《1 Introduction》

1 Introduction

Green metallurgy refers to the maximization of resource utilization, energy utilization, and environmental benefits in the metallurgical processing of complex materials. It comprehensively considers resource and energy consumption, as well as the environmental impact. The full lifecycle of metal products comprises design, production, packaging, transportation, utilization, and scraping. Green metallurgy aims to achieve minimal energy consumption, maximal resource utilization, and minimal negative environmental impact across the full lifecycle. Coordinated optimization and harmonious development of economic, environmental, and social benefits of enterprises can also be achieved.

Green metallurgy is a clean metallurgical process with low environmental entropy. Narrowly, it refers to resource recycling, low-carbon energy, and ecological protection in the metallurgical process. Broadly, it manifests as non-toxic raw materials, waste recycling, clean production, intelligent control, and digital management. Pollution control and reduction at the source is emphasized, but end-of-point treatment is not totally excluded. Research on green metallurgy involves the theoretical research, technological development, and engineering of metallurgical processes. Based on such research, eco-friendly smelting, technical equipment, a fabrication procedure, and various products and service can be developed. The contradiction between environmental pollution and the sustainable development of metallurgical processes can be well resolved. Ultimately, the co-development of environmental and economic benefits can be achieved.

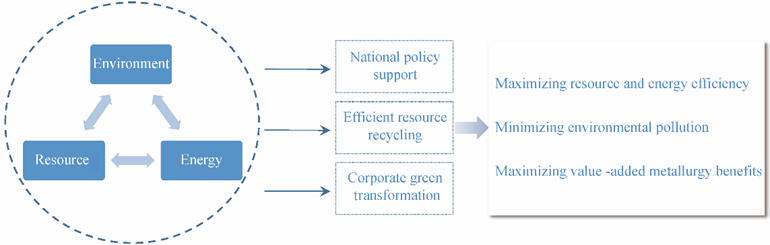

Green metallurgy is highly dependent on enterprises’ determination to transform their development model. It means that enterprises must adopt the unification of economic, social, and environmental benefits as the primary goal for their further development. The main features of green metallurgy are optimization and the upgrading of industrial structure, comprehensive green transformation, cross-industrial resource recycling, and clean energy substitution. Consequently, with the support of national policies, maximal resource and energy efficiency, minimal environmental pollution, and the maximized benefits of value-added metallurgy will be realized (Fig. 1).

《Fig. 1》

Fig. 1. Schematic diagram of a green metallurgy development pathway and model.

From the perspective of long-term development, the demand for key metal resources is still very high, and the passive situation of insufficient strategic metals must be reversed as soon as possible. The vital role of the metallurgical industry in supporting high-quality development on the national level should be firmly established. Additionally, the position of China’s metallurgical industry as a world leader requires maintenance and even enhancement. However, the development of the metallurgical industry is facing multiple constraints related to resources, energy, and the environment. In view of this, scientific research on green metallurgy is of great significance.

In this paper, the impact of the current status on the development of China’s metallurgical industry is fully analyzed. The global status of steel and nonferrous metal regarding resources and energy consumption are described. Future trends and possible problems in the development of green metallurgy are predicted. Based on this analysis, we offer proposals for green metallurgy and provide a fundamental guide for the strategic development of the metallurgical industry.

《2 Background of innovative development of green metallurgy》

2 Background of innovative development of green metallurgy

《2.1 Development of the metallurgical industry regarding emissions peak and carbon neutrality》

2.1 Development of the metallurgical industry regarding emissions peak and carbon neutrality

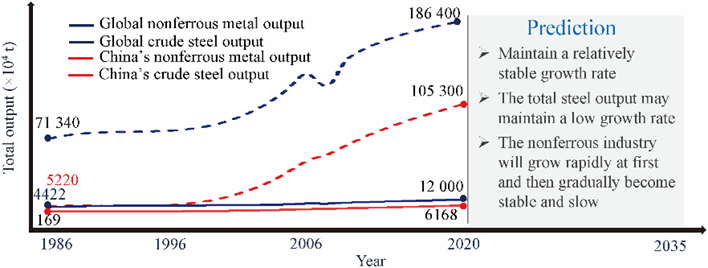

Currently, China is the world’s largest carbon dioxide (CO2) emitter [1], and it has officially committed to the development goal “Strive to reach the peak of CO2 emission by 2030 and achieve carbon neutrality by 2060.” As the highest carbon emission industry among China’s 31 manufacturing industries, iron and steel manufacturing has outputted rapidly in the past 20 years (Fig. 2) [2]. It is forecasted that growth will remain moderate in the next 15 years. On one hand, the macro development situation of carbon peak and carbon neutralization will encourage the iron and steel industry to attain a higher-level dynamic balance between supply and demand, which favors optimizing the process flow structure and realizing the smelting technology revolution. On the other hand, it is vital to promote industrial intelligent upgrade with enhanced multi-industry collaborative environmental governance, given the necessity of this for establishing the lifecycle evaluation of steel products and a low-carbon standard suited to actual Chinese conditions.

Over the past 30 years, the production of nonferrous metals in China saw rapid growth (Fig. 2) [3]. It is predicted that nonferrous metal output will continue to increase steadily in the next 15 years; specifically, it will grow fast at first and then gradually maintain stable. In 2020, the non-ferrous metal industry’s CO2 emissions accounted for 4.7% of the total national emissions [4]. Electrolytic aluminum accounted for 64.6% of the total emissions in nonferrous metal industry, which will be an important field for the industry’s achievement of emission peak. The National Development and Reform Commission encourages the promotion of the green low-carbon transformation of key industries such as electrolytic aluminum [5]. While implementing low-carbon transformation, after stipulating emission peak and carbon neutralization targets, it is necessary to maintain the maximum production capacity of electrolytic aluminum (4.5 × 107 tons), strictly control the production capacity of copper, lead, and zinc smelting, increase clean energy use, expand the utilization scope of recycled nonferrous metals, and strive for industry-wide emission peak. Additionally, green carbon-reduction technology needs to be developed and applied to reduce carbon at an ideal pace after emission peak.

《Fig. 2》

Fig. 2. Steel and nonferrous metal production trends in China and the world.

《2.2 Development of the metallurgical industry under the domestic and international double cycle industry policy》

2.2 Development of the metallurgical industry under the domestic and international double cycle industry policy

Chinese steel production is mainly based on domestic recycling. In 2019, China had the lowest export proportion (6.6%) among all countries with crude steel output over 2×107 t. Against the background of emphasizing domestic and international double circulation, future structural change in the steel industry mainly concerns the formation of a new balance between domestic supply and demand, as well as expansion to a new external demand market. Furthermore, given the Belt and Road Initiative, China’s steel enterprises are continuously upgrading their level of internationalization, with the aim of achieving higher quality open cooperation. For the nonferrous metal industry, the internal cycle will continue to expand domestic consumption of nonferrous metals, while the international market will guarantee the external cycle. Therefore, the formation of a new development pattern with respect to the domestic major cycle could be accelerated as the main body, with the components of the domestic and international double cycle promoting each other.

《2.3 Development of the metallurgical industry against the background of supply-side reform》

2.3 Development of the metallurgical industry against the background of supply-side reform

Since the dissemination of the national supply-side reform requirements, the business model of the iron and steel industry has been actively upgraded. Both the degree of equipment sophistication and product structure have advanced in ranks on the global scale, supporting China’s bid to become the world’s center of steel manufacturing, consumption, research, and investment. For example, there are more than a thousand kinds of steel smelting (including high temperature alloy and fine alloy) and over 40 000 varieties of steels available for rolling and processing in China, where 19 out of 22 categories of steel products have a self-sufficiency rate exceeding 100% (the other three categories exceed 98.8%). During the 14th Five-Year period, supply-side reform is the main concern of iron and steel industry development, and the focus has shifted to high-end products and the technological upgrade of key environmental protection. Against the background of supply-side reform, the rapid growth of some nonferrous metal production capacity has been observed. The supply side is suppressed, and new demand will be created, leading to gradual expansion of the gap between domestic supply and demand. The nonferrous metal industry will accelerate intelligent transformation, maintain the momentum of safe high-end green, low-carbon development, and improve the high-end supply capacity of new nonferrous metal materials. It will also expand the domestic market and continuously improve the quality and efficiency of the development of the nonferrous industry in the future.

《3 Current status and development trend of metallurgical resource exploitation and utilization in China and abroad》

3 Current status and development trend of metallurgical resource exploitation and utilization in China and abroad

《3.1 Iron and steel resources》

3.1 Iron and steel resources

The world’s reserves of iron ore resources are relatively rich. They are mainly in Australia, Brazil, Russia, and China. These four countries account for around 70% of the global reserves. However, 98% of Chinese iron ore is not rich (i.e., the iron grade is less than 35%), indicating that the quality of iron ores in China is significantly lower than in the other three aforementioned countries (as iron content typically exceeds 64%). Additionally, Simandou iron ore in Guinea is the opencast hematite resource with the largest reserve and the highest quality among the undeveloped iron ores worldwide, and its reasonably inferred iron ore reserves exceed 2.25×109 t. Total potential reserves are up to 5×109 t, and the overall grade is around 66%–67% [6].

Presently, Chinese iron ore output and crude steel production are obviously mismatched, highlighted by the fact that external iron ore dependence has reached 85%. It is predicted that in the next 15 years, the growth of Chinese crude steel output will remain slow paced. Therefore, the iron ore import dependence situation will continue, but the import channels tend to be diversified. For example, Chinese iron ore import in 2020 from Guinea significantly increased, and the volume of imports from countries along the Belt and Road are rising steadily. Iron ore imports from India have also increased. Additionally, China has actively participated in the development of the international mining market, and gradually intensified its efforts to develop and utilize overseas minerals. Deep mining in Africa is expected to continue to supply 2.4×109 t of iron ore.

Waste iron and steel can be seen as green resources. Increasing their utilization can reduce CO2 emission and solid waste generation. This is the only alternative steelmaking resource, and it will help the iron and steel industry save energy and reduce consumption. The 14th Five-Year Plan of China Circular Economy Development (2021) has pointed out that the utilization of scrap steel in China will reach 3.2×108 t by 2025 [7], and the proportion of crude steel produced from scrap steel will gradually increase.

《3.2 Nonferrous metal resources》

3.2 Nonferrous metal resources

The global nonferrous metal reserves are relatively concentrated, but the distribution is scattered. The reserves of magnesium, tungsten, molybdenum, and rare earth resources in China are extremely abundant. Australia, Chile, Peru, and Brazil are famous for their rich mineral stores. For example, Australia is distinguished for tantalum and zirconium (accounting for more than 60% of the world’s stores), as well as rutile (nearly 50%), lead, zinc, nickel, and bauxite (more than 20%), and gold, silver, cobalt, copper, lithium, and antimony (more than 10%). Chile and Peru have advantages in terms of copper resources. Brazil has rich reserves of tantalum and niobium (accounting for about 90% of the world’s stores) and tin and nickel (about 15% and 13%, respectively). Additionally, Africa has high potential by virtue of its mineral reserves. For instance, the cobalt reserves in the Democratic Republic of the Congo (DRC) account for about 50% of global stores, and Guinea has a large bauxite reserve.

From the perspective of total resources, China is a major country in terms of nonferrous metal resources. China’s reserves of magnesium, ilmenite, tungsten, molybdenum, and rare earth rank first in the world, and its bauxite, copper, lead, and zinc reserves are also abundant. However, with the rapid development of strategic emerging industry, including new generation information technology and high-end equipment manufacturing, the demand for mineral resources in China will remain high, while the supply of low-quality minerals such as bauxite and titanium exceeds the demand, and unfortunately, the demand for high-grade minerals remains dependent on imports. As the world’s largest producer of refined copper, lead, and zinc, China still relies heavily on imports for mineral concentrate, and overseas resources are being actively expanded. Rare earth consumption in China accounts for 57% of the global total, and the import volume of rare earth has increased gradually. Nickel and cobalt resources are relatively scarce, and dependence on external nickel resources is high at 90%.

It is predicted that in the next 15 years, Chinese total consumption of nonferrous metals will continue to grow and will remain high, while the demand for mineral resources remains strong. However, the new resource reserves cannot keep pace with increased consumption. The effective supply capacity of domestic resources is still low, and dependence on imports of some mineral resources will continue. Presently, mineral resources are facing problems such as large demand, lack of global market control, and inadequate supply chain and transportation security, leading to the severe mineral resources supply situation in China [8]. Focusing on future development, we should fully exploit secondary nonferrous metal resources. By 2025, the output of secondary nonferrous metals is expected to reach 2×107 t. Among these, the volumes of copper, aluminum, and lead are 4×106 t, 1.15×107 t, and 2.9×106 t, respectively [7]. It would also be beneficial to simultaneously exploit low-grade, unmanageable, and complex minerals to improve the support capacity of domestic resources. China should also actively promote overseas mining projects, enhance the guarantee of international resources, and form a new coordinated development pattern of “primary minerals + secondary minerals + refractory minerals.”

《4 Development status and problems of China’s metallurgical industry》

4 Development status and problems of China’s metallurgical industry

《4.1 Current status and challenges facing iron and steel metallurgy》

4.1 Current status and challenges facing iron and steel metallurgy

4.1.1 Development status of iron and steel metallurgy

Chinese steel output, consumption, and import and export volume have all ranked first in the world for many consecutive years. In 2020, Chinese steel output amounted to 1.065 × 109 t, accounting for 56.7% of the world’s total output. Furthermore, among the world’s top 50 steel companies, domestic enterprises account for half. Apparent steel consumption is 9.95 × 108 t, with a total export volume of 5.14 × 107 t and a total import volume of 3.79 × 107 t [2]. Correspondingly, Chinese iron ore mainly depends on imports. In 2020, its import volume accounted for 82.35% of the total consumption, and about 80% of the imported ore was sourced from Australia and Brazil. National utilization of scrap steel is about 2.6 × 108 t, reducing CO2 emission by about 4.16 × 108 t [2].

In recent years, with the accelerated withdrawal of backward production capacity, the rapid development of short-process steelmaking, and the continuous improvement of energy-saving technology and equipment, comprehensive energy consumption per ton of steel of Chinese enterprises has continued to decline, reaching 0.551 tce in 2020 (down 3.7% from 2015) and thus contributing to the gradual narrowing of the gap in terms of advancement on a global scale. Nevertheless, due to the enormity of the industrial capacity, the steel industry’s energy consumption accounted for more than 13% of China’s total energy consumption in 2020. China will eventually fully realize an ultra-low emission iron and steel industry and devise new energy conservation and emission reduction strategies to support the sustainable green development of the iron and steel industry. Based on the high-quality development concept, maintaining and expanding the iron and steel industry’s future development space has become a problem to be tackled.

The pollutant emission intensity of Chinese iron and steel industry has entered the world’s highest ranks. In 2020, the new water consumption per ton of steel in iron and steel enterprises decreased by 4.34%, the chemical oxygen demand decreased by 10.11%, and sulfur dioxide (SO2) emission decreased by 14.38% year on year, while the steel slag utilization rate increased by 0.98%, and that of coke oven gas increased by 0.08% year on year [9].

Regarding technology and equipment, the Chinese iron and steel industry has, on a whole, attained an international level of advancement and is even a world leader in terms of its comprehensive design, equipment manufacturing, and construction. Iron and steel smelting has become an arena for independent innovation. In the development stage, dominated by new and integrated innovations, a series of achievements have been made including slag splashing furnace protection [10] and long-life combined blowing process [11,12], high-efficiency production technology for thin slab continuous casting and rolling [13,14], negative energy steelmaking equipment and technology [15,16], high-efficiency and low-cost clean steel production technology [17], carbon-reduction smelting reduction technology [18], hydrogen energy steelmaking technology [19,20], and intelligent manufacturing technology [21].

4.1.2 Problems in the development of iron and steel metallurgy

Iron ore is an important raw material for iron and steel production enterprises. The grade of iron ore in China is poor, and the yield of qualified iron concentrate is low. To meet infrastructural construction needs, the demand for iron ore in China has increased greatly, while independent supply cannot meet the demand of steel production; consequently, China must rely on imports to bridge the gap between supply and demand.

In recent years, the regional distribution of construction projects in the Chinese iron and steel industry has been unbalanced, showing a pattern of “more in the South and less in the North.” Furthermore, special steel output is low, while the proportion of medium- and high-end special steel is even lower. Some imports are still needed to meet equipment development needs.

Chinese iron and steel industry has made significant technical improvements and notable progress toward sustainable development. However, the problems iron and steel metallurgy faces––such as an increased resource, energy, and environmental load; a complex process flow; and the high carbonization of the energy structure––have not been eliminated, and the realization of carbon peak, carbon emission reduction, and carbon neutralization is also facing great challenges.

《4.2 Current status and challenges associated with nonferrous metallurgy》

4.2 Current status and challenges associated with nonferrous metallurgy

4.2.1 Development status of nonferrous metallurgy

In recent years, the transformation and upgrading of Chinese nonferrous metal industry has seen remarkable achievements; the scale advantages are improved, and the output of crude copper, refined copper, and electrolytic aluminum, all ranked first in the world. New progress has been made in terms of production capacity structure. Sustainable transformation has taken on a new look, and innovation ability and intelligent manufacturing have reached a new level.

China is the world’s largest nonferrous metal producer and consumer. Its global share of the output of ten common nonferrous metals has been stable at more than 50% for a long time. In 2020, the total output of nonferrous metals was 6.188 × 107 t, of which the output volumes of refined copper and copper materials were 1.003 × 107 t and 2.046 × 107 t, with a year-on-year growth rate of 7.4% and 0.9%, respectively [22]. In the same year, the output volumes of alumina, electrolytic aluminum, and aluminum materials were 7.313× 107 t, 3.708 × 107 t, and 5.779 × 107 t, with year-on-year growth rates of 0.3%, 4.9%, and 8.6%, respectively. Moreover, the scale of the renewable nonferrous metals industry has been growing, and total output reached 1.45 × 107 t in 2020, accounting for 23.5% of the total output of the ten non-ferrous metals. Among them, the output of recycled copper is 3.25 × 106 t (32.4%), and that of recycled aluminum is 7.4% × 106 t (20%), while that of recycled lead is 2.4 × 107 t (37.25%) [7].

The comprehensive energy consumption of key metals in the nonferrous metal smelting industry has gradually decreased. In 2020, the comprehensive energy consumption per unit of electrolytic aluminum decreased by 1% year on year. The comprehensive energy consumption per ton of copper has dropped below 0.212 tce. The comprehensive energy consumption of some copper smelting enterprises has fallen below 0.15 tce, reaching an advanced international level. The comprehensive energy consumption per ton of lead decreased from 0.467 tce in 2012 to 0.345 tce. Coal consumption per 1 kg molybdenum oxide roasting decreased from 0.4 tce to 0. Regarding CO2 emission, the nonferrous metal industry produced 6.6× 108 t in 2020, accounting for 4.7% of the total national emission. Among them, the CO2 emission of the aluminum industry was about 5.5 × 108 t, while the copper, lead, zinc, and other nonferrous metals smelting industry accounted for about 9%, and the copper and aluminum rolling processing industry accounted for about 10%.

The nonferrous metal metallurgy industry has made significant progress in terms of environmental protection. Electrolytic aluminum enterprises in key air pollution prevention and control areas have, overall, achieved ultra-low emission levels; for instance, particulate matter emission is lower than 10 mg/m3, SO2 emission has been reduced to 35 mg/m3, and fluoride emission is lower than 1 mg/m3. The technical and economic indicators of copper smelting have been continuously optimized, and the sulfur capture and recovery rates of copper smelting enterprises have reached 99%. The alumina industry initially realized the comprehensive utilization of red mud, and the comprehensive utilization of recyclable valuable elements, such as iron and alkali and products, has exceeded 25% of the output.

The degree of technological and equipment sophistication of Chinese nonferrous metal industry has entered the world’s advanced ranks overall. Boasting 500 kA and 600 kA large aluminum electrolytic cells, a new cathode structure, and other aluminum electrolysis energy-saving technologies, China has become a world leader in terms of electrolytic aluminum industrial technology. Moreover, boasting oxygen bottom-blowing and side-blowing copper smelting, oxygen top-blowing copper smelting, and double-flash copper smelting, China’s copper smelting industrial technology is also world-class. Additionally, the sophistication of smelting technology for lead, zinc, nickel, and tin is also internationally competitive, and significant progress has been made in magnesium, titanium, tungsten, and molybdenum smelting, as well as in rare earth smelting and separation.

4.2.2 Problems in the development of nonferrous metallurgy

The nonferrous metal industry is facing a new challenge to high-quality development. For example, the demand for electrolytic aluminum and other products is about to enter the platform period, and weakening is observable in the power of scale and quantity demand expansion.

The recycling rate of nonferrous metal resources in China is low (at only 30%), while that in developed countries is generally over 70%. The industrial orientation of recycled nonferrous metals has been adjusted toward the energy conservation and environmental protection industry and the strategic emerging industry, which are of great importance to resource and environmental security and sustainable economic and social development. However, compared with primary mineral resources, nonferrous metal secondary resources are characterized by uncertain raw materials sources, rich and diverse resources, highly complex components, high component composition fluctuation, and high material density. The recycling process is relatively complex due to these characteristics and compounding.

The problem of the “three wastes” the nonferrous metal metallurgical industry produces remains. By 2020, China’s cumulative tailings stockpile was about 2.07 × 1010 t, of which copper tailings accounted for about 3.5 × 109 t, and tungsten tailings accounted for about 4.5 × 108 t. The total amount of comprehensively utilized tailings is about 3.35 × 108 t, but the comprehensive utilization rate is only 28%. The output of smelting waste slag is about 3.7 × 105 t, including red mud, copper slag, and nickel slag. Therefore, the situation of energy conservation, emission reduction, and comprehensive resource utilization in the nonferrous metal industry is complex, and the task is arduous.

《5 Situation prediction and potential analysis of innovative development of green metallurgy》

5 Situation prediction and potential analysis of innovative development of green metallurgy

《5.1 Prediction of the green metallurgy development trend》

5.1 Prediction of the green metallurgy development trend

Green development is important as a key manifestation and an ultimate goal to promote the high-quality development of the Chinese metallurgical industry, which entails a material recycling society with well-coordinated resources and energy and a healthy environment at the core. The developing direction of the metallurgical industry envisions a reasonable industrial layout, advanced technology and equipment, high-level intelligence, strong global competitiveness, and green and low-carbon sustainability. Looking forward to the metallurgical industry technology in the new era, the development trend is moving toward a technical system to comprehensively respond to challenges in terms of resources, energy, and the environment, while the core topic is promoting environmental protection and material circulation.

5.1.1 Solve the problem of resource recycling and overcome resource and environmental constraints

Resource recycling is an inevitable green development trend in the metallurgical industry, and the utilization of steel scrap is expected to gradually alleviate dependence on iron ore imports. Steel recycling materials, represented by scrap steel, are fully reduced metals, which are energy-carrying and environmentally-friendly green resources. The largescale use of steel recycling materials will be an important development direction for low-carbon metallurgy in the future; it will limit blast furnace usage of molten iron and greatly reduce CO2 and pollutant emissions. In 2020, steel scrap utilization was about 2.6×108 t, reducing CO2 emissions by about 4.16×108 t, and equivalently, replacing about 4.1×108 t of 62% grade iron concentrate. It is estimated that steel scrap utilization will be about 3.2×108 t by 2025 [7].

As the apparent consumption of ten types of nonferrous metals in China continues to rise, it is expected to reach 8.162×107 t in 2025, and this demand growth has exacerbated the resource constraints on the development of the nonferrous metal industry. In the future, advanced, comprehensive plans for resource replacement should be deployed, and a recycling system for renewable resources should be established. The proportion of renewable resources should also be increased by 15%–50%. Combining the innovative primary smelting technology with urban mineral utilization can solve the resource recycling problem. Combing mining, processing, and smelting technologies can boost the utilization level of steel and nonferrous resources, thereby realizing green and low-carbon metallurgy, while the recycling of tailings and smelting slag needs to be strengthened. From the perspective of the whole lifecycle, improving smelting technology can significantly reduce resource consumption and increase domestic and international resource security, thereby supporting the industry’s green, low-carbon transformation.

5.1.2 Find energy alternatives and reduce metallurgical pollutant and CO2 emissions

The blast furnace process is still mainstream in the steel industry for a certain period in China. Thus, the steel industry will develop vigorously and actively apply energy-saving and low-carbon technologies, such as recycling residual heat and energy to improve interface energy efficiency and optimizing the whole-process energy efficiency of the metallurgical industry. Efforts should be made to increase the proportion of clean energy (such as natural gas) utilization, and expand the renewable energy (such as solar, wind, and biomass energy) utilization scale, as well as the hydrogen energy industry. This will comprehensively promote a clean, low-carbon energy structure and strengthen the application of technologies for carbon capture, utilization, and storage.

Regarding the metallurgical processes that directly consume fossil fuels, replacement with clean energy is the only way to solve the carbon emission problem. For example, hydrogen energy will become a preferred clean energy for the nonferrous metal industry. Metallurgical enterprises should be encouraged to actively adjust their energy consumption structure, with the hope that the proportion of renewable clean energy will reach 45% by 2050. Additionally, promoting joint hydropower–metallurgical projects and introducing new clean energy metallurgical processes and equipment can improve smelting technology from the perspective of the whole lifecycle and reduce the carbon emission intensity.

5.1.3 Enhance industrial concentration and promote multi-industry links

Presently, iron and steel industry restructuring is facing new challenges in China. The optimization and reorganization of iron and steel enterprises should continue to be accelerated. Measures focused on improving the industry’s overall efficiency, reasonably strengthening industrial concentration, and resolutely eliminating backward production capacity should be implemented. In this process, all-round integration from the perspective of technology, structure, system, and resources, especially the integration and optimization of human resources and core technology, should be prioritized to support the substantive improvement of industrial competitiveness. Moreover, encouraging linkage and cooperation between the iron and steel industry and various other industrial industries can promote top-notch industrial development. Since entering the stage of high-quality development, the iron and steel industry has focused on accelerating the establishment of a domestic and international dual-cycle development pattern, deeply implementing supply-side structural reform, and facilitating a smooth connection between upstream and downstream industries.

Therefore, the nonferrous metal industry is urgently in need of in-depth scientific restructuring. In the future, it should abandon extensive production increase and actively turn to the deep processing of nonferrous metals with higher added value and wider demand. Specifically, (1) given the industry’s history of sufficient production capacity, advanced technology can be used to improve quality and efficiency, form a complete industrial chain, and drive industrial transformation and upgrading from the low- to the high-end, and high-speed to high-quality development. (2) Coordinated domestic and foreign production factors will optimize the layout of the nonferrous metal industry and promote the withdrawal of inefficient production capacity, while also encouraging the transfer of existing production capacity to energy- and resource-rich and consumption-concentrated areas, such as the transfer of the electrolytic aluminum and aluminum processing industries to the west and the north, respectively. Finally, it would be beneficial to form an integrated high-efficiency aluminum industry chain comprising coal (water)–electricity–alumina–electrolytic aluminum–aluminum deep processing–recycled aluminum and provide parts manufacturing, semi-finished products, manufactured products, and production services.

5.1.4 Advance process informatization and achieve intelligent industrial manufacturing

Given that intelligent manufacturing has become a development trend in many industries, its introduction among metallurgical enterprises will not only improve productivity and product quality, but also realize interconnected production information. In the future, the steel industry will fully exploit the new generation of information technology to continuously improve digitization, networking, and intelligence. Additionally, intelligent manufacturing will be the development theme to promote transformation, upgrading, and high-quality development [23]. Specifically, it entails building a big data platform comprising process parameters–product comprehensive performance–quality stability, carrying out in-depth optimization of process parameters throughout the whole production process, and establishing an intelligent process model library for product production suitable for mass customization and multi-process collaboration. In the future, the nonferrous metal industry will surpass the traditional division of labor in the nonferrous, steel, chemical, construction, and other industries and see the formation of cross-industry compound enterprises or joint enterprises through mutually beneficial coordination.

《5.2 Innovation and development potential of iron and steel metallurgy》

5.2 Innovation and development potential of iron and steel metallurgy

Up to the present, China’s iron and steel industry has achieved remarkable results in terms of reducing overcapacity and ensuring green development at the source. During the 13th Five-Year Plan period, not only was the upper limit (1.5×108 t) of the target achieved ahead of schedule, but a certain scale of substandard steel production capacity (1.4×108 t) was banned in accordance with the law. Within this process, performance process equipment has been remarkably improved, and the promotion of advanced green technologies has been accelerated. Specifically, the capacity of 5.5 m and above tamping and 6 m and above top-charging coke ovens increased by 6.7%, while the capacity of 1000 m3 and above blast furnaces increased by 6.5%. Additionally, the proportion of converters and electric furnaces with a production capacity of 100 t and above increased by 10%. Furthermore, the green development capacity and energy-saving indicators have seen significant improvement. For example, among key iron and steel enterprises, average SO2, NOx, and particulate emission per ton decreased by 48%, 18%, and 39%, respectively, and the comprehensive energy consumption per ton of steel dropped from 0.572 tce to 0.554 tce.

Faced with the urgent need for higher-level green development, we should exploit new green processes, equipment, and technologies, and adopt a green iron and steel industry production mode that is well suited to the national conditions and characteristics. By optimizing the industrial structure, gradually increasing industrial concentration, and expanding market influence, we can completely change the small and scattered industry development situation and drive the green development process across the whole industry through advantageous enterprises. Further, the transformation of the raw material structure and technological processing should be promoted to strive to increase the proportion of steel scrap in the national iron and steel industry to 30% and the proportion of electric furnace steel to 20% by the end of the 14th Five-Year Plan period. It is necessary to implement the green upgrading and transformation of iron and steel, and accelerate the high-value and agglomerated development of comprehensive resource utilization industries. Iron and steel enterprises should be encouraged to build comprehensive industrial bases for waste recycling that can play a leading role in the market, thereby effectively promoting the coupled development of the iron and steel, building materials, electric power, chemical, and other industries. The green manufacturing standards system should be improved, and standards systems for energy-saving, water-saving, and comprehensive resource utilization for the steel industry will be built.

《5.3 Innovation and development potential of nonferrous metallurgy》

5.3 Innovation and development potential of nonferrous metallurgy

Up the present, China’s nonferrous metallurgical industry has made remarkable achievements in terms of structural transformation and upgrading. Through the transformation and upgrading of the industrial structure, the expansion of inefficient production capacity has been restrained, and the transfer of the production of nonferrous metals to areas rich in clean energy, such as hydropower in the provinces of Yunnan and Sichuan, has been encouraged. Additionally, the situation of coal-reliant production has changed, and expanded product application has provided new momentum for the industry’s development, such as reducing wood by supplementing with aluminum in the construction field, replacing steel with aluminum in the transportation field, and replacing plastic with aluminum in the packaging field.

The energy-saving and emission reduction potential of the non-ferrous metallurgical industry continues to be evident, and the high energy consumption proportion continues to decrease. In this context, the comprehensive energy consumption of aluminum ingot and blister copper smelting have reached world-class levels. Additionally, new emission reduction technologies have improved the energy-saving and emission reduction indicators, such as inert anode, which has increased electrolytic aluminum efficiency to 97% and the removal effect of impure elements to 80%. Furthermore, SO2 production intensity and particulate production in the lead and zinc smelting industry have decreased by 97% and 90%, respectively [23]. Oxygen-enriched smelting and direct reduction process have boosted cleaner production to 90%.

Given the rapid development of recycling in the nonferrous metal industry, a new pattern of “primary + recycling” coordinated development has gradually emerged. The development and application of new materials have demolished foreign countries’ blockade of key technologies, such as high-purity metals, 8-inch silicon wafers, and lead frame materials.

Focusing on the future, the development potential of non-ferrous metallurgy industry depends on the following aspects: research and development of renewable metal utilization technology; deepening of metal resource recycling to resolve the primary resource shortage [7]; promotion of industrial energy innovation technologies to maximize energy conservation and reduce energy consumption; and optimization of the industrial structure and cluster links to advance the application of frontier technologies such as big data, artificial intelligence, fifth-generation mobile communications (5G), edge computing, and virtual reality. This will drive the high value-added utilization of resources, and accelerate the integrated development of upstream and downstream industries. Moreover, the key metallurgical technology system should be improved to essentially break through the bottleneck restricting the industry’s development.

《5.4 Green development stages and paths of the metallurgical industry》

5.4 Green development stages and paths of the metallurgical industry

In view of the green development goals of metallurgical industry, the characteristics and missions of different stages of green metallurgy development were identified, and a four-stage division of the green development of China’s metallurgical industry is proposed (Fig. 3). At different stages of development of the metallurgical industry, corresponding green development measures should be taken to achieve the objectives of each stage to smooth the metallurgical industry’s transition to innovative, intelligent, green, and low-carbon development.

《6 Measures for innovative development of green metallurgy》

6 Measures for innovative development of green metallurgy

《6.1 Strengthen the strategic position of metallurgical power and optimize the development of the green metallurgical industry》

6.1 Strengthen the strategic position of metallurgical power and optimize the development of the green metallurgical industry

6.1.1 Restructuring the metallurgical industry by relying on advantageous resources and clean energy

This entails encouraging the transfer of metallurgical production capacity to renewable energy-rich areas, such as wind and solar energies (in Northwest China) and hydropower (in Southwest China), or areas rich in metal resources/recycled resources. Metallurgical industries (e.g., aluminum electrolysis) can be located near coastal nuclear power enterprises (e.g., Fuqing, Fujian Province) when combined with the construction of industrial chain bases. It is necessary to strengthen the regional agglomeration effect of resources and energy, with a focus on the domestic, and increase the exploration and examination of strategic minerals such as lithium, cobalt, and ionic rare earth, with consideration to iron, copper, and other bulk scarce mineral exploration. It is also necessary to redouble efforts to discover minerals in key metallogenic zones and accumulate reserves; accelerate prospective investigation and mineral search prediction in zones in the southwest and northwest regions, such as copper, nickel, and lithium; enhance the guaranteed capacity of strategic mineral resources; and conduct deep and peripheral exploration of old mines to form key mineral resource succession zones. Additionally, it is necessary to adjust the product structure and capacity layout and appropriately extend the industrial chain, such as the layout of future steel mills, which can be divided into two categories: large multi-plant corporations with a blast furnace–converter long process and sheet material production, primarily laid out in coastal deep-water port areas; and full scrap electric furnace short-process steel mills primarily laid out in the urban periphery and mainly producing long products used for construction, to eliminate social wastes, such as steel scrap, abandoned electricity, and municipal water.

《Fig. 3》

Fig. 3. The stages and paths of the green development of the metallurgical industry.

6.1.2 Responding to the Belt and Road Initiative and actively laying out overseas metallurgical sources

Key development directions are copper resources in DRC, Zambia, and Peru; bauxite resources in Guinea, Indonesia, Jamaica, Laos, and Cambodia; and laterite nickel ores in Indonesia, the Philippines, Myanmar, and Papua New Guinea. Through overall planning, rational layout, long-term follow-up, the orderly promotion of major projects in related areas, and the improvement of supporting infrastructure and port construction, we will also establish largescale overseas mineral resource bases, characterized by complete variety, comprehensive support, and international competitiveness, to significantly improve the capacity of the overseas resource guarantee. Countries and regions along the Belt and Road are rich in iron, copper, lead, zinc, nickel, gold, and other resource reserves, and Chinese advanced metallurgical technology and standards that approach international standards can be achieved, with the layout of overseas metallurgical sources. For example, there are select countries and regions along the Belt and Road with conducive conditions to lay out aluminum, copper, and other processing capabilities, provide additional space for industrial development, and efficiently extend the industrial chain.

6.1.3 Improving metallurgical science and technology and strengthening national laboratory capacity building

To effectively meet the challenges of resource and environmental security and stranglehold links, it is necessary to build high-end science and technology innovation platforms, such as national laboratories for nonferrous metals, to tackle major industrial technical problems such as metal extraction, material preparation, and ecological disposal in the context of extremely poor and mixed resources, extreme environments, and complex systems.

Using advanced information technology platforms to support the upgrading of metallurgical science and technology entails developing intelligent manufacturing information infrastructure using the industrial Internet, 5G, and other technologies; applying big data, artificial intelligence, edge computing, and other technologies based on the data-driven concept in order to improve the learning and cognitive ability of information systems to support practical solutions to problems such as unstable process control and frequent equipment failures in the smelting process; and the use of virtual/augmented reality and other technologies to develop human–machine collaborative hybrid augmented intelligence, giving full play to the wisdom of process technicians and machine intelligence so that they may inspire each other and ultimately add value.

6.1.4 Strategic planning to strengthen China’s metallurgical power

Objectives should include demonstrating the development of basic research action and strategic plans for engineering technology in the metallurgical industry; improving the overall level of science and technology in the metallurgical field; enhancing the performance of industry technology and equipment; enhancing the green transformation, industrial upgrading, and the adjustment of production capacity; enhancing the development of a high-end value chain; and fundamentally solving the industry developmental bottleneck of traditional resource shortage and serious environmental pollution. The steel industry should not adopt an export-oriented means for addressing excess capacity; the export of pig iron, billets, and other primary products should be prohibited, exports of products with high energy consumption and low added values should be strictly limited; and the export of numerous mid-range products should be discouraged. Furthermore, regarding the export of highly technical steel, it is necessary to adjust the export catalog through dynamic management, encourage the processing of high-end manufactured products or electromechanical products before export, and promote the construction of plants abroad to implement production and sales in close proximity of one another.

《6.2 Layout of green metallurgical technology development and major projects》

6.2 Layout of green metallurgical technology development and major projects

6.2.1 Developing disruptive technologies for waste-free metallurgy in advance

We deepen basic research, develop original theories, and introduce breakthrough core key technologies to address the many stranglehold technological problems affecting key strategic metals and their applications.

First, we will enhance funding for basic research on the integration of metallurgy and multiple disciplines. We are forming teams comprising professionals in chemistry, physics, information technology, mathematics, and other disciplines to perform joint and focused research for open basic research grants and projects established by enterprises or local governments under the unveiling system. Such research focuses on the fundamental theories and technical principles of essential technologies, such as energy and resource substitution, metallurgical transformation (e.g., hydrogen metallurgy), and pollution and carbon reduction, to provide major original innovations.

Second, we should achieve breakthroughs in important disruptive and core technologies. Objectives include aggressively promoting technological innovations in the metallurgical industry, enhancing reaction efficiency at the atomic/molecular level, and overcoming the challenges of high-energy consumption, high material consumption, and high pollution in the metallurgical process at the source. We should conduct research and show the processual mechanisms of molecular movement, transfer, collision, adsorption, and reaction in the different environments and scales of the metallurgical process, while also coordinating and controlling the molecular transfer and reaction processes on multiple scales, developing technologies to enhance the metallurgical process, such as microreactors, supergravity, microwave technologies, and process coupling, and focusing on the development of hydrogen metallurgy, critical metallurgy, unconventional resource metallurgy, carbon-free aluminum metallurgy, arsenic metallurgy, intelligent metallurgy, and other progressive technologies.

6.2.2 Deployment of major innovation projects in the metallurgical industry

The first project is an innovation initiative focused on the future of resources and energy security. Resource management information systems and an information-sharing mechanism should be established using remote sensing and information technologies. Key research content includes (1) intelligent smelting technology, encompassing basic material science (a molecular, atomic microscopic dimension), process technology science (a process, equipment mesoscopic dimension), and process engineering science (a process, plant macroscopic dimension); (2) big-data-based smelting technologies, depending on an ironmaking big data platform for online monitoring, blast furnace physical analysis, report querying, process calculations, real-time warning, quality tracking, furnace reports, and expert guidance; (3) intelligent robot whole-process smelting technology, instead of manual steel smelting in the entire process of production work, which would liberate people from the hard, tiring, unclean, and generally poor working environment and significantly enhance production efficiency and product quality. Further, the development of metal resources and energy development strategies will reduce constraints and enhance the management systems related to resource protection. Energy and resource development in the marine field and other areas will broaden industrial resource supply channels and encourage enterprises’ high-quality participation in global mineral resource development and smelting technology industrialization.

The second project is the recycled resources smelting innovation project. Since China has not yet established a perfect scrap metal recycling system, it is confronted with a weak industrial base, low concentration, lack of technology and equipment, and a need to improve added values of products, among other challenges. Strengthening basic research on renewable resource recycling, establishing efficient and clean separation and extraction approaches, and developing primary smelting with urban mineral usage technology can contribute to achieving efficient resource recycling. Moreover, building an integrated industrial chain including waste recovery processing (recycling) of products or the production of raw materials (reuse) can reduce resource constraints and environmental pollution and promote the development of a social circular economy. The usage and elimination of bulk solid waste and smelting slag in the context of resource development in the mining process is also a subject of scientific and technological innovation and study.

The third project is an alternative clean energy innovation project that entails introducing hydrogen, solar energy, wind energy, hydropower, coal to gas, and other clean energy breakthroughs through multi-energy synergistic complementary technology, thereby increasing the proportion of clean energy usage in the metallurgical industry; developing waste heat usage and other new energy recovery approaches and paths; designing essential processes and equipment; and promoting cross-process and cross-industry energy recovery and usage. Key research includes (1) encouraging the transfer of electrolytic aluminum production capacity to renewable power-rich areas, from self-provided electricity to grid power conversion while considering the ecological carrying capacity of clean energy-rich areas, thus to implement emission reduction from the source; (2) replacement of producer gas with natural gas, while eliminating gas production process with high energy consumption and high pollution; (3) full use of the calorific value of municipal waste and the freezing, crushing, and partial replacement of pulverized coal to create circular economy industrial links; and (4) encouraging enterprises to change their energy structures and fully utilizing hydropower, wind power, photovoltaic, nuclear power, and other resources, with a focus on promoting hydropower in particular to support carbon peak in the metallurgical industry.

The fourth project is the clean smelting innovation project, the vision of which applies to the entire lifecycle. We promote an ecological metallurgical industrial design, precise control of key pollution production nodes, and breakthroughs in cogeneration and other industrial linkage technologies, thus to optimize resources and energy allocation throughout the entire process, enhance pollution control technology, and ultimately, achieve pollution and carbon reduction in key categories such as steel and aluminum. Actions include (1) devising a calculation approach for the lifecycle inventorying of metallurgical products in the steel industry that reflects closed-loop recycling characteristics and the steel industry carbon footprint model; in combination with advancements in carbon capture technology, developing flue gas recovery management technology for CO2 capture in steel smelting that considers low-cost carbon capture and resource/productization. (2) In the aluminum industry, the bauxite mining process will reduce the phenomenon of mining high-grade while abandoning low-grade ores in small mines and lower the loss of mining by enhancing mining technology; the alumina smelting process will enhance the alumina recovery rate of the Bayer approach through technological progress; the main aluminum electrolysis process will accelerate the elimination of outdated electrolytic cells and continuously enhance the operation management and electrolysis operation level of electrolytic aluminum plants; in the aluminum and final product production link, the layout of electrolytic aluminum enterprises, casting plants, and aluminum processing enterprises should optimized to increase the proportion of aluminum liquid direct casting and rolling (omitting aluminum ingot casting and remelting links) and reduce burn loss and energy consumption.

The fifth project is the circular economy industry innovation project, which entails establishing novel theories and approaches for the eco-friendly extraction of complex mineral resources and the recycling of secondary resources, driving technological advancements for efficient resource usage. Objectives include guiding the construction of intra- and cross-industry resource and energy links; optimizing resources and energy usage rationing, as well as supply and disposal; and establishing a regional multi-industry recycling model. Key research content includes (1) building coke oven gas scale hydrogen production and a circular economy ecological chain in the petrochemical industry; (2) establishing green oil, coal, and natural gas resources processing with the integrated and effective use of clean products; the formation of coal gasification combined with a cycle of multi-generation chemical technology; (3) promoting the nonferrous metals development model of “raw material production + terminal application” integration; realizing high value-added resource usage through upstream and downstream linkage; promoting product consumption upgrading and utilizing aluminum to save wood and replace steel and plastic; (4) developing industrial clusters such as aluminum profiles–auto parts–building components–home products, and rare earth metals–new energy materials–new energy auto parts–power battery materials; (5) forming a variety of distinctive industrial clusters by promoting the mining–smelting–processing integrated development of the copper industry and by supporting the integration of the aluminum industry with coal, electricity, chemical, and clean energy industries.

The sixth project is a linkage innovation project involving the nonferrous iron and steel industry. It entails improving support for the metallurgical industry resources green cycle and achieving breakthroughs for crucial technologies such as secondary materials valuable elements recovery and associated metal solid waste recycling. The key directions involve (1) metal separation and resource extraction from iron- and zinc-containing solid waste throughout the processing of nonferrous metals and steel; and (2) multi-metal synergistic smelting in the metallurgical processing of nonferrous metals, iron, and steel, thus reducing the dependence on mineral resources and enhancing the recovery rate of secondary and rare resources. We conduct cross-industry and cross-sectoral innovative industry chain projects to realize industry chain synergy between metallurgy and fields including housing, transportation, and environmental protection to enhance solid waste resource consumption.

《7 Countermeasures and suggestions》

7 Countermeasures and suggestions

《7.1 Perfecting the national policy system to lead green industrial development》

7.1 Perfecting the national policy system to lead green industrial development

The green development strategy for the metallurgical industry should be perfected, and a specific index constraint and a fiscal taxation system should be formed to create a green, low-carbon, circular, and intelligent industry development model. It is essential to implement strict resource and environmental policies and concentrate on the formation of a long-term mechanism to drive the green development of the metallurgical industry. Breaking with the traditional fragmented and segmentary state of the metallurgical industry is suggested to favor the deep integration with renewable resources and environmental protection. The disposal of secondary resources, such as urban mineral resources and hazardous solid waste, should be incorporated into the metallurgical industry system. It is essential to improve the carbon trading market and encourage new energy consumption to reduce coal consumption. Environmental tax should be levied on metallurgical enterprises with high energy consumption and emissions. Carbon emission source control should be strengthened, and a database of major metallurgical projects should be established. Regarding stock capacity, gradual reduction of carbon emission quotas or differential electricity prices should be adopted to promote the achievement of clean energy alternatives as soon as possible among the relevant enterprises. Great efforts should be made to promote the disposal of steel scrap to form a system that uniformly applies recycling–classification–processing distribution–utilization. If scrap processing and distribution enterprises meet the access conditions, a taxation reduction policy could be adopted. The importation of resource products (scrap ships, waste cars, waste electrical appliances, and other iron resources) is encouraged. To achieve this goal, the management of steel scrap importation should be standardized and simplified. The added-value tax on imported scrap steel should be reduced based on a zero tariff.

《7.2 Formulating a standards system in green metallurgy to standardize high-quality industry development》

7.2 Formulating a standards system in green metallurgy to standardize high-quality industry development

In accordance with the Guidelines for the Constructing a Carbon Peak and Carbon Neutral Standards System for the Industry (2021), a low-carbon standards system and a green metallurgy evaluation standards system should be established to formulate plans to guide the green and healthy development of the metallurgical industry. Green metallurgy construction pilots should be impelled. It is essential to publish guidelines for the establishment of a green metallurgical standards system. In light of the national strategic demands and industry development trends, the development level and room for improving key enterprises should be unraveled, and a systematic management system, technical specifications, and universal standards should be established. Regarding international cooperation in metallurgy, we should participate in the formulation of international standards for metallurgical technology to improve the international right of speech of Chinese metallurgical enterprises regarding market and technology.

《7.3 Cultivating metallurgical innovation talent to strengthen the driving force for industrial development》

7.3 Cultivating metallurgical innovation talent to strengthen the driving force for industrial development

Talent is the primary resource. Therefore, a national personnel training system should be established to support the high-quality development of the metallurgical industry and guarantee the industry’s core competitiveness, including related technology. Establishing a special metallurgical innovation personnel training project is suggested. Relying on high-level universities and key enterprises, high-level engineering and technical personnel in the metallurgical industry should be cultivated. The cultivation of interdisciplinary talent in metallurgy and chemistry, environmental protection, carbon finance, and other relevant industries is a priority to provide comprehensive intellectual support for basic green metallurgy research and carbon emission reduction. Various preferential terms should be employed to attract talent and encourage the vitality of talent innovation, creating a platform for scientific research and innovation. An information resource sharing, communication, and science popularization platform should be established for the high-level and professional popularization of science and to boost public attention to, recognition of, and participation in green metallurgy.

《Compliance with ethics guidelines》

Compliance with ethics guidelines

The authors declare that they have no conflict of interest or financial conflicts to disclose.

京公网安备 11010502051620号

京公网安备 11010502051620号