TE operation flow is shown in Fig. 3; it is an iterative process until the aggregated schedule from the prosumers is feasible for the network. Starting from Step 1, PVST prosumers will first optimize their own schedules according to their predicted price and energy quantities, and then submit the schedule to their subscribed aggregators. In Step 2, the aggregated schedules will be passed on to the responsible DSO by the aggregators. If no violations are found in the network, the process will stop (Step 3), and the aggregators will go to the electricity market for trading. If network constraints are violated, the TE mechanism will be triggered to help reschedule the PVST prosumer’s schedule until an agreement is reached among the aggregators and the DSO (Step 4). Afterward, the aggregator sends the PA to its associated prosumers and then obtains an updated schedule from them. The HEMS manages each prosumer’s schedule and implements the PA in its algorithm to influence the prosumer’s behavior.

《Fig. 3》

Fig. 3. Operation flow for the TE system in each rolling window.

《3. Optimization models》

3. Optimization models

The overall optimization problem is formulated as a social welfare maximization (and cost minimization) problem.

《3.1. The prosumers’ operation model》

3.1. The prosumers’ operation model

For the PVST type of prosumers, the HEMS mainly controls the storage unit to achieve economic operation. Since the energy purchasing/selling prices are asymmetric due to tariffs and taxes, binary variables are required to indicate both the prosumer’s action (i.e., buying or selling) and the battery operation status (i.e., charging or discharging). Table 1 provides a specification of the binary variables.

《Table 1 》

Table 1 Specification of binary and bi-linear terms.

Considering the electricity products provided by the aggregators, the PVST prosumers’ objective function in each rolling procedure can be expressed as follows↑ .

↑ The nomenclature of the symbols used in the paper is provided at the end of the paper.

Eq. (1) shows that the net cash flows of the prosumers from the electricity transactions are maximized. Since the prosumer cannot directly trade in the electricity market, the tax should be included in the electricity price shown in Eq. (2). Energy selling or buying by the prosumers cannot happen at the same time, and is bound by the constraints in Eqs. (3) and (4). The charging/discharging power limits are fulfilled by Eqs. (5) and (6), and the SOC is constrained within a predefined zone by Eq. (7). Eq. (8) indicates the initial SOC of each prosumer’s battery, while the SOC of a battery at each time step is expressed by Eq. (9). It should be noted that the above optimization problem has a simplified format. The original format contains bi-linear terms, making the problem nonconvex, which can be easily formulated according to our previous work [7]. This intractable problem can be resolved by linearizing the bi-linear term by introducing the extra variables  , as listed in Table 1. This is the so-called ‘‘big M” technology [34]. However, it should be noted that the prosumer model in Eqs. (1)–(9) can be simplified into a linear programming model if no negative electricity price occurs, which fits the case for household operation optimization [35].

, as listed in Table 1. This is the so-called ‘‘big M” technology [34]. However, it should be noted that the prosumer model in Eqs. (1)–(9) can be simplified into a linear programming model if no negative electricity price occurs, which fits the case for household operation optimization [35].

To simplify the format of the equations, the index i is neglected in the following formulas. For the energy schedule from the PVST prosumers for time interval t at bus j,  will be submitted to the DSO via the aggregators. If the schedule violates the system constraints, the TE mechanism will be triggered; otherwise, this schedule will be accepted. A simple battery life cost model is adopted, as proposed in Ref. [36]; it is mathematically expressed as follows.

will be submitted to the DSO via the aggregators. If the schedule violates the system constraints, the TE mechanism will be triggered; otherwise, this schedule will be accepted. A simple battery life cost model is adopted, as proposed in Ref. [36]; it is mathematically expressed as follows.

To consider the impact of the battery degradation discharging cost (BDDC) on the scheduling, the objective function in Eq. (1) is modified into the following

《3.2. The distribution system operators’ objective》

3.2. The distribution system operators’ objective

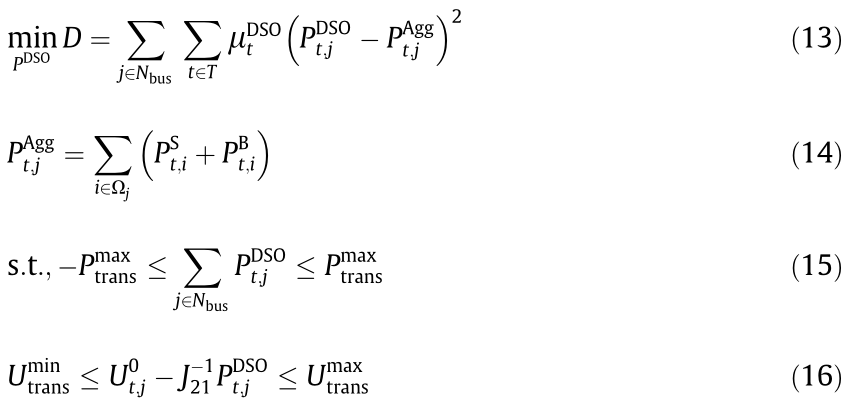

The responsibility of the DSO is to meet the energy demand of each aggregator while ensuring that the overall operational schedule meets the distribution system constraints. The DSO’s optimization problem can be written as follows.

The corresponding prosumers’ schedules of bus j will be aggregated by the aggregator, as shown in Eq. (13). The reactive power to voltage (QV) sensitivity method, which ignores reactive power variation in the low voltage (LV) grid, is adopted to calculate the grid voltage in Eq. (16) [6]. The results obtained by the proposed method have been compared with the results obtained by Matpower and showed good agreement.

《3.3. The aggregators’ operation model》

3.3. The aggregators’ operation model

The aggregators try to meet the demand of the prosumers based on market trading. Here, we consider an aggregator that already has a purchase agreement from the day-ahead market trading. The schedule submitted by the prosumers close to the real-time operation represents a modification of the day-ahead schedule. The deviation from the day-ahead schedule may introduce extra cost to the aggregator. To minimize the cost, this modification can be considered as balancing the power provided to the grid. Each aggregator’s optimization problem in this phase can be expressed as follows.

The schedule sent to the DSO can be expressed as follows.

The aggregator can either provide up-regulation or downregulation, which is indicated in Eq. (17). The range of the up-/ down-regulation energy is described in Eqs. (19) and (20), respectively. Considering the difficulties in obtaining the SOC information of PVST prosumers via smart meters in the real world, a modification is made in this work that relaxes the upper boundaries of the charging/discharging limit by assuming a full battery storage in the t–1 time interval. Eq. (21) shows the common interests between the aggregator and the DSO.

《3.4. Social welfare maximization between the DSO and aggregators》

3.4. Social welfare maximization between the DSO and aggregators

A social welfare optimization problem can be formulated as follows.

s.t., Eqs. (17), (18), (20)–(23).

It can be seen that Eq. (22) combines the optimization problem of the DSO and the aggregators.

《3.5. Distributed transactive energy model》

3.5. Distributed transactive energy model

Eq. (22) will be solved iteratively between the DSO model and the aggregator’s model using a price signal that represents the cost of security (CoS). As specified in Section 3.1, the whole problem has been reformulated into a convex problem; therefore, the alternating direction method of multipliers (ADMM) is adopted here to solve the problem [37]. Firstly, an augmented Lagrangian of the problem in Eq. (22) is written as follows.

where ρ > 0;  is the pth iteration’s

is the pth iteration’s  shown in Eq. (23). To solve Eq. (23), the ADMM includes the iterations in the following:

shown in Eq. (23). To solve Eq. (23), the ADMM includes the iterations in the following:

A constant step size ρ is utilized to update  , and is defined as 0.8 in this study. The primal residual

, and is defined as 0.8 in this study. The primal residual  and dual residual

and dual residual  are applied as the convergence criterion, which can be expressed as follows.

are applied as the convergence criterion, which can be expressed as follows.

where ε is set as 0.005 in this study. After solving Eq. (23), the new schedule that is accepted by both the DSO and the aggregators can be formulated as follows

《3.6. Rescheduling of PVST prosumers via a PA》

3.6. Rescheduling of PVST prosumers via a PA

The price quantity reflecting the CoS should be communicated to the prosumers to reflect the network conditions, as it is induced due to the schedule of the prosumers. Since the converged price can be much higher than the usual electricity retail price caused by the rigid mathematical formulation, the application of the price is restricted. In this work, we propose a price component based on this converged price, which we call the PA. The difference before and after the initial schedule is normalized is represented by the normalized difference (ND):

There are a total of four combinations when the initial schedules of the PVST prosumers are required to be updated, as shown in Table 2.

In Table 2, a positive ND means that the agreed-upon schedule between the DSO and aggregator requires the PVST prosumers to use less energy from the grid or inject more energy into the grid. In such a situation, it can be imagined that, regardless of the sign of the CoS, a positive PA should be given to the prosumer so that the right response can be activated from the PVST prosumer. Likewise, if ND has a negative sign, a negative PA should be applied. The  is formulated by the following formula:

is formulated by the following formula:

where  is the converged value of

is the converged value of  after the iteration shown in Eqs. (24)–(26). Upon receiving the PA from the aggregator, each PVST prosumer will reschedule its consumption by adding the PA to its forecasted price:

after the iteration shown in Eqs. (24)–(26). Upon receiving the PA from the aggregator, each PVST prosumer will reschedule its consumption by adding the PA to its forecasted price:

The process described in Sections 3.1–3.7 will be repeated until the schedule is accepted by the DSO.

《Table 2》

Table 2 PA direction according to the sign of the ND and CoS.

‘‘+” and ‘‘–” refer to positive and negative values, respectively.

《3.7. Discussion》

3.7. Discussion

In order to have the scheme work in reality, the following conditions must be fulfilled:

• Prosumers can receive the forecasted electricity price from a service provider to schedule their controllable devices with a certain accuracy level and are responsive to the price signal;

• The marginal cost of the TE operation is low, which means that the communication channels are available; furthermore, mathematically, the problems can be solved quickly and reliably;

• A balance or imbalance market is available for the aggregators to trade their own imbalance.

《4. Case study》

4. Case study

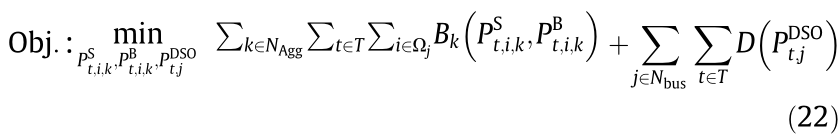

A representative low-voltage grid is used to illustrate the efficacy of the proposed framework. The system topology is shown in Fig. 4.

《Fig. 4》

Fig. 4. Distribution system for the case study.

《4.1. Parameter settings》

4.1. Parameter settings

In this work, it is assumed that there are a total of 18 PVST prosumers contracted with two different aggregators in a 0.4 kV lowvoltage distribution system, which is the same as the test system used in Ref. [6]. The power transformer capacity allocated to all residents in that area is 220 kW. The minimum and maximum voltage of the bus is set at 0.9 and 1.1 per unit (p.u.) respectively. The parameters of the batteries are specified in Table 3.

《Table 3》

Table 3 Battery parameters.

《4.2. Results and discussion》

4.2. Results and discussion

Due to low diversity in PV production and likely similar forecasts of the electricity price, schedules from prosumers can coincide, which can lead to violations of the network constraints during high or low price periods. For simplification, it is assumed that all the prosumers under one aggregator have the same forecast of electricity prices. The predicted variable electricity price that is applied for the PVST prosumers is compared with the original variable electricity price in Fig. 5.

The day-ahead market prices shown in Fig. 5(c) were obtained from Energi Data Serivice↑ , from 00:00 to 23:00 on 5 March 2019 for the Estern Denmark (DK2 area). The profits of each aggregator are considered by using a profit coefficient, which is a profit margin that each aggregator expects, assuming that each aggregator is a price-taker. This profit coefficient concept applies in both the purchasing and selling prices of the aggregator and reflects the differences of aggregators’ bidding strategies. The predicted purchasing/ selling electricity prices by the PVST prosumers associated with Aggregator 1 are shown in Figs. 5(a) and (b), and were obtained based on the prices in Fig. 5(c). For brevity, the predicted electricity prices from Aggregator 2 are not shown here.

↑ https://www.energidataservice.dk/

《Fig. 5》

Fig. 5. Variable electricity price provided by the aggregator. (a) Predicted electricity selling price in each rolling process (prosumers in Aggregator 1); (b) predicted electricity purchasing price in each rolling process (prosumers in Aggregator 1); (c) day-ahead market price.

It can be seen in that Aggregator 1 gives a cheaper electricity product to its contracted customers and purchases the surplus energy from its customers for a lower price as well, compared with the business strategy used by Aggregator 2. For Aggregator 1 and 2, the purchasing profit coefficient  are set at 10% and 12% respectively, while for selling

are set at 10% and 12% respectively, while for selling  are 8% and 11% apiece.

are 8% and 11% apiece.

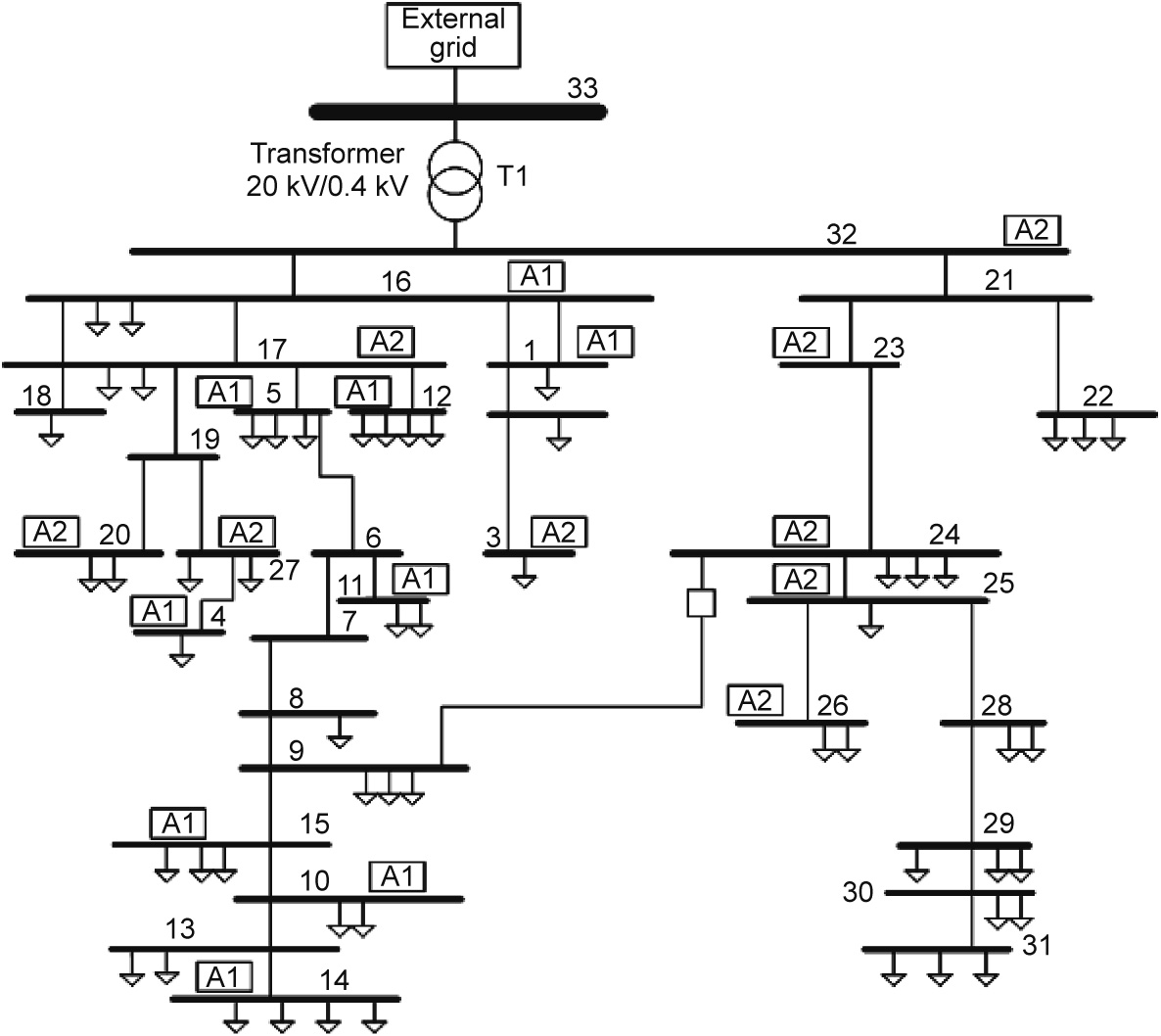

Based on the procedure in Section 3, the simulation results of all the prosumers are shown in Figs. 6–9. The aggregated schedule before and after the TE in each RWO process is compared in Fig. 6(a), where the solid color lines represent the schedules for each RWO without the TE process, and the dotted lines represent the schedules for each RWO with the TE. This corresponds to Step 1 of the optimization problem in Fig. 3. The final aggregated schedule after each rolling step is shown in Fig. 6(b); for each step, the process will go through Steps 2–7, in case congestion is taking place in a rolling window. It can be seen that a congestion problem occurrs between 11:00 and 13:00, which corresponds to the time interval of high solar irradiation. Under the incentive price signal created by the TE, the smart device will make a new schedule and thus will not violate the network constraints, as shown in Fig. 6(b).

Due to the congestion constraint, the TE will be activated at hour 11 in Fig. 6, which corresponds to the 6th rolling step in the simulation case. The aggregated schedules before/after the TE at the 6th rolling step are shown in Fig. 7(a), while the voltage profile is shown in Fig. 7(b). It can be seen that there is a remarkable voltage rise in each bus node. The CoS is shown in Fig. 7(c) after Step 4 in Fig. 3 in the first TE process.

《Fig. 6》

Fig. 6. (a) Aggregated schedule of prosumers before/after the TE in each RWO process; (b) aggregated schedule that is finally submitted to the DSO.

《Fig. 7》

Fig. 7. Summary of the TE results at hour 11 at the 6th rolling step. (a) Aggregated schedule of prosumers before/after TE; (b) system voltage before/after TE; (c) CoS of each node.

The aggregated schedules before/after the TE at the 7th rolling step are shown in Fig. 8(a), while the voltage profile is shown in Fig. 8(b). Both the congestion and the voltage violation problems occur in this period. After the TE, the system voltage constraints are met, as indicated by the green line in Fig. 8(b), while the congestion problem is also solved, as shown in Fig. 8(a). The corresponding CoS is illustrated in Fig. 8(c). The CoS for each node is the same, even when the voltage violation problem is solved. Thus, the CoS benefits from the flexibility of the PVST prosumers, and especially from their storage units.

《Fig. 8》

Fig. 8. Summary of the TE results for hour 12 at the 7th rolling step. (a) Aggregated schedule of prosumers before/after the TE; (b) grid voltage before/after the TE; (c) CoS for each node.

To elaborate on this situation, we reduce the battery size of the PVST prosumer on buses No. 16 and 32 from 13.1 and 12.3 kW·h to 4.8 and 3.6 kW·h, and the power rating to 1.05 and 0.80 kW, respectively, and rerun the program. The overall simulation results are quite similar to the graphs illustrated in Figs. 6–8. However, the CoS of the 7th rolling step exhibits a different feature, as shown in Fig. 9.

《Fig. 9》

Fig. 9. CoS for each node of hour 14 at the 7th rolling step when assuming smaller batteries.

Due to the voltage constraints, a larger CoS was induced at buses No. 16 and 32, respectively. In this case, the PVST prosumers with smaller batteries cannot help the grid when they are asked to reschedule; thus, higher prices are paid to so that they will be willing to change their schedule. This is not fair for those customers, as the network voltage issues are affected by all customers. Therefore, we recommend broadcasting the same PA signal for all the customers.

《5. Conclusions》

5. Conclusions

In this paper, a new TE framework for distribution systems with prosumers is proposed. The framework contains two interactions: aggregators with DSOs and aggregators with prosumers. A PA is formulated to reflect the CoS for the prosumers’ operation. The procedure has closed-loop characteristics that ensure a response from the prosumers and can preserve the privacy information of PVST prosumers when participating in a TE market to help meet the system constraints.

The model is scalable, as the calculations of the schedules are solved at the prosumer level. For a large distribution network involving thousands of prosumers and many aggregators, the aggregators’ model would be more complex, as each would have their objective, variable, and constraints. However, as the negotiation process is solved in a distributed manner through the exchange of price only with the DSO, scalability can be preserved. Each aggregator will still decide on the PA for their customers.

In practice, the flexibility of the prosumers may be insufficient to mitigate the grid issues. In this case, the stopping criteria of the TE may be relaxed to a certain extent while there is still room for DSOs to use other control methods to regulate the voltage and congestion issues. Alternatively, the DSO optimization problem in the TE framework can be extended to a distribution system optimal power flow problem that includes more control variables.

《Nomenclature》

Nomenclature

Parameters

i, t, k, r, j Index of prosumer, time slot, aggregator, rolling optimization procedure, and bus number, respectively

Ai,k Objective function of the ith prosumer associated with the kth aggregator

B Objective function of the aggregator during the transactive process

Forecasted retail electricity price at hour t associated with aggregator k, EUR∙(kW∙h)-1

Forecasted retail electricity price at hour t associated with aggregator k, EUR∙(kW∙h)-1

Price of selling and purchasing electricity by prosumer i at hour t, respectively, EUR∙(kW∙h)-1

Price of selling and purchasing electricity by prosumer i at hour t, respectively, EUR∙(kW∙h)-1

Up-regulation and down-regulation price at hour t, respectively, EUR∙(kW∙h)-1

Up-regulation and down-regulation price at hour t, respectively, EUR∙(kW∙h)-1

Grid tariff at hour t from the TSO and DSO, respectively, EUR∙(kW∙h)-1

Grid tariff at hour t from the TSO and DSO, respectively, EUR∙(kW∙h)-1

Electricity tax, EUR∙(kW∙h)-1

Electricity tax, EUR∙(kW∙h)-1

Day-ahead market price at hour t, EUR∙(kW∙h)-1

Day-ahead market price at hour t, EUR∙(kW∙h)-1

NAgg Total number of aggregators in the system

Nbus Total number of buses in the studied distribution system

Profit coefficient of aggregator for purchasing and selling, respectively, %

Profit coefficient of aggregator for purchasing and selling, respectively, %

VAT Value-added tax, %

MDSO Participation factor representing the preference of each prosumer, EUR∙(kW∙h)-1

Umax ,Umin Minimum and maximum voltage limit p.u. respectively

U0 Initial voltages of the buses in the network p.u.

Power capacity of the transformer p.u.

Power capacity of the transformer p.u.

Maximum charging and discharging power of prosumer i, respectively, kW

Maximum charging and discharging power of prosumer i, respectively, kW

PV output of the ith prosumer at hour t, kW

PV output of the ith prosumer at hour t, kW

Load consumption of the ith prosumer at hour t, kW

Load consumption of the ith prosumer at hour t, kW

dV/dP sensitivity matrix in the inversed load flow Jacobian

dV/dP sensitivity matrix in the inversed load flow Jacobian

Battery capital and degradation cost, EUR∙(kW∙h)-1

Battery capital and degradation cost, EUR∙(kW∙h)-1

LET Battery life energy throughput, kW·h

Lc ,Ls ,DoD Cyclic lifetime, battery capacity, and depth of discharge, respectively

Ωj Set of bus index number

T Whole time window of the optimization horizon, h

Es,i ,Eb Energy storage system capacity of the ith prosumer and battery energy capacity respectively, (kW∙h)

Charging and discharging efficiency of battery respectively

Charging and discharging efficiency of battery respectively

SOCinitial ,SOCmax ,SOCmin Initial, maximum, and minimum SOC of battery, respectively

p Iteration index for price adder

ρ Step size

ε Convergence accuracy

Variables

Charged/discharged power in the battery at hour t, kW

Charged/discharged power in the battery at hour t, kW

Bought/sold power by prosumer i at hour t, kW∙h

Bought/sold power by prosumer i at hour t, kW∙h

Power schedule submitted to the DSO at hour t of bus j, kW

Power schedule submitted to the DSO at hour t of bus j, kW

Power schedule submitted to the aggregator at hour t of bus j, kW

Power schedule submitted to the aggregator at hour t of bus j, kW

SOC Battery state of charge

Binary indicator of energy Exporting-To and Importing-From the grid by prosumer i at hour t, respectively, kW

Binary indicator of energy Exporting-To and Importing-From the grid by prosumer i at hour t, respectively, kW

Price adder, EUR∙(kW∙h)-1

Price adder, EUR∙(kW∙h)-1

Revised price signal broadcasted to prosumers, used in Eq. (31), EUR∙(kW∙h)-1

Revised price signal broadcasted to prosumers, used in Eq. (31), EUR∙(kW∙h)-1

《Acknowledgments》

Acknowledgments

This study is supported by PVST project, funded under the Danish Energiteknologiske Udviklings-og Demonstrationsprogram (EUDP) programme (64017-0041), and the State Key Laboratory of Alternate Electrical Power System with Renewable Energy Sources (LAPS21).

《Compliance with ethics guidelines》

Compliance with ethics guidelines

Peng Hou, Guangya Yang, Junjie Hu, Philip J. Douglass, and Yusheng Xue declare that they have no conflict of interest or financial conflicts to disclose.

京公网安备 11010502051620号

京公网安备 11010502051620号