《1 Introduction》

1 Introduction

Nickel sulfate is a primary product of nickel ore smelting and processing, and it is a crucial raw material in the production of ternary lithium batteries, electroplating nickel, nickel–hydrogen batteries, and other goods. Owing to the rapid development of new energy vehicles, China’s nickel sulfate consumption is expected to reach approximately 4 × 105 t in 2021, with roughly 60% of that going toward power batteries used in new energy vehicles [1].

The major driver of the nickel sulfate demand increase is batteries for new energy vehicles. In 2021, 3.52 million new energy vehicles were sold in China, representing a 1.6-fold increase over the previous year [2]. The demand for nickel sulfate is increasing rapidly owing to the rapid growth of the new energy vehicle market. According to estimates, China is expected to produce 20 million new energy cars by 2035, requiring 1.05 × 106 t of nickel sulfate for power batteries [3–6]. This accounts for approximately 90% of the total demand for nickel sulfate. Although demand is growing very rapidly, domestic nickel ore reserves account for only 3% of the global total [7], and thus most of the raw materials for the production of nickel sulfate need to be imported from abroad. Meanwhile, the main nickel-exporting countries have complicated and changeable policies, which impedes the stable development of the Chinese electric battery industry. Given the present situation and long-term development, it is difficult to develop a high-quality nickel sulfate industry in China.

Fostering the development of China’s new energy industry has become an unavoidable choice for China’s development needs. Under the new industrial situation, it is of great importance to ensure a steady supply of nickel sulfate in China for the development of the new energy industry. Previous studies [4,8–10] have discussed the overall development of China’s nickel sulfate industry, the demand status and development trends of downstream fields, and the investment layouts and development modes of nickel sulfate enterprises. However, there has been less research related to the existing problems and future development of China’s nickel sulfate industry, particularly development ideas, goals, and specific initiatives in strategic-level research.

Therefore, this study focuses on development of a high-quality nickel sulfate industry, compares the current situation of the nickel sulfate industry in China, examines the key factors restricting development of the industry, proposes development directions and corresponding suggestions to realize high-quality development of the industry, and provides a reference for future research on the nickel sulfate industry.

《2 Status of China’s nickel sulfate industry》

2 Status of China’s nickel sulfate industry

《2.1 As the scale of the industry continues to expand, integrated plants become the main growth force》

2.1 As the scale of the industry continues to expand, integrated plants become the main growth force

From 2016 to 2021, there was a significant increase in nickel sulfate production in China. Before 2017, the production of nickel sulfate in China was stable at 3 × 104 t to 5 × 104 t. With the rapid increase in the production of new energy vehicles in China in 2017, the production of nickel sulfate also increased, and the demand for ternary materials was significant. The production of nickel sulfate in China increased from 5 × 104 t in 2016 to 2.8 × 105 t in 2021 and is expected to grow to 3.8 × 105 t in 2022 [1] (Fig. 1).

《Fig. 1》

Fig. 1. Change in nickel sulfate production in China and other countries, 2016–2021 [1].

China’s nickel sulfate production is concentrated, mainly in Gansu, Guangdong, and Guangxi. In 2021, CNGR became the largest nickel sulfate producer in China, with output dominated by nickel beans/nickel powder dissolution [11]. In addition, GEM Co., Ltd. has seen a rapid rise in nickel sulfate production in recent years, with battery metal recycling providing an important raw material. Jinchuan Group Co., Ltd. has the richest nickel resources in China, with relatively stable nickel sulfate production. Relative to the resource-based Jinchuan Group, a series of battery plants such as CNGR, GEM, and Huayou Cobalt have further increased their output. These companies have invested in mines, allowing for an integrated process from nickel ore to ternary lithium batteries. As a result, their profits and output are expected achieve large-scale growth (Fig. 2).

《2.2 Production of raw materials from nickel sulfide ore to nickel laterite ore》

2.2 Production of raw materials from nickel sulfide ore to nickel laterite ore

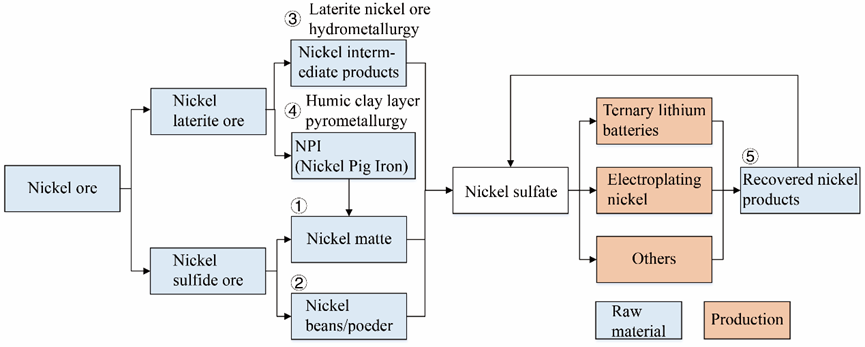

From the perspective of the production raw materials, the production route for nickel sulfate includes five main processes: (1) nickel sulfide ore → nickel matte → nickel sulfate; (2) nickel sulfide ore → refined nickel → nickel sulfate; (3) nickel laterite ore → laterite nickel ore hydrometallurgy→ nickel sulfate; (4) nickel laterite ore → nickel pig iron (NPI) → nickel matte → nickel sulfate; and (5) recovered nickel products → reprocessing → nickel sulfate [9] (Fig. 3). The main raw material for nickel sulfate production is high-grade nickel sulfide ore; however, laterite nickel ore has been used as a raw material in recent years. On one hand, because of the short history of laterite nickel ore mining and abundant resources, the production of NPI is relatively surplus, and the technology for converting NPI to nickel matte has matured. On the other hand, the continuous decrease in nickel sulfide ore reserves has led to grade decline and increased mining and smelting costs, and thus the supply has difficulty meeting the demand. Therefore, with the breakthrough of intermediate product processing technology, low-grade nickel laterite ore can be used to produce nickel sulfate through laterite nickel ore hydrometallurgy products, and higher-grade nickel laterite ore can be converted to nickel matte by producing NPI, which in turn produces nickel sulfate [8,12,13].

《Fig. 2》

Fig. 2. Top ten nickel sulfate production enterprises in China in 2021[11].

《Fig. 3》

Fig. 3. Nickel sulfate production paths.

China’s nickel sulfate production mainly uses laterite nickel ore hydrometallurgy products and nickel beans/powder. In 2020, China’s nickel sulfate raw materials—nickel matte and laterite nickel ore hydrometallurgy products—accounted for about half the dosage. In 2021, owing to production restrictions of laterite nickel ore hydrometallurgy projects, new projects to be put into production were not yet determined, resulting in a relatively slow increase in production. As a result, the nickel matte and laterite nickel ore hydrometallurgy products for use in nickel sulfate production increased by only 2 × 104 t compared with 2020 (Fig. 4). In contrast, the use of nickel beans/powder increased considerably. Nickel beans/powder are mainly produced from nickel sulfide ore with a relatively stable production capacity, and nickel sulfate is mainly produced from nickel beans/powder when the output of nickel matte and laterite nickel ore hydrometallurgy products are insufficient to support the demand.

Owing to the nickel resources in China mainly existing as nickel sulfide ore and the shortage of raw material supply capacity, large quantities of imports are needed. In 2021, 4.1 × 105 t of laterite nickel ore hydrometallurgy products were imported (in physical quantity), 2.2 × 105 t of nickel beans/powder and nickel plates were imported (in physical quantity), and 1.6 × 104 t of nickel matte were imported (in physical quantity). For example, China mainly imports laterite nickel ore hydrometallurgy products from Papua New Guinea, New Caledonia, Australia, and other countries (Fig. 5). Affected by COVID-19, imports from Papua New Guinea dropped from 1.8 × 105 t in 2020 to 1.3 × 105 t in 2021. Imports from Australia were 8.3 × 104 t, representing a year-on-year increase of 140% owing to the resumption of production at First Quantum’s Ravensthorpe project in Australia with rapid production growth [1]. Imports from Indonesia increased to 6 × 104 t. Indonesia is currently home to a high concentration of global laterite nickel ore hydrometallurgy projects. As a result of the continuous operation of laterite nickel ore hydrometallurgy product projects constructed in the early stage of the industry, the production and export of laterite nickel ore hydrometallurgy products in Indonesia have continued to increase.

《Fig. 4》

Fig. 4. Nickel sulfate feedstock in 2020 (left) vs. 2021 (right) [1].

《Fig. 5》

Fig. 5. Sources of wet smelting nickel intermediate product imports to China [14].

Source: UN Comtrade (commodity code: 283324)

《3 Problems in the development of the nickel sulfate industry》

3 Problems in the development of the nickel sulfate industry

China is the largest producer of nickel sulfate in the world, and while smelting and processing technologies are constantly improving, the development of China’s nickel sulfate industry still faces numerous problems and depends to a large degree on importing raw materials. Production processes for nickel sulfate still face problems such as high carbon emissions, incomplete recovery systems, lack of raw materials, and low resource utilization rates. Therefore, realizing a sustainable and stable supply of nickel sulfate in China must overcome considerable challenges.

《3.1 With a scarcity of domestic nickel resources, the nickel sulfate raw material supply is limited》

3.1 With a scarcity of domestic nickel resources, the nickel sulfate raw material supply is limited

The need for raw materials is still the main factor constraining the development of China’s nickel sulfate industry. Indonesia and other countries use laterite nickel ore to produce nickel sulfate. These countries are rich in resources; meanwhile, the costs of ore and labor are far lower than those in China. In contrast, China’s nickel ore reserves account for only 3% of the global supply, consisting of mainly nickel sulfide ore that underwent early development [15]. The use of domestic nickel sulfide ore to produce nickel sulfate is costly and the available resources have difficulty meeting the demand. As a result, the raw materials for the production of nickel sulfate in China are mainly obtained from imports. Thus, China’s dependence on foreign countries for raw material imports is high, and future increases in the global nickel supply are expected to come mainly from Indonesia [16]. However, Indonesia has begun to develop its own power battery industry, and policies governing the export of nickel products have changed frequently. Thus, the supply of nickel sulfate raw materials in China is limited, resulting in considerable challenges to industrial development.

《3.2 Carbon emissions from nickel sulfate production are higher for the nickel laterite pathway than the nickel sulfide pathway》

3.2 Carbon emissions from nickel sulfate production are higher for the nickel laterite pathway than the nickel sulfide pathway

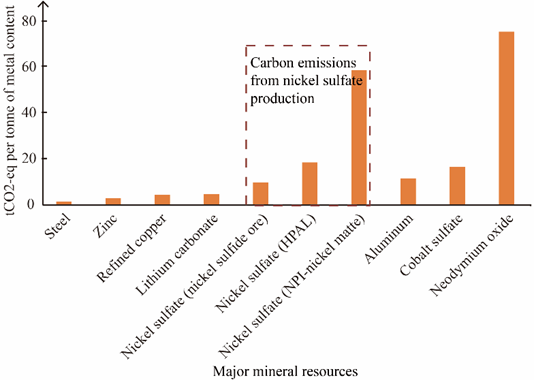

Against the background of carbon peaking and carbon neutralization, the development of new energy vehicles is closely related to reducing carbon emissions. Nickel sulfate is the main raw material for the production of new energy vehicle power batteries, and thus the carbon emissions resulting from the production process are attracting increased attention. Compared with steel, zinc, and refined copper, nickel sulfate production has higher carbon emissions; moreover, nickel sulfate production from laterite nickel ore yields significantly higher carbon emissions than production from nickel sulfide ore [10,17]. The carbon emission intensity is greatest for nickel sulfate production from NPI-nickel matte (Fig. 6). In the situation of a rapid growth in nickel sulfate demand, carbon emissions in the production process will increase, and nickel sulfate production will face more pressure regarding carbon emissions.

《Fig. 6》

Fig. 6. Comparison of the CO2 emission intensities of major mineral resource production processes [17].

《3.3 As the cost of downstream ternary lithium batteries rises, cost-effective lithium iron phosphate batteries gains an increased market share》

3.3 As the cost of downstream ternary lithium batteries rises, cost-effective lithium iron phosphate batteries gains an increased market share

The downstream demand for nickel sulfate in China is mainly concentrated in the field of new energy automotive power batteries; mainstream power batteries include ternary lithium batteries and lithium iron phosphate batteries. Ternary lithium batteries have a higher range and battery capacity, but lower cost and safety compared to lithium iron phosphate batteries [18]. Before 2019, the installed base of ternary lithium batteries increased rapidly. However, in the past two years, as a result of reduced subsidies for new energy vehicles in China, car companies have used lithium iron phosphate batteries in large quantities in consideration of cost factors. In 2021, China’s installed base of lithium iron phosphate batteries reached 79.8 GW·h, accounting for 51.7% of the total installed base, which is an increase of 227.4% [19] (Fig. 7). As they provide the advantage of low costs, the installed volume of lithium iron phosphate batteries continues to increase, while the price of nickel, which is the main raw material for ternary lithium batteries, remains high. As raw material prices continue to rise, the market share of ternary lithium batteries will continue to decline in the short term, and the growth in nickel sulfate demand will also decline.

《Fig. 7》

Fig. 7. Comparison of installed power battery capacities in China [19].

《3.4 Imperfect systems for power battery recycling lead to a low utilization rate of renewable resources》

3.4 Imperfect systems for power battery recycling lead to a low utilization rate of renewable resources

Given the scarcity of nickel sulfate raw materials in China, recycling can alleviate the shortage of nickel sulfate supply, improve the sustainable use of materials, and facilitate the establishment of a safer and more resilient domestic material supply chain in China.

The retired power batteries in the downstream products of nickel sulfate will become the main source of recycling, as other areas of nickel sulfate consumption are small, and thus the corresponding recycling value is low. The recovery rate of nickel metal in power batteries can theoretically reach 99%. However, as the recycling of power batteries in China is an emerging field, the current recycling system is imperfect, resulting in large amounts of wasted nickel resources and environmental pollution. The theoretical end-of-life of a power battery is five to eight years, and the first batch of power batteries produced in China from 2014–2017 have thus reached their recycling age. However, the number of scrapped batteries is low, and the number of these batteries with recycling value is also low, resulting in high battery recycling costs and a low proportion of recycled nickel use (13% in 2021). In addition, China’s power battery recycling standards are also imperfect, and testing standards for the safety, durability, and reliability of retired batteries are lacking. Moreover, problems such as insufficient technology and talent reserves for residual assessment of batteries also restrict the recycling and reuse of power batteries in China [20]. Therefore, China’s power battery recycling system is imperfect, and the output of recycled nickel is low for several reasons.

《4 Development trends in the nickel sulfate industry in China》

4 Development trends in the nickel sulfate industry in China

《4.1 Accelerated integration of China’s nickel sulfate industry and increased concentration of enterprises》

4.1 Accelerated integration of China’s nickel sulfate industry and increased concentration of enterprises

Power batteries have strict requirements for their battery life, safety, cost control, and many other aspects. Therefore, from the perspective of ensuring the safety and stability of the raw material supply chain, coordinated development of technology and low-cost competitive advantages for leading manufacturers of complete vehicles and batteries produces a strong impact on raw material enterprises. We attach great importance to continuous supply, cost control, quality management, technology research and development, and other capabilities of these companies and are willing to extend the industrial chain through restructuring and other methods to build an internationally competitive integrated industrial chain for battery raw materials. The deep integration of industry chains and supply chains has become the dominant development trend in the industry, and enterprises with integrated upstream and downstream industry chain layouts will likely outcompete their rivals. For example, CATL announced cooperation with GEM and Tsingshan as early as September 2018 along with the construction of a laterite nickel mine in Indonesia to produce battery-grade nickel sulfate projects, with battery companies, new energy vehicle enterprises, and mines joining forces to enhance raw material security and reduce the risk caused by price changes.

In this situation, the concentration of enterprises in the nickel sulfate industry will continue to increase. Enterprises that do not form a scale will face high costs and lower profits, making survival more difficult. Companies in the class of LG and Tesla generally tend to work with companies of a certain scale, and thus it is difficult to cooperate with small enterprises [21]. Therefore, as the scale of large enterprises in the nickel sulfate industry continues to expand and production capacity increases, large enterprises will squeeze small companies from the market, and the concentration of nickel sulfate businesses will gradually increase.

《4.2 Production of raw materials for laterite nickel ore and laterite nickel ore hydrometallurgy products will become mainstream》

4.2 Production of raw materials for laterite nickel ore and laterite nickel ore hydrometallurgy products will become mainstream

The main raw materials for the production of nickel sulfate are NPI for the nickel matte route and the stainless steel industry, whose output will be subject to changes in the stainless steel demand. Meanwhile, the raw materials required for high-grade laterite nickel ore resources are gradually declining, and thus this method for producing nickel sulfate will become more restricted. Nickel beans/powder and dissolved nickel sulfate are processed into nickel ore beans, powder, and then dissolved, providing a path to produce nickel sulfate with high production costs and thus low profits. In contrast, laterite nickel ore hydrometallurgy products have the advantages of lower costs, lower carbon emissions, and sufficient raw materials, and thus this is expected to become the primary raw material for nickel sulfate [8,9] (Table 1). Although the current investment in production is relatively small, with the successive construction of various projects, projects operated by Chinese enterprises in Indonesia will increase significantly after 2022 (Table 2). However, while the production of nickel sulfate from laterite nickel ore hydrometallurgy products still produces high carbon emissions, gradual improvements in the existing technology, reduced costs, and decreased carbon emissions are expected in the future. With the continued increase in demand for nickel sulfate for new energy vehicles, it is expected that laterite nickel ore hydrometallurgy products will become the mainstream technology for nickel sulfate development by domestic and foreign enterprises.

《Table 1》

Table 1. Comparison of nickel sulfate production paths.

| Raw materials | Advantages | Disadvantages |

| Nickel beans (powder) | Can be directly put into the ternary battery precursor production line | High cost |

| Low investment and short construction period | ||

| Simple supply and low environmental qualification requirements | ||

| Hydrometallurgy intermediate products | Low total cash costs | Large tailing volume and high treatment cost |

| Safe production process, without high-temperature or high-pressure environment | Long investment cycle and high risk | |

| Raw material is limonite layer laterite nickel ore, with an abundant supply and low cost | ||

| High-ice nickel (nickel laterite) | Short construction period and low investment cost | High energy consumption in the production process |

| Flexible process | The raw material is relatively costly laterite nickel ore with a humic clay layer | |

| Recycled nickel | Low cash costs | Supply is unstable and influenced by downstream consumption, power battery recycling efficiency is currently low |

| Safe production process without high-temperature or high-pressure production environment | Fragmented supplier distribution |

《Table 2》

Table 2. Part of the wet smelting intermediate goods project

| No. | Projects | Company | Annual production capacity | Production time |

| (× 104 t of nickel metal) | ||||

| 1 | Qingmeibang | GEM, Bump Cycle, Green Mountain Group | 5 | 2022 |

| 2 | Huayue Nickel-Cobalt Project | Huayou Cobalt, Luoyang Molybdenum, TsingSHAN Group | 6 | 2023 |

| 3 | Indonesia Huafei Nickel and Cobalt Wet Smelting Project | Huafei Nickel & Cobalt (Indonesia) Company Limited (51% share of Huayou Cobalt) | 12 | Construction begins in 2022 |

《4.3 Increased high-nickel ternary lithium battery demand drives rapid development of the nickel sulfate industry》

4.3 Increased high-nickel ternary lithium battery demand drives rapid development of the nickel sulfate industry

According to data from Antaike Information Co., Ltd., in 2021, the nickel sulfate consumption of the battery sector in China was approximately 2.4 ×104 t, representing an increase of 72%. In the past two years, lithium iron phosphate batteries have benefited from the electrification of the microcar market, and have quickly seized a large market share. However, ternary lithium batteries still have a significant range advantage over lithium iron phosphate batteries, and thus ternary lithium batteries are mainly used in new energy passenger cars [18,22]. In essence, the customer overlap for ternary lithium batteries and lithium iron phosphate batteries is not high. Therefore, in the long run, lithium iron phosphate batteries and ternary lithium batteries will achieve differentiated growth, with parallel development of both technologies.

In addition, the production of high-nickel ternary lithium batteries increased from 22% in 2020 to 39% in 2021, and the trend for high-nickel ternary lithium batteries is more obvious than that in 2020 [1]. With the gradual increase in the capacity density of high-nickel ternary lithium batteries, technology and quality control will be improved, and the decrease in unit cost arising from the increased energy density will also be beneficial for the popularity of new energy vehicles. In the future, new energy vehicles will continue to be developed with higher energy densities and longer ranges, and the development trend of high-nickel ternary lithium batteries will thus become increasingly obvious. Therefore, the trend of “high nickel and low cobalt” and even “high nickel and no cobalt” in ternary lithium batteries will further drive the rapid increase in the nickel sulfate demand in China.

《4.4 Improvements in the power battery recycling system and the use of recycled nickel will ease the scarcity of raw materials》

4.4 Improvements in the power battery recycling system and the use of recycled nickel will ease the scarcity of raw materials

China has introduced several policies to promote development of the power battery recycling market, and the power battery recycling system has gradually improved. The government departments have introduced several power battery recycling laws and standards. China is quite concerned about the field of lithium battery recycling and aims to strongly promote the recycling of lithium batteries. In 2020, the Ministry of Industry and Information Technology issued the Specifications for Waste Power Battery Comprehensive Utilization Industry of New Energy Vehicles (2019), with provisions for nickel, cobalt, and manganese. According to this standard, the comprehensive recovery rates of nickel, cobalt, and manganese should be no less than 98%, with the added requirement that “the recovery rate of lithium should not be less than 85%, and the comprehensive recovery rate of other major valuable metals such as rare earth should not be less than 97%” [23]. Strengthening the requirements for environmental protection and the recycling rate can improve the industry access threshold to a certain extent, thus forcing enterprises to upgrade their technology while improving the traceability management of power batteries to ensure that participating enterprises have certain commercial interests.

China’s power battery recycling industry will continue to improve in terms of regulations, policies, technology, standards, industry, and other aspects to accelerate the promotion of new energy vehicle power battery recycling, and the reuse of nickel sulfate production will continue to improve, thus easing the scarcity of nickel sulfate raw materials in China.

《5 Future development ideas and goals for the nickel sulfate industry in China》

5 Future development ideas and goals for the nickel sulfate industry in China

《5.1 Development ideas》

5.1 Development ideas

Closely integrated with national strategic development goals, through the integration of available nickel resources, the aim is to increase the control of resources, cultivate a strong force, realize strong innovation ability with the international influence of large nickel sulfate enterprises, improve the utilization rate and value of China’s resources, improve the recovery system mechanism to ensure the effective supply of raw materials, carry out basic theoretical and experimental research to improve the independent innovation capacity and maximize the value of resources utilized, achieve high-quality development of nickel sulfate in China leading to future development of the global nickel sulfate industry chain, and provide support for the stable development of China’s new energy vehicle power battery industry.

《5.2 Development goals》

5.2 Development goals

Combining the actual situation in China and the challenges faced by the nickel sulfate industry, the following medium- and long-term development goals are proposed.

5.2.1 Ensuring the effective supply of nickel sulfate raw materials by 2025

The goal is to improve the supply capacity of China’s nickel sulfate industry, decrease the concentration of raw material imports, and diversify imports. In addition, we aim to improve the occupancy rate of high-quality mines, establish an enterprise cooperation platform to protect the effective supply of resources, increase the environmental protection efforts of nickel sulfate enterprises, and improve the quality of these enterprises to achieve the goal of a 20% reduction in comprehensive energy consumption compared with the present. Moreover, we should strive to establish an optimal nickel recovery system and mechanism to improve the current situation of wasted nickel resources and the low recovery rates in China based on the cultivation of 2–3 existing large recycling enterprises to alleviate the tight supply of nickel sulfate raw materials in China.

5.2.2 Realizing high-quality development of the nickel sulfate industry by 2035

China aims to occupy an important position in the field of nickel sulfate raw material production through reducing the concentration of imports, improving the comprehensive utilization rate of nickel resources in China, optimizing the production process of each link, establishing a memorandum of cooperation between overseas nickel enterprises and domestic enterprises to achieve a significant increase in the overall competitiveness of China’s nickel industry, comprehensively improving the recycling rate of downstream products, and improving recycling technology and the use of recycled nickel over primary nickel.

《6 Suggestions for countermeasures》

6 Suggestions for countermeasures

《6.1 Focusing on establishment of the supply system to promote a diversified raw material supply》

6.1 Focusing on establishment of the supply system to promote a diversified raw material supply

It is suggested to increase planning of the nickel sulfate industry supply system, create diversified investment conditions favorable to nickel sulfate raw materials, alleviate the current problem of raw material scarcity, and establish an effective and stable supply system. It is also necessary to encourage enterprises to vigorously explore the foreign nickel sulfate market, appropriately increase financing support for relevant enterprises, support enterprises to cooperate in the development of nickel resources, and diversify the sources of nickel sulfate raw material imports while accelerating investment in different nickel sulfate raw material markets to achieve a stable supply.

《6.2 Promoting technological innovation and reducing production costs to reduce supply pressure》

6.2 Promoting technological innovation and reducing production costs to reduce supply pressure

Technological innovation can play an important role in reducing supply pressure and production costs. The costs associated with nickel sulfate raw materials account for most of the total costs, and thus technological innovation in nickel sulfate production can be strengthened through research and development efforts to improve production capacity and efficiency, reduce production costs, use materials more efficiently, and increase the supply as much as possible to improve market competitiveness.

《6.3 Accelerating development of the renewable nickel industry to improve the amount of recycled nickel》

6.3 Accelerating development of the renewable nickel industry to improve the amount of recycled nickel

Recycling can reduce the supply pressure on nickel sulfate raw materials. We should aim to strengthen the recycling of various nickel sulfate materials, particularly for the future large-scale retirement of power battery recycling, adopt relevant policies by incentivizing the recycling of products that reach their service life, implement an extended producer responsibility system, allow producers to bear part of the recycling costs and recycling responsibilities, and promote the construction of a recycling system jointly by producers and recycling enterprises. Meanwhile, it is important to improve the collection and classification system and actively improve the current recycling technology to realize adequate preparation for the rapid growth of recycled nickel production.

《6.4 Accelerating the internationalization of China's enterprises and industrial integration process while enhancing the core competitiveness》

6.4 Accelerating the internationalization of China's enterprises and industrial integration process while enhancing the core competitiveness

China should accelerate the cultivation of several integrated productions, internationalization of large enterprises, and the future formation of mineral resources smelting, including processing and manufacturing of nickel sulfate products and recycling of integrated comprehensive international enterprises. The industry should aim to guide enterprises to actively invest in resources, recycling, and other aspects to enhance the ability of industrial synergy development, ensure the smooth supply of raw materials, and enhance core competitiveness. Meanwhile, cooperation among Chinese enterprises should be actively promoted to develop joint overseas nickel resources mineral smelting and nickel sulfate production, and effectively enhance industrial synergistic development. Promoting industrial integration and internationalization can on one hand guarantee a stable supply of raw materials for the production of nickel sulfate in China, and on the other hand, it can effectively reduce production costs, improve product profitability, and enhance the core competitiveness of enterprises through industrial integration.

《Compliance with ethics guidelines》

Compliance with ethics guidelines

The authors declare that they have no conflict of interest or financial conflicts to disclose.

京公网安备 11010502051620号

京公网安备 11010502051620号