《1 Introduction》

1 Introduction

The new material industry is an important component of China’s strategic emerging industries. It plays an important role in supporting China’s goal of innovation-driven development [1–3]. High-performance fibers and their composites, as the vanguards of new material technology and industrial transformation, are widely used in important areas such as in aerospace, rail transit, naval vehicles, new energy, healthcare, and infrastructure construction. As they integrate military value and economic value, high-performance fibers and their composites are a focus of military development as well as economic competition in various countries [4].

The State Council, the Development and Reform Commission, the Ministry of Industry and Information Technology, and the Ministry of Science and Technology of China have successively issued policy documents including Made in China 2025, Guiding Opinions on Accelerating the Innovative Development of New Materials Industry, and the New Material Industry Development Guide, which emphasize the significant strategic position of the new material industry and provide important development opportunities for high-performance fibers and their composites [5,6]. In 2018, the Chinese Academy of Engineering launched a major consulting project, “Research on New Material Power Strategy by 2035.” The project aims to implement the spirit of the Nineteenth National Congress to promote the high-quality development of strategic emerging industries and to provide decision-making and consulting suggestions to realize the strategic transformation from a country with large quantity to a country with high quality in the field of material science and engineering.

As one of the focal points of the major consulting project’s sub-project “Research on the Developing Strategy of Key Strategic Materials,” this study systematically presents the current status of domestic and foreign technological and industrial development of high-performance fibers and their composites, one of the core strategic materials. In addition, we investigate and forecast their future development trends as well as the challenges by analyzing the current major hurdles in China. We establish development ideas, principles, and key tasks to overcome these challenges. Accordingly, we offer several policy suggestions to provide a reference for the development of highperformance fibers and their composites.

《2 Development status of foreign high-performance fibers and their composites》

2 Development status of foreign high-performance fibers and their composites

High-performance fibers and their composites mainly include carbon, organic, and ceramic fibers and their corresponding composites. They are the preferred materials for lightweight structures and are also irreplaceable functional materials for extreme service environments. Driven by a series of major scientific and technological projects and research plans in various countries around the world, breakthroughs have been made in new state-ofthe art technologies applicable to global high-performance fibers and their composites. Industrialization has gradually entered a mature development stage [7,8].

《2.1 Maturation of the technology and industry》

2.1 Maturation of the technology and industry

As the main technology cradles and benefiting from a strong industrial foundation and long-term accumulated experience, the United States (USA), Japan, and Europe have acquired first-mover advantages in the field of highperformance fibers and composites. The USA has advantages in rayon-based carbon fiber, pitch-based carbon fiber, alumina fiber, aramid fiber, resin matrices, and thermal equipment and their composite application technologies. Japan has obvious advantages in polyacrylonitrile-based carbon fiber, pitch-based carbon fiber, ceramic fiber and their composites, and composite sports goods. Europe has a good foundation and a high level of spinning equipment and composite manufacturing equipment. The development of indigenous composites is driven by the aerospace industry at a certain scale. The USA, Japan, and Europe have a high degree of interdependence in high-performance fibers and composites. Techniques and capital are cross-integrated to form an industrial ecosystem. Traditional Eastern European countries, such as Russia, inherited the composite technology independently developed by the Soviet Union. The development level of their organic fiber, rayon-based carbon fiber, and composites is relatively high, and various pieces of thermal processing equipment are practical and reliable, which meet the basic needs of the national defense industry.

《2.2 Technological breakthroughs》

2.2 Technological breakthroughs

Breakthrough in carbon fiber in terms of micro–nano defect control technology has provided strong support for its high performance and once again triggered an upsurge of competition for high-end carbon fiber products. Japan’s Toray and USA’s Hexcel have successively launched seven GPa-grade ultra-high-strength carbon fibers T1100G and IM10, and Japan’s Mitsubishi and Toho have also launched corresponding grades of carbon fibers. In 2018, Toray announced the development of M40X carbon fiber through the regulation of microstructure and graphite orientation at the nanoscale. When its modulus is equivalent to that of the M40J carbon fiber, its tensile strength and elongation at break increased by ~30%. In 2019, Hexcel immediately responded and launched the HM50 carbon fiber. The characteristics of M40X and HM50 carbon fibers are high strength, high modulus, and high elongation at break. These developments indicate that the competition for carbon fiber technology has reached a new level and establishes the main characteristics of the next generation of carbon fiber.

In terms of aramid fiber, USA’s DuPont and Japan’s Teijin have already manufactured a series of products with complete specifications. In recent years, they have developed customized technologies and produced Kevlar 29 AP and Twaron 1015 aramid fibers for rubber reinforcement to meet high-volume applications in industry. In addition, the strength of Russia’s new generation of heterocyclic aramid fiber Rusar is as high as 6 GPa, which is >20% higher than that of Armos fiber. Furthermore, ultra-high-molecular-weight polyethylene (UHMWPE) fibers, polyimide (PI) fibers, and polyparaphenylene benzobisoxazole (PBO) fibers have all reached a certain level of industrial scale and have been applied in special fields such as transportation, bridges, bullet-proof and flame-proof clothing, and competitive sports.

For ceramic fibers, Japanese companies have covered three generations of SiC fiber products. Their maximum operating temperatures were increased from 1300°C to ≥1800°C, and multifunctional silicon carbide fibers were derived. After inventing Nextel 312 alumina fiber, USA’s 3M Company successively developed Nextel 550, Nextel 720, and other high-performance fibers. In addition, developed countries such as the USA, Japan, France, and Russia have realized the preparation and application of new ceramic fibers such as boron nitride, silicon nitride, and silicon boron nitrogen. The matrix of ceramic-based composites has also evolved from a single matrix to a composite matrix and an ultra-high-temperature matrix. These have found increasing applications in the fields of aero engines, aerospace vehicles, space cameras, and nuclear energy.

《2.3 Domination by global industrial monopolies》

2.3 Domination by global industrial monopolies

The global production capacity of polyacrylonitrile-based carbon fiber mainly comes from Toray (including Zoltek), Toho, and Mitsubishi in Japan; Hexcel and Cytec in the USA; SGL in Germany; and Formosa Plastics in China. The industry is highly concentrated, as technology is controlled by Japan and the USA. Japan, the USA, and Europe dominate the market (representing 80% of sales). Carbon fiber companies in emerging countries (e.g., China, Russia, Turkey, South Korea, and India) have been operating for more than ten years and have never made any impact or posed a threat to traditional carbon fiber giants. In 2015, Toray acquired Zoltek, which increased its total production capacity and market share to over one-third of the world’s, creating a dominant market leader. In terms of pitch-based carbon fiber, the technologies of Cytec Corporation (acquired by BP Amoco), Mitsubishi Chemical, and the Graphite Fiber Company of Japan are far ahead of its competitors. These companies have manufactured a series of products and occupy a leading position in the global market.

DuPont’s Para-aramid (Kevlar) and Meta-aramid (Nomex) products and Teijin’s products occupy the majority of the global market of aramid fiber. In terms of UHMWPE fiber, the Dutch firm DSM, USA’s Honeywell, Japan’s Toyobo and Mitsui Chemicals, and other traditionally superior companies are jointly in a market oligopoly position. In terms of ceramic fiber, Japan’s Carbon, Ube, and Suitomo and the USA’s 3M and Dow Corning not only possess the key technologies of alumina, silicon carbide, boron nitride, and other fibers and precursors but also provide a wide range of products in series. They account for >80% of the global market share and strictly control the sales areas of their products.

《2.4 Expansion of the scale of the industry》

2.4 Expansion of the scale of the industry

The demand for carbon fiber composites in traditional industries, such as aerospace, sports, and leisure, has maintained a steady growth rate. The energy sector, mainly power transmission and wind power, together with the transportation sector, mainly car and rail transportation, has injected new vitality into the development of the carbon fiber industry. Low-carbon and green economy needs will significantly stimulate the application of carbon fiber, pushing the industry into a new era dominated by industrial applications. In recent years, pultruded plates have been successfully applied to blade composite beams to realize the rapid growth of carbon fiber demand in the wind power field. BMW and SGL have jointly built a carbon fiber plant in the USA with a total production capacity of 9000 tons per year, with the goal of lightening electric vehicles while managing to control the source of raw materials. Toray acquired Zoltek and launched Z600 carbon fiber to realize the diversified development of large-tow and small-tow fibers and prepared them to respond to the increasing demand for industrial-grade low-cost carbon fibers in the fields of wind power, automobiles, and pressure vessels in the future.

《3 Development status of high-performance fibers and composites in China》

3 Development status of high-performance fibers and composites in China

After decades of development, with the strong support of relevant national ministries and commissions, through the implementation of various scientific and technological projects, the construction of special capacity and the establishment of national-level innovative research institutions, high-performance fibers and composite technology and industrial development in China have achieved some satisfactory results [9,10].

《3.1 Continuous technical breakthroughs》

3.1 Continuous technical breakthroughs

Domestic breakthroughs have been made in basic carbon fiber development, engineering, and key technologies for aerospace applications, and independent guarantees for key projects have been achieved. Breakthroughs have been made in the key techniques of the development and engineering of wet-spinning high-strength carbon fibers and in application research on some equipment. Carbon fibers with high strength and medium modulus have been fabricated, and key technology research has been conducted; the field has now entered the stages of evaluation, trial, and verification. Research and development of high-strength and high-modulus carbon fibers have been conducted. High-modulus carbon fibers have been used in the aerospace field. A series of industrialization technologies for civil dry-jet wet-spinning carbon fibers have been developed, while high-end carbon fiber research, application research, and application promotion in the civil field are underway. In terms of pitch-based carbon fiber, breakthroughs have been made in the key technologies for the preparation of high-purity spinnable mesophase pitch and continuous high-thermal-conductivity pitch-based carbon fiber.

In terms of aramid fiber, breakthroughs were made in the key technologies of para-aramids and heterocyclic aramids, while several industrialized installations were built. Stable mass production and supply of basic para-aramid have been realized. The domestic supply of high-strength para-aramid has been realized in batch applications in the fields of optical fiber cables, hoses, and bulletproof vests. The performance of aramid products in China reached the same level as that of Armos in Russia. They have been applied in batches in solid rocket motors and high-end bulletproof materials. The domestic UHMWPE fiber industry is on par with internationally superior enterprises, which can not only partially replace imports but also have a certain export capacity. The breaking strength of the domestic PI fiber has reached 3.5 GPa with a modulus of 140 GPa, which makes it a commercial product of high temperature resistance, high strength, and high modulus.

In addition, domestic scientific research institutions have successively made breakthroughs in the engineering preparation technology of continuous silicon carbide fibers and their composites, performed engineering application verification, and initially established production lines for alumina fibers, silicon nitride fibers, and other ceramic fibers.

《3.2 Expansion of the scale of the industry》

3.2 Expansion of the scale of the industry

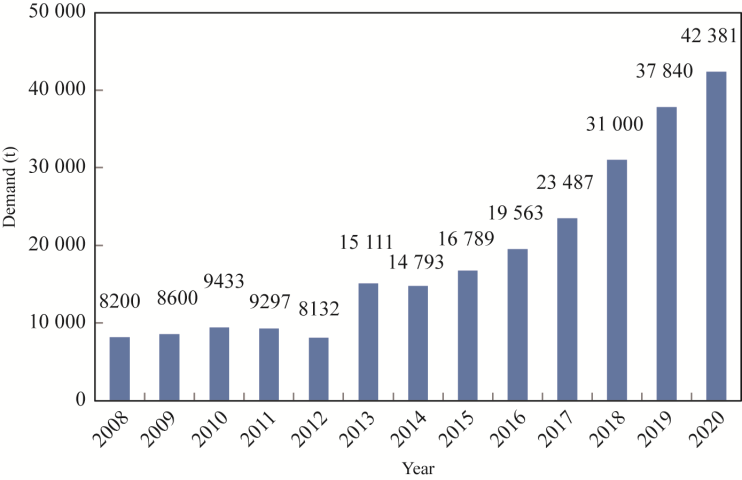

In 2019, the domestic carbon fiber demand in China was 38 000 tons (Fig. 1), but more than two-thirds of its consumption was foreign carbon fibers. The total production capacity of domestic carbon fiber >25 000 tons per year, while actual sales are 12 000 tons. Domestic small-tow carbon fibers have achieved sales of 7000 tons and their market share is gradually expanding. The rest are domestic large-tow carbon fibers [11]. The main driver of China’s ultra-high-growth demand is the wind power blade market, which has brought rare development opportunities for domestic carbon fiber companies.

《Fig. 1》

Fig. 1. China’s carbon fiber demand in recent years (including Taiwan, China) [11].

In terms of aramid fiber, China has built several thousand-ton para-aramid production lines. In 2019, China’s para-aramid production reached 2800 tons, and it is expected to reach 5000 tons in 2020. The production capacity of meta-aramid is >15 000 tons, and the output reaches 11 000 tons, making it one of the main producers of metaaramid fibers. In 2019, the production capacity of China’s UHMWPE fibers was 33 000 tons, the output was 23 000 tons, and exports were 3355 tons, demonstrating that domestic products in China are internationally competitive.

《3.3 Prominence of the strategic supporting role of high-performance fibers and their composites》

3.3 Prominence of the strategic supporting role of high-performance fibers and their composites

The application of high-performance fibers and their composites in China has gradually matured. The application area has been expanded from secondary load-bearing components to primary load-bearing components, while the composites have transformed from single-functional materials to multi-functional and structural-function integration, which effectively meet the urgent needs of major national projects and key defense equipment production. The highperformance fiber industry has also moved from a period of development and promotion to a period of rapid expansion and stable growth. The application fields of composites have expanded from aviation, aerospace, and weapons to many civilian fields such as wind power, rail transit, and automobiles. The scale of the industry has continued to expand. For example, the domestic carbon fiber sales volume reached about three billion CNY. In recent years, advantageous companies have successively invested in expansion projects in central and western regions such as Inner Mongolia and Qinghai provinces, which will also play a positive role in the development of science and technology and the economy in central and western regions of China and support the balanced development of emerging industries.

《4 Development trends and challenges》

4 Development trends and challenges

Under the superimposed impacts of global competition and the COVID-19 epidemic, the reshaping of domestic and international industrial structures will accelerate.

《4.1 Manufacturing》

4.1 Manufacturing

High-performance fibers and their composites are the material basis for the realization of major national projects such as satellite platforms, carrier rockets, large aircraft, and automobiles and ships. Related products have been under embargoes or prohibitive pricing for a long time. As competition among major powers continues to evolve, the blockade of raw materials, equipment, and technologies of high-performance fibers and their composites will further escalate. Independent research and development of high-performance fibers and their composites are key to breaking through the problem of “subject to others” and the only way to realize the China Manufacturing 2025 plan.

《4.2 Performance》

4.2 Performance

After nearly 30 years of relative stagnation, the technical route of decreasing diameter to enhance tensile strength has changed. Toray and Hexcel successively launched T1100G and IM10 carbon fibers, respectively. While the fiber diameter maintains the characteristics of the original serial grade, the strength and modulus are significantly improved simultaneously. The recently launched M40X and HM50 carbon fibers possess a comprehensive performance of high strength, high modulus, and high elongation. The domestically developed carbon fiber with a large diameter has realized compression/tension ratios from 0.52 to 0.67, which means that the balance between the compressive strength and tensile strength of the composites is improved. The breakthrough of the new generation of carbon fiber and the third-generation advanced composite technology presents an important opportunity to achieve the same performance as with international cutting-edge technology.

《4.3 Costs》

4.3 Costs

Developed countries have achieved standardization and serialization of high-performance fibers. An important driver for future development is low cost. Low-cost fiber preparation technology not only requires reducing the cost of production factors but also requires breakthroughs in innovative preparation and low-cost production processes. In the field of carbon fiber, the first step is to improve the existing preparation technology to achieve a substantial increase in spinning speed and to expand single-line production capacity. The second is to develop new spinning and carbonization technologies to significantly reduce energy consumption [12]. Additionally, with the current polyacrylonitrile fiber industrial base, research should be conducted on the preparation technology of large-tow raw fibers and carbon fibers above 48K. When the price of carbon fiber reaches US$10/kg, its application in wind power, infrastructure construction, and sports equipment will be further expanded. The fundamentals for carbon fiber industrial applications can be fully consolidated.

《4.4 Role of emerging industries》

4.4 Role of emerging industries

After 60 years of development, the global carbon fiber demand exceeded 100 000 tons for the first time in 2019. As the application technology matures and the cost of carbon fiber continues to decline, it is expected that the growth period for the next 100 000 tons will be significantly shortened. In recent years, China has continuously increased investment in emerging industries, such as high-speed trains and other rail transit, new energy vehicles and charging stations, extra-high-voltage power networks, and other new infrastructure. At the same time, with continuous breakthroughs in the application technology of carbon fiber in car body frames, high-pressure gas cylinders, robot arms, cable batteries, and other components, the domestic carbon fiber market is expected to provide an important opportunity to expand the application and realize the sustainable development of the industry.

《4.5 Foreign oligopolies and impact of COVID-19》

4.5 Foreign oligopolies and impact of COVID-19

Foreign high-performance fiber giants continue to strengthen international dominance through acquisitions and mergers. Upstream raw-material companies and downstream applications companies have combined and reorganized to form control capabilities for the entire supply chain. The domestic high-performance fiber industry has gradually returned to rational investment after more than ten years of rapid development. With the impact of the COVID-19 epidemic, the global market is constrained in the short term with both internal and external factors superimposed. This will surely accelerate the survival of the fittest in the industry. Owing to the earlier control of the epidemic, China resumed work and production. To make further progress, domestic enterprises should grasp the opportunities created by the booming demand of domestic superior industries, such as rail transit, large bridges, island and reef construction, large-diameter wind turbine blades, and oilfield mining equipment.

《5 Challenges in the development of high-performance fibers and composites in China》

5 Challenges in the development of high-performance fibers and composites in China

The development of high-performance fibers and composites in China started early enough, but progress has been relatively slow for complex reasons. Although great progress has been made in the past ten years, there is a significant gap between the products of China and those of developed countries such as Japan and the USA in terms of performance stability, cost, scale, and application level.

《5.1 Generation gap》

5.1 Generation gap

Second-generation advanced composites with high-strength and medium-modulus carbon fibers as the reinforcements have already been applied in foreign aerospace fields on a large scale, but China is still in the stage of evaluating and verifying second-generation advanced composites. The progress to date is about one generation behind that of developed countries. Additionally, the effective independent supporting capabilities of high-strength, high-modulus carbon fibers and ultra-high-modulus carbon fibers have not been established. In the fields of highperformance organic fibers and ceramic fibers, there are also some problems, such as a lack of high-end products and poor consistency.

《5.2 Low level of technology readiness in the industry》

5.2 Low level of technology readiness in the industry

The high-performance fiber industry is a refined industry with highly interrelated technology and equipment. Large-scale production process technology is not in place in China. At this stage, domestic carbon fiber production is still dominated by small-tow products of ≤12K. The industrial production technology of large-tow and low-cost carbon fibers has not yet been fully established. Foreign companies have begun to integrate the low-cost production technology of large tows with high-quality production technology of small tows, improving product quality and reducing costs continuously. Domestic aramid fibers still have gaps with developed countries in terms of product performance, production efficiency, industrial scale, and application support, while their price does not have local advantages, resulting in low enthusiasm for the use of domestic aramid fibers and disappointing business growth. The UHMWPE fiber production line is confronted with low production capacity, high investment cost, low production efficiency, and high energy consumption, making it difficult to achieve large-scale, low-cost production.

In addition, the capacity for designing and manufacturing industrialized fiber fabrication equipment is insufficient. Skilled design and simulation talent is lacking, while the design and simulation software is dependent on imports. Basic industrial technology (such as machining) and the quality of raw materials (such as heating element materials) are far behind those of developed countries, leading to a lack of accuracy and production capacity of domestic independent equipment. The equipment has poor operational stability and a high failure rate, which constrains fiber product performance and cost control [13].

《5.3 Lack of industrial capabilities in designing, evaluating, and verifying composites》

5.3 Lack of industrial capabilities in designing, evaluating, and verifying composites

Compared with traditional metal materials, the biggest advantage of composites is their designability, meaning that composites can be optimized according to the service environment and structural characteristics. At present, there is only a relatively complete capability to design, evaluate, and verify composites in the aerospace industry in China. Industries focused on ships, automobiles, wind power, rail transit, and infrastructure construction obviously lack these capabilities. Engineers in these areas are accustomed to tracking advanced application technologies and preparing high-performance fiber composites in the way of molding and processing, resulting in a general problem of being incapable of using composites or of using them well. This has constrained the large-scale application of domestic fibers and their composites.

《5.4 Insufficient investment in basic research for high fibers and their composites》

5.4 Insufficient investment in basic research for high fibers and their composites

Driven by major national tasks, high-performance fibers and their composites in China have been developed with the idea of reference and fabrication, focusing on product development to meet urgent application needs. Research within universities and research institutions is often based on creating the products, while the in-depth relationships among high-performance fiber composition, structure, process, and performance have not been fully understood, and the necessary scientific mechanism has not been clearly revealed. Material development and application are ahead of basic research in related disciplines, leading to a lack of theoretical support when facing new application requirements. Adapting to future technological needs and sustaining innovation needs will be challenging.

《5.5 Need for a sound industrial system and healthy industrial ecology》

5.5 Need for a sound industrial system and healthy industrial ecology

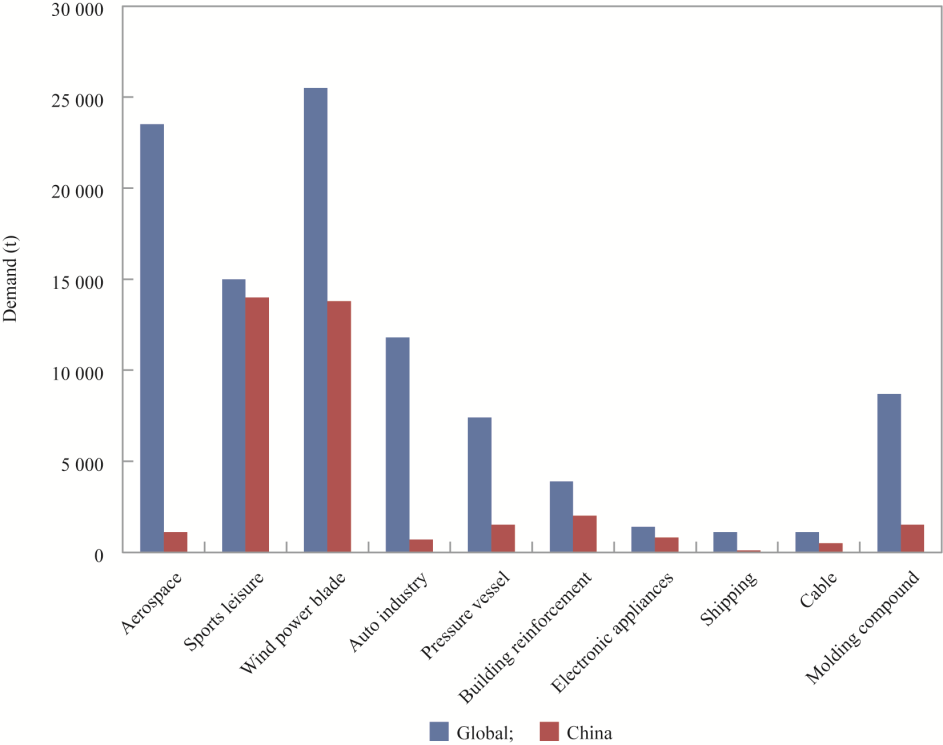

At present, the system of high-performance fiber and composite industries in China is incomplete. The manufacturing capacities of key equipment, important raw materials, supporting materials, and capacities for testing and evaluation are weak. The overall scale of using fibers in the aerospace field is still too small to drive the development and improvement of the entire industrial supply chain. Industries focused on automobiles, pressure vessels, and rail transit have not yet achieved a high volume (Fig. 2). Under the stimulus of multiple factors such as the country’s attention and availability of capital investment in high-technology areas, there are still low-level duplications and investments far away from market realities. The quality of projects is uneven, which not only causes redundancy and waste of a large amount of national and social resources but is also seriously detrimental to the competitiveness of the industry and the formation of a sustainable industrial ecology.

《Fig. 2》

Fig. 2. Comparison of the main application areas of carbon fiber in China and those in the world in 2019 [11].

《6 Development ideas and goals》

6 Development ideas and goals

Considering the development status and main challenges of high-performance fibers and their composites in China while focusing on the strategic goal of becoming a strong country in materials in 2035 and that of the 14th Five-Year Plan, visions and goals have been established. The aim is to achieve independent supply security of highperformance fibers and their composites, to build a solid foundation for industrial safety, and to establish a complete industrial supply chain.

《6.1 Guiding ideology and principles》

6.1 Guiding ideology and principles

To achieve the strategic goal of constructing a strong country in materials, based on documents such as China Manufacturing 2025 and the New Material Industry Development Guide and guided by the urgent demands of national projects and the national economy, fiber research and the expansion of the application market for composites should be considered as the primary pathway. A developmental strategy of product independence, technology independence, and system independence for high-performance fibers and their composites should be implemented. Moreover, the concept of developing a complete and consolidated industrial chain should be established.

First, the principle of supplying key products should be followed. To improve high-end products, ensure the security of key products, and meet the needs of major national projects, the reliability of the independent capability of high-performance fibers and their composites should be improved significantly.

Second, the formation of complete industrial chains should be established. To realize the rebuilding of the industrial foundation, the potential safety hazards and technical shortcomings of the raw materials used in key equipment should be resolved.

Third, innovative development of the industrial system should be pursued. A complete system of highperformance fibers and their composite industries should be constructed. Strategic emerging markets should be developed to leverage industrial advantages and market competitiveness. An innovative research and development system with collaborations involving the whole industrial chain should be established, supporting the independent innovation of high-performance fibers and their composite technology in China.

《6.2 Development goals》

6.2 Development goals

6.2.1 Target for 2025

The problems of employing high-performance fibers and their composites from other countries in the fields of key national projects, key national equipment, and strategic emerging industries should be solved. The key highperformance fibers and their composites should be supplied domestically, the key equipment should be independently developed, and the security of the industrial chain should be comprehensively improved. Some products should be industrialized and standardized, while a complete system of high-performance fibers and their composite industry should be established.

There should be some breakthrough in the preparation technology of high-end carbon fiber products, realizing a sales volume of 50 000 tons/year for domestic carbon fibers. An intelligent production capacity of 10 000 tons/year for para-aramids and heterocyclic aramids should be achieved, creating one or more well-known brands. The overseas market share of UHMWPE fiber should be >40%, realizing a production capacity of 1000 tons/year of high-strength, high-modulus PI fibers. The preparation technologies for high-performance silicon carbide, alumina, and other ceramic fibers and the application technologies of their composites should be obtained to meet the demand for high-performance fibers and composites in key projects.

6.2.2 Target for 2035

The independence of high-performance fibers and their composites should be secured, while an independent development system for high-performance fibers and their composites should be established. An innovation system of collaboration within the entire industrial chain should be established, covering material design, research, development, and application. Technological diversification, product serialization, and increased production capacity of high-performance fibers and composites should be achieved. An environmentally friendly and sustainable industrial system should be fully established, while domestic products should be able to enter the international supply chain of high-end applications.

The sales volume of domestic carbon fiber should reach 150 000 tons/year. The self-sufficiency rate of paraaramid fibers should be >80%. Innovative products with aramids, UHMWPE, PI, and other organic fiber products should achieve a leading position in the international market. An industrial chain of ceramic fibers and their composites should be constructed. The scale, quality, and cost of high-performance fibers and their composites should have certain advantages in the international market.

《7 Key development tasks》

7 Key development tasks

《7.1 Carbon fibers and their composites》

7.1 Carbon fibers and their composites

The key engineering preparation technology of high-strength, medium-modulus carbon fiber; high-strength, high-modulus carbon fiber; high-strength, high-modulus, and high-extension carbon fiber; and their composites should be obtained. The tensile strength of high-strength, medium-modulus carbon fibers should be >7 GPa. The tensile modulus of high-strength, high-modulus carbon fibers should be >650 GPa. The tensile strength of high-strength, high-modulus, and high-extension carbon fibers should be >5.7 GPa, with a tensile modulus of >370 GPa and an elongation at break of >1.5%. Finally, the demand for carbon fibers and their composites used in high-end equipment should be met independently.

Integrated equipment for fabricating carbon fibers with a wet-spinning process, dry-jet wet-spinning process, and large tows (≥48K) should be independently designed and manufactured. Innovative technologies, such as spinning, pre-oxidation, and pre-carbonization, should be realized. Consistent, low-cost production of domestic carbon fiber should be realized to support its large-scale application.

The common key technologies such as design–manufacturing–evaluation–verification of composites should be established while the recycling technology of composites should also become reality. A complete industrial chain of carbon fibers and their composites should be established, and the application of domestic carbon fibers and their composites in the areas of aerospace, transportation, energy, and construction should be continuously promoted.

《7.2 Organic fibers and their composites》

7.2 Organic fibers and their composites

The key technologies for the industrial production of high-performance organic fibers, such as aramids, PI, UHMWPE, and PBO should be advanced to achieve stable application in key national equipment. Serialized and functional para-aramid fibers should be developed to meet the demands of different application fields. A new generation of high-strength, high-modulus, and low-cost heterocyclic aramid fibers should be developed. New technologies that can improve the production efficiency of meta-aramid fibers should be developed. Heat-resistant and creep-resistant UHMWPE fibers should be developed, and preparation technologies for medium-strength UHMWPE and high-strength UHMWPE should be improved to solve problems such as excessive energy consumption and high cost. The polymerization and spinning processes used in fabricating PBO fibers should be optimized to achieve a stable supply of high-quality products. Low-cost, high-performance PI fibers should be developed, and the key technologies and integrated equipment technologies for polymerizing and stretching PI molecules should be available to expand the application fields of PI fibers and their composites.

《7.3 Ceramic fibers and their composites》

7.3 Ceramic fibers and their composites

High-performance ceramic fibers and their composite technology, represented by ultra-high-temperature and lowcost carbide fibers, should be developed. The engineering and stable preparation technology for silicon carbide, alumina, silicon nitride, boron nitride, silicon boron nitrogen, and other fibers should achieve a breakthrough. A rapid, low-cost manufacturing technology for ceramic matrix composites should be developed to eliminate problems in the engineering-size composite preparation process and equipment. Ceramic fibers and their composite product spectrum should be formed to realize engineering applications of ceramic matrix composites in gas engines and other major equipment.

《8 Policy suggestions》

8 Policy suggestions

(1) The capabilities of design and application of composites should be comprehensively improved while highperformance fiber-reinforced composites should be better and more thoroughly utilized to further advance application of domestic high-performance fibers.

In addition to the aerospace field, especially in the fields of rail transit, vehicles and ships, pressure vessels, healthcare industries, and other areas with great potential, the technical level of the entire chain of composite design– manufacturing–evaluation–application should be improved by considering the specific conditions of the application fields. In addition, the focus should be on improving the design and application of composites in industrial areas. Training a skilled workforce in the field of composite design should be strengthened. Eliminating problems in the application of domestic high-performance fibers will unblock the application channel will be unblocked, resulting in the large-scale consumption of domestic fibers.

(2) The integrated equipment technology for manufacturing high-performance fibers and their composites should be developed, while the technical capability of the industry should be enhanced.

It is necessary to establish an advantageous technical force to solve the problem of industrialized manufacturing equipment for large-scale high-performance fibers and their composites. This joint force should integrate mechanical engineering, thermal engineering, chemical engineering, automation, and other disciplines. It is essential to focus on efforts in integrating manufacturing equipment technology, industrialized equipment technology for applying composites, and basic software technology of supporting industries and to build a collaboration-driven mode of combining technology, equipment and application.

One of the effective experiences in the development of the domestic carbon fiber industry is the insistence on the development of key equipment. Only independent development of equipment can enable the carbon fiber industry to establish itself. Moreover, the procurement, transportation, and maintenance of imported equipment are increasingly seriously affected by changes in the international environment. Therefore, key equipment should be developed to support the online verification of domestic equipment and improve the equipment in use.

(3) Integrating superior resources, establishing a joint innovation platform in the field of high-performance fibers and composites, and creating an innovation environment in which talents gather and collaborate are recommended. An upstream and downstream collaborative mode and a sustainable innovation system should be established.

By relying on the innovation platform, the chain of basic research, material research, pilot production, and application could be integrated. The research and development of common and basic technologies should be strengthened, focusing on resolving problems and shortcomings in technology and industry. Innovative elements such as knowledge, technology, capital, and talent should be integrated to establish an intelligent, systematic, and sustainable research and development model. Focus should be placed on the training and reserve of a professional skilled workforce to meet the long-term needs of developing the discipline and the need for key original innovations.

京公网安备 11010502051620号

京公网安备 11010502051620号